Equity Linked Savings Scheme is the best tax saving investment for wealth creation

With less than three months remaining before the close of this financial year, maximum tax saving is likely to be one of the most important financial considerations for many. From FY 2015 onwards investors can save up to Rs 46,350 in taxes by investing Rs 150,000 in eligible tax saving investments under Section 80C of Income Tax Act 1961.

The eligible investments in Section 80C include, Employee Provident Fund (EPF) deducted by the employer, Voluntary Provident Fund (VPF), Public Provident Fund (PPF), National Savings Certificates (NSC), 5 year tax saving bank fixed deposits, 5 year tax saving post office deposits, Senior Citizens Savings Scheme (SCSS), Sukanya Samriddhi Yojana (SSY), Life Insurance (both traditional and unit linked) Premiums, National Pension Scheme (NPS), notified mutual fund Pension Plans and Equity Linked Savings Schemes (ELSS). The tax saving schemes can be classified into two broad categories:-

- Risk free investments (e.g. VPF, PPF, NSC etc.)

- Investments which are subject to market risks (ELSS, ULIPs etc)

While it is unfair to compare risk free investments with investments subject to market risk, it is also important for investors to be very clear about the investment objectives when they are making an investment. We have seen that, investors with the same risk capacity (same age-group, income group etc.) invest in two different product classes for the same financial goal (e.g. retirement, children’s education etc.) because their risk preferences are different.

You should understand the difference between risk capacity and risk preference. Risk capacity is objective based on your financial potential, whereas risk preference is subjective based on your temperament. Since investment is a personal financial decision, risk preference becomes a more important factor in decision making; however, you should understand the risk / return characteristics of different tax saving investments, so that you can make the most objective decision for your financial goals.

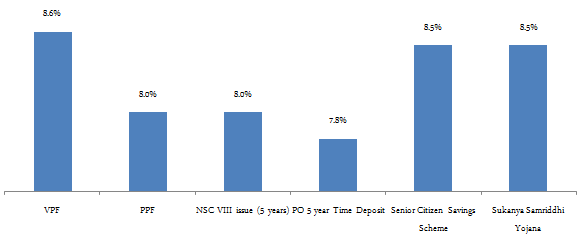

Risk Free Tax Saving Investment Returns

Let us first discuss the risk free investments and see how much interest rate they are offering currently.

Source: India Post

You can see in the chart above that, small savings interest rate ranges from 7.8 to 8.6%. Senior Citizen Savings Schemes and Sukanya Samriddhi Yojana are specific to certain demographic profiles, namely senior citizens or if you have a girl child below the age of 10. VPF offers 8.6% interest rate but you have to wait till retirement to get money from your PF account. The other small savings schemes offer around 8% interest rate. If you invest Rs 1 lakh every year at an 8% rate for 15 years (which is the tenure of PPF; other tax saving investments, except VPF, have lower tenures), you will at the end of the period accumulate a corpus of Rs 27 lakhs.

You should also understand that current interest rates are not fixed forever, but benchmarked to relevant Government Bond yields. Under rules announced by the Government last year, the interest rates of small savings schemes will be revised every quarter, based on the previous 3 month yields of the benchmark Government Bonds with a small mark up. So if Government Bond yields fall by 20 basis points in this quarter, the interest rates of small savings schemes can go down further by 0.2% in the next quarter.

Market Linked Tax Savings Investment Returns

Market linked tax savings investments under section 80C are NPS, ULIP and ELSS. Market linked investments, as the name suggests, are subject to market risks and hence there is no assurance with respect to returns. The notion of risk is scary to many investors because no one wants to lose money, but investors should also understand that, they can get higher returns only if they take risks.

Historical performance data shows that, equity is the best performing asset class in the long term. Investors often confuse volatility and risk. Volatility is change in price of an asset (either upwards or downwards) in the short term, whereas risk is the probability of a loss when you sell. Historical data analysis has shown that, volatility of equity as an asset class reduces over time. That is why for long term investors, equity is the best asset class for wealth creation.

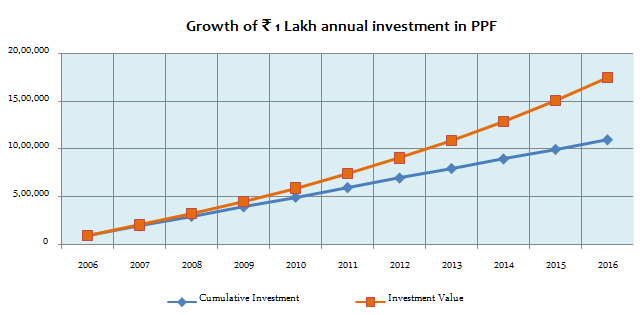

To understand why equity is the best asset class for wealth creation, let us examine with historical data, corpuses accumulated by investors over a long period of time by investing in PPF (risk free investment) and ELSS (market linked investment). Let us assume that you invested Rs 1 lakh per annum in PPF and ELSS respectively since year 2006 to 2016.

For the sake of simplicity, let us assume, you made your deposit on January 1 every year; the last deposit was made on January 1, 2016. The chart below shows the growth of your PPF account balance from 2006 to 2016.

Source: Advisorkhoj Research

Your PPF account balance on January 1, 2016 would be Rs 17.5 lakhs, while your cumulative investment over the 10+ year period will be Rs 11 lakhs.

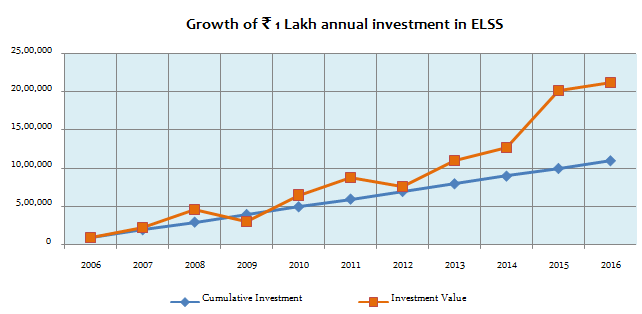

Let us assume you invested Rs 1 Lakh per annum in an ELSS fund from 2006 onwards. For the sake of simplicity, let us assume, you made your investment on January 1 every year; the last deposit was made on January 1, 2016. In this example, we have assumed the return of your ELSS fund was the average ELSS category returns over the last 10 year (2006 to 2016) period. The chart below shows the growth of your annual ELSS investment from 2006 to 2016.

Source: Advisorkhoj Research

Compare this chart with the previous (PPF) chart. You can see in the previous (PPF) chart that growth of your investment was almost linear, but in this chart the growth is much more volatile.

Recall, earlier in our post, we said that, ELSS is subject to market risks. Your ELSS investment value would have fallen below your cumulative investment in late 2008 / early 2009. But let us look at wealth creation over the 10 year horizon. Your ELSS investment value on January 1, 2016 would be Rs 21.3 Lakhs, while your cumulative investments over the 10 year period would have been Rs 11 Lakhs. The wealth creation by ELSS was nearly Rs 4 Lakhs more than that of PPF.

You should know that, a long (e.g. 10 year) investment horizon will have both bull and bear markets. Your investment value will rise in bull markets and fall in bear markets. From 2006 to 2016, we had three bear markets – 2008, 2011 and 2015/2016. But over the same 10 year period, we also had bull market years. The fall in bear market was more than compensated by the rise in bull markets. That is why we say, equity is the best performing asset class over a sufficiently long investment horizon.

Comparing ELSS with other Market Linked Investments

Let us compare ELSS with other market linked investments. An ELSS is essentially a diversified equity scheme with a lock in period of three years from the date of the investment. If you invest in an ELSS through a systematic investment plan (SIP), each investment will be locked in for 3 years from their respective investment dates. Compared to other retirement planning investments under Section 80C, ELSS offers higher liquidity and potentially superior post tax returns.

Unit linked insurance plans (ULIPs) are also market linked instruments. However, unlike ELSS, ULIP is not a pure investment product; it is a hybrid insurance and investment product. A portion of your investment (premium) is used to pay for your life insurance cover (in ULIP parlance, known as mortality charges), a portion is used to pay for various charges levied by the insurance company (e.g. premium allocation, policy administration etc) and the balance amount is invested in purchasing units of a fund of your choice. Therefore, the actual amount invested in units is lesser than what you would have invested (premium). Some low cost online ULIPs only charge for life cover and fund management fees, but even then the actual amount invested in units is less than in ELSS (because of the life cover charges or mortality charges).

The question you should ask yourself as an investor is whether the purpose of your tax saving investment is life insurance or wealth creation? Even if you need both, financial planners are of the opinion that investors should seek the best solutions for these two needs separately and not mix it.

Let us now discuss, ELSS versus NPS. You can claim an additional deduction of Rs 50,000 from your taxable income, over and above the Rs 1.5 lakhs 80C limit by investing in NPS under Section 80CCD(1b). Since the incremental benefit is available only for NPS, by default, it is the only choice for investors who want to claim the additional tax deduction.

However, within the 80C options, ELSS is a better option than NPS for the following reasons. Firstly, ELSS is far more liquid than NPS. Though equity investments should always be made with a long investment horizon, ELSS offers more flexibility because the lock in period is 3 years only, whereas NPS can be withdrawn partially only once you reach the age of 60. Secondly, even on maturity NPS offers much less flexibility. While in ELSS, you can redeem the entire amount (all units) after the lock in period, in NPS, you can only withdraw 60% of the corpus, while at least 40% has to be compulsorily invested in annuities for monthly pension. Thirdly, ELSS is much more tax friendly than NPS. Capital gains in ELSS are totally tax free. Dividends declared in ELSS schemes are also tax free. In NPS, out of the 60% that you can withdraw after maturity, 40% is tax free, while the rest 20% is taxable, as per your income tax rate. Further, the income from the annuity is also fully taxable.

Conclusion

In this blog we have objectively reviewed several tax saving options (both risk free and market linked) under Section 80C of Income Tax Act 1961. In terms of wealth creation potential, liquidity, flexibility and tax friendliness, we have seen that ELSS is simply one of the best tax saving investments for investors looking to create wealth in the long term.

If you still have not made all your tax saving investments for FY 2017, you may want to consider ELSS, if you have a sufficiently long investment horizon (e.g. 5 years or longer) and the capacity to take some risks.

Disclaimer

The information herein below is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Certain factual and statistical information (historical as well as projected) pertaining to Industry and markets have been obtained from independent third-party sources, which are deemed to be reliable.

This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Recipients of this information should rely on information/data arising out of their own investigations. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY