Do Debt Funds make sense even after LTCG benefit is taken away?

What is the tax change in debt funds?

The recent tax change for non-equity funds may have come as a rude surprise for many mutual fund investors. As per the amendment to the Finance Bill, which came into effect from 1st April 2023, all capital gains in non-equity funds, whether long term or short term will be taxed as per income tax rate of the investor. Prior to this amendment, capital gains in debt funds held for 36 months or longer (long term capital gains) were taxed at 20% after allowing for indexation benefits. From 1st April 2023, all capital gains in debt funds, irrespective of your holding period, will be added to your income and taxed as per your marginal tax rate (i.e. income tax slab).

Do debt funds make sense after removal of LTCG benefits?

The tax change made by the Finance Minister has brought the taxation of debt funds at parity with taxation of Bank Fixed Deposits and some Government Small Savings Schemes. With no tax advantage does it make sense to invest in debt funds? The decision to remove LTCG tax benefit was met with outcry on social media, some calling it unfair for treating a market linked product at par with a virtually risk-free investment. Some people concluded that there is no longer any benefit of investing in debt mutual funds which are subject to market risks; one should invest in risk free Bank FDs instead.

In our view, you should not jump to conclusions in haste. Were you investing in debt mutual funds just for the tax benefits? What are some of the other benefits in debt funds?

What is real risk free return?

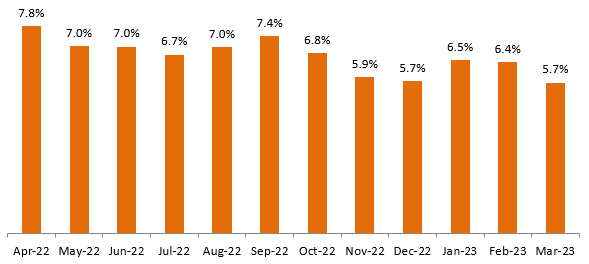

Risk free rate is the lowest return an investor should expect. For any risk that you take, you will expect additional returns over and above the risk free rate. If you do not take any risk, you will be compensated only for time. Money loses its purchasing power over time because of inflation. If you do not take any risks, you will be compensated only for the loss of purchasing power of your investment. In other words, the risk-free return is usually slightly higher than inflation rate on a pre-tax basis. If you were looking for real risk free return then you should subtract inflation from your nominal risk free interest rate e.g. your FD interest rate. The chart below shows the monthly CPI Inflation rate over the past 12 months (ending 31st March 2023). The average CPI inflation rate over the last 12 months is 6.66%. The 2 to 3 year term deposit interest rates of major public and private sector banks in 6.5 – 7%. Since FD interest is fully taxable, your post tax return will be 4.6 – 4.9% (assuming you are in the highest tax bracket). In other words, during periods of high inflation, your post tax real risk free return can often be negative.

Source: Ministry of Statistics and Program Implementation. Period: 1st April 2022 to 31st March 2023

Why debt funds have the potential of giving higher returns?

Debt funds invest in debt and money market instruments like Government Bonds (G-Secs), State Development Loans (SDLs), Non Convertible Debentures (NCDs), Commercial Papers (CPs), Certificates of Deposit (CDs) etc. Bonds usually give higher returns than fixed deposit interest rates. Why? If the bond does not pay higher coupon interest rate than bank FD, why will you invest in the bond? The bond issuer will pay you a higher coupon rate than the FD interest rate to compensate for the risk you are taking.

Furthermore, the yield of a bond also depends on its maturity. Bonds with longer maturity will give higher yields than bonds with shorter maturities. You can invest in appropriate maturities depending on your investment needs. Contrast this with interest rates of bank FDs. If you check the interest rates of different term deposits (FDs), then you will see the interest rates are flat beyond 2 to 3 year tenures. Sometimes a year 5 year FD interest rate can be even lower than a 3 or 2 year FD interest rate. On the other hand, a 5 year bond will almost always give higher yields (except in rare situations when the yield curve is inverted) than a bond with 2 – 3 year maturity. This makes debt mutual funds suitable investments for different investment needs.

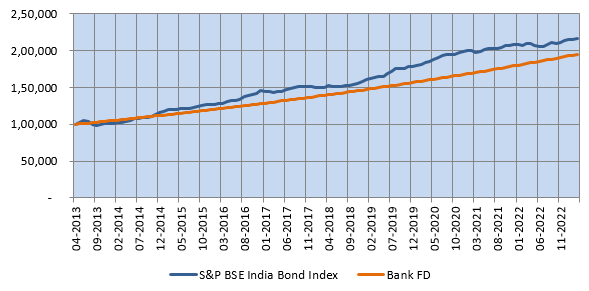

Debt funds have historically given higher returns than bank FDs

The chart below shows the growth of Rs 1 lakh investment in S&P BSE India Bond Index (composite index of Government and corporate bonds) versus FD over the last 10 years (ending 31st March 2023). You can see that, even though S&P BSE India Bond Index was more volatile, it was able to outperform Bank FDs over the 10 last years. The CAGR return of S&P BSE India Bond Index was 8.14%, while that of Bank FD was 6.75%. The outperformance of S&P India Bond Index can be attributed to the higher yields of debt and money market instruments compared to the risk free interest rate as explained in the previous sections of this blog post.

Source: S&P Global, BSE, SBI, Advisorkhoj. Bank FD interest is the average 1 year FD interest rate of SBI over the investment tenure. Period: 01.04.2013 to 31.03.2023. Disclaimer: Past performance may or may not be sustained in the future.

Capital appreciation in favourable interest rate environments

Debt mutual funds can have two sources of returns – income and capital appreciation. Income is the yield of the bond i.e. the coupon or interest paid by the bond divided by its price. Capital appreciation is the change in price of the bond. Bond prices are inversely related to interest rate changes. Bond prices and debt fund Net Asset Values (NAVs) go up when yields or interest rates fall and vice versa. For the sake of investor awareness, we must mention here that the change in bond price due to interest rate changes can be a double edged sword. While you get the benefit of capital appreciation in a favourable interest rate scenario, you may also see a decline in NAV if interest rate change is unfavourable. So what is the interest rate scenario at the present time?

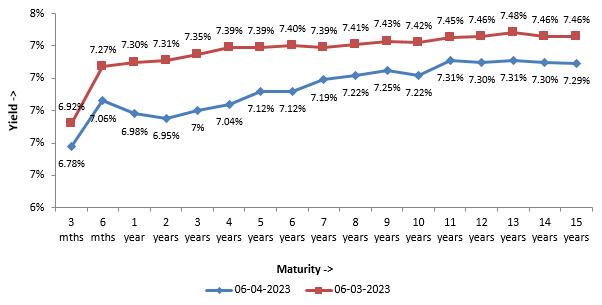

The yield curve in India has been flattening over last 6 months, indicating potential mean reversion in the future (change in interest rate trajectory). Yields have come down across all maturities in the last one month (see the yield curve below). In the monetary policy meeting on 6th April 2023, the Reserve Bank of India hit the pause button on rate hikes; this caused yields to ease. Can yields go down further? Fund managers have told us that the market is pricing 6.75% terminal repo rate in bond yields. The current repo rate is 6.5%. So if we go with market expectations, then we are nearing the end of this interest rate cycle. With clear signs of a global economic slowdown, the central banks, including RBI will have to pivot in their interest rate policy somewhere down the road. As mentioned earlier, bond prices and debt fund NAVs will go up if yields come down further in the future. Therefore, there is potential of capital appreciation over sufficiently long investment tenure. However, it is important to reiterate here that the main objective of debt fund is income generation; capital appreciation will be additional returns over accrual in favourable interest rate environment.

Source: worldgovernmentbonds.com, Advisorkhoj, as on 06.04.2023. Disclaimer: Past performance may or may not be sustained in the future.

Taxation during investment tenure – impact on returns

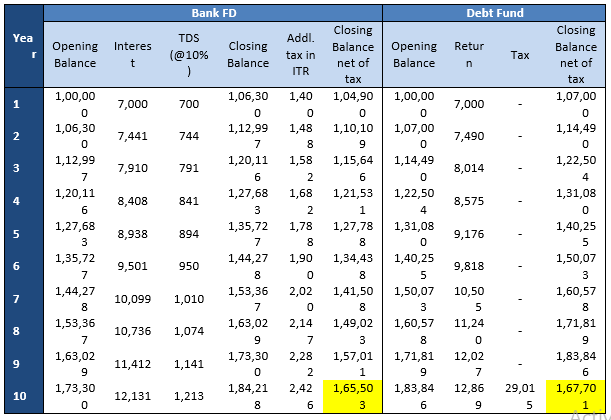

Though the capital gains of debt funds will be taxed as per your income tax rate, there is still a major difference between taxation of debt funds and FD. In a financial year, FD interest (whether paid out or accrued) is added to your income and taxed as per your income tax slab. The bank will deduct 10% TDS from your FD interest every year. You may have to pay additional tax in your Income Tax Return on your FD interest if you are in higher income tax slabs. There is no taxation on unrealized gains in debt funds; i.e. you do not have to pay any tax if you do not redeem your debt fund units. Since there is no taxation during the investment tenure, you gain more from compounding.

Let us understand how this will work with the help of an example. Suppose you invested Rs 1 lakh each in a Bank FD and a debt mutual fund. The FD interest rate and the debt fund CAGR are both 7%. You are in the 30% tax bracket. The table shows your investment returns after 10 years.

You can see that value of your investment at the end of the tenure was higher in debt funds even though both debt fund returns and FD interest were taxed as per your income tax rate. Even though the bank was deducting 10% TDS, you had to pay additional tax at the time of filing your ITR or as advance tax since you are in the 30% tax bracket. Since tax had to be paid every year the balance left for compounding was less. In debt funds, since there was taxation during the investment tenure, the compounding effect was higher. Also please note that for the sake of simplicity, we have not taken into account, the opportunity cost of the additional tax that you had to pay every year i.e. instead of paying the amount as tax, you could have invested it. If we take the opportunity cost into account the difference in returns of debt funds and FDs will be higher.

Conclusion

The change in LTCG taxation of debt funds would have caused disappointment to many investors. But you should not act in haste. You will continue to get Long Term Capital Gains Tax benefit of indexation for all investments made before 1st April 2023. Even for your fixed income investments going forward, debt funds can be suitable investment solutions. You should consult with your financial advisor to discuss which debt funds may be suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY