The role mutual funds play in retirement planning

Why is retirement planning important?

- After retirement the main source of income for most people is from their investments. In India, a relatively small percentage of retired people have other sources of income e.g. pension, rental income etc. You need to have sufficient savings and investments, which generates enough income to meet your regular expenses after retirement.

- Financial independence is the most important objective of your retirement planning. Financial independence implies that your income from your investments is sufficient to meet all your financial needs. If you lose financial independence you will have to be financially dependent on your children or other relatives.

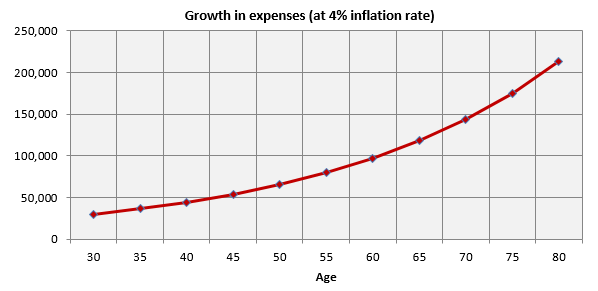

- With increasing longevity thanks to better medical care, retired lives are getting longer. Your retirement corpus should be large enough to last for the entirety of you and your spouse’s lives. Longer retired life also means higher expenses due to inflation. Let us assume that you are 30 years old and your monthly expense is Rs 30,000. Let us further assume that you will retire at the age of 60. Assuming an inflation rate of 4%, your monthly expense at the age of 60 will be Rs 97,320. Even after you retire, your expenses will continue to grow due to inflation. In this example your monthly expenses will Rs 2.13 lakhs by the age of 80.

![Growth in expenses Growth in expenses]()

- Working lives are getting shorter as students are pursuing higher education, professional courses before joining the work-force. In previous generation, people started working at the age of 20 – 21; now people are continuing their education till the age of 24 – 25. Also many people are being forced into retirement early, due to ill-health, challenges with career mobility at a certain age, workplace redundancies due to change in technology etc. Shorter working lives and long life expectancy has made retirement planning even more important today than it was in previous generations.

How should you plan for retirement?

- Calculate how much corpus you need at retirement: You should calculate how much corpus you need at the time of retirement, factoring in inflation. Income from your corpus should be sufficient to last 20 – 30 years of retired life.

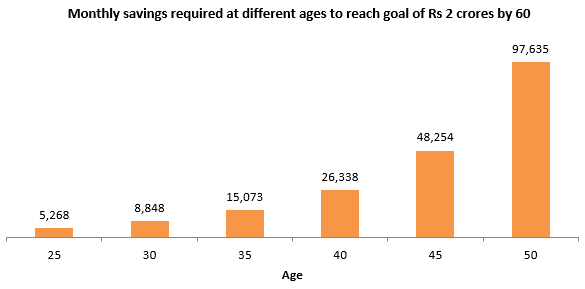

- Calculate how much you have to save: Next, you need to calculate, how much you need to save on a monthly basis to reach your retirement goal. Let us assume your retirement savings target at the age of 60 is Rs 2 crores. Let us see how much you need to save and invest on a monthly basis, to meet your retirement goal if you begin retirement planning at different ages. We have assumed a return on investment of 10% in this example.

![Monthly savings required at different ages to reach goal of Rs 2 crores by 60 Monthly savings required at different ages to reach goal of Rs 2 crores by 60]()

- Start as early as possible: Time is the most important factor in investment returns. You can see in the chart above that, you can reach your retirement goal with much smaller monthly savings if you begin early. The longer you remain invested, the higher will be your returns due to the power of compounding. You can reach your retirement goal comfortably, with relatively less savings, if you start investing early.

- Saving is not enough, you have to invest: You need to invest your savings to get returns that help you reach your retirement goal. Different asset classes have different risk / return profiles. You need to invest in the right asset class depending on your investment needs and risk appetite. You should consult with a financial advisor if you need help in understanding your risk appetite. Mutual funds can provide solutions for a wide variety of investment needs (capital appreciation, income), investment tenures and risk appetites (low, moderate, high).

Mutual fund in retirement planning

Mutual funds help you get exposure to different asset classes and sub-classes, which can help to meet your financial goals in different stages of life. Wealth creation is very important for retirement planning because your retirement corpus should last for 20 – 30 years and should be able to beat inflation. Historical data shows that equity is the best performing asset class in the long term and has the potential to create wealth for investors over a long investment horizon. In the last 10 years, Nifty 50 TRI, the total returns index of 50 largest stocks by market capitalization in India, gave a CAGR return of 16.5%.

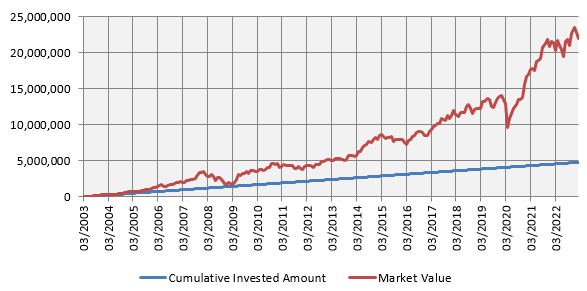

Systematic Investment Plan (SIP) for retirement planning

Mutual fund systematic investment plan (SIP) is one of the best ways to save and invest for retirement planning. You can start your SIPs with very small monthly (or any other intervals) investments, as low as Rs 1,000. The longer your SIP tenure, the more wealth you can create through the power of compounding. The chart below shows growth of Rs 20,000 monthly SIP in Nifty 50 TRI over the last 20 years. You can see that with a cumulative investment of just Rs 48 lakhs, you could have accumulated a corpus of Rs 2.2 crores over the past 20 years.

Source: National Stock Exchange, Advisorkhoj Research. Period: 01.03.2003 to 28.02.2023. Disclaimer: Past performance may or may not be sustained in the future

SIP Top-ups are ideal for retirement planning of young investors

SIP Top-up or SIP Step-up is a SIP facility using which you can increase your SIP instalments at regular intervals e.g. half yearly, annual etc. The chart below shows growth of Rs 10,000 monthly SIP with an annual top-up of 10% in Nifty 50 TRI over the last over the past 25 years or so (we have assumed a start date of 30.6.1999, which is the inception date of the Nifty 50 TRI). With a cumulative investment of just Rs 60 lakhs, you could have accumulated a corpus of Rs 3.04 crores. You can see that using the SIP Top-up you can start with much smaller investments and still meet your financial goals over longer investment horizons.

Source: National Stock Exchange, Advisorkhoj Research. Period: 01.07.1999 to 28.02.2023. Disclaimer: Past performance may or may not be sustained in the future

Asset allocation for retirement planning with mutual funds

Asset allocation is the diversification of your retirement savings / investments across equity, debt, gold, international equity and other asset classes. Your asset allocation for retirement planning will depend on your age, stage of life and risk appetite. Mutual funds have products (schemes) across a large number of asset classes and categories. When you are young, you can have high exposure to equity, including relatively more volatile equity categories like midcap and small cap funds, which can potentially generate higher returns / wealth creation over long investment horizons.

Once you are in the mid-stages of your career with retirement and other life-stage goals e.g. children’s higher education, children’s marriage etc getting closer, you need to have a more balanced asset allocation. Large cap funds, hybrid funds and longer duration debt funds can be prudent investment choices in this life-stage.

Once you get closer to retirement, you need to reduce the risk of your portfolio. A large part of investment portfolio (more than 50%) should be in debt mutual funds or debt oriented hybrid funds (conservative hybrid funds) which can generate income for you after you retire. At the same time, you should continue to have exposure to equity since your expenses will keep increasing due to inflation all through your retired life. Historical data shows that equity as an asset class can beat inflation over long investment horizon.

You may try this Asset Allocation Tool

Should you invest in retirement funds?

Retirement funds are solution oriented mutual fund schemes that can help to meet your retirement goals. One of the advantages of retirement funds is that they can provide the asset allocation solutions depending on your stage of life and investment needs. In other words, if you invest in a retirement fund, the asset allocation / rebalancing etc is inbuilt in the fund itself. You can simply select a plan that is suitable for your stage of life and risk appetite. Retirement funds may have lock-in periods. Read the scheme information document carefully and make informed investment decisions. You should consult with your financial advisor if you need help in understanding the features of your retirement fund.

Mutual funds give tax efficient returns over long investment horizons

In India, most investors still prefer traditional fixed income schemes like Bank Fixed Deposits, Government Small Savings schemes like Voluntary Provident Fund, Post Office Monthly Income Scheme (PO MIS), Senior Citizens Saving Schemes (SCSS) and other schemes for retirement savings. Tax planning is one of the most important aspects of financial planning. Unfortunately, most of the investments where senior citizens usually put their retirement savings e.g. Bank FD, SCSS, PO MIS, annuities etc are taxable as per the income tax rate of the investors.

Mutual funds, on the other hand, are one of the most tax friendly investment options in India. Long term capital gains (investing holding period of more than 1 year) from equity and equity oriented hybrid funds (more than 65% gross exposure to equity) are tax free up to Rs 1 lakh per year. Long term capital gains from equity or equity oriented funds exceeding Rs 1 lakh are taxed at 10%. Long term capital gains (investing holding period of more than 3 years) from debt funds or debt oriented hybrid funds are taxed at 20% after allowing for indexation benefits.

Conclusion

Retirement planning should be one of our most important financial planning priorities during our working lives. An early start to retirement planning can ensure financial independence and at the same time, enable you to maintain your lifestyle even after retirement. Mutual funds are wonderful investment solutions for retirement planning. You can build your own retirement savings portfolio by investing in equity, hybrid and / or debt funds. Alternatively, you can also invest in retirement funds which provide asset allocation solutions for different investment needs and risk appetites. You should consult with your financial advisor, if you need help in selecting schemes that are suitable for your investment needs and risk appetite.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY