Rollover of ELSS Funds can provide magical dual benefits of tax savings and wealth creation

Now that we are in the final stretch of this financial year, tax savings will be an important priority for many taxpayers. Section 80C of Income Tax Act 1961 allows investors to claim deductions of up to Rs 150,000 in a Financial year (FY) from their taxable income letting them save up to Rs 46,800 in taxes.

There are several eligible schemes under Section 80C. In our blog post, we have discussed numerous how mutual fund Equity Linked Savings Schemes or ELSS Funds is one of the best tax saving investments for investors with high risk appetite because of its triple advantage:-

- Superior long term returns

- Superior liquidity

- Tax advantage

In this blog post, we will discuss how these advantages which ELSS Funds enjoy over other 80C investment options enable ELSS Funds to provide wonderful long term tax planning solution using a simple roll-over strategy.

What is ELSS?

Most of our regular readers will be familiar with ELSS, but for the benefit of new readers and others, ELSS is essentially a diversified equity mutual fund scheme, investment in which allows investors to claim deduction equal to the investment amount from their taxable income, subject to ceiling of Rs 1.5 Lakhs. ELSS investments have a lock-in period of 3 years, which means that you will not be able to redeem your investments for 3 years from the investment date; after 3 years, you can redeem your investment partially or fully at any time. Capital gains in ELSS Funds are tax free up to Rs 1 Lakh in a financial year; capital gains in excess of Rs 1 Lakh are taxed at 10% (from this financial year onwards).

Read – ELSS Tax saving funds is the best tax saving investment for wealth creation

Roll-over in ELSS Funds

By rollover we mean that once your ELSS investment tenor is past the lock-in period of 3 years, you can use a portion of the investment value to re-invest for your tax savings. This can provide a long term tax planning solution, without you having to make fresh 80C investments from your savings.

Let us explain this strategy with the help of an example. Let us assume you begin in April 1, 2010 with an investment of Rs 1 Lakh in an ELSS Fund. For the sake of illustration let use the BSE 200 index as a proxy for a tax saving fund (ELSS); BSE 200 is an index of large cap and midcap stocks. Further, let us assume you are in the 30% tax bracket; for sake of simplicity, we will ignore Cess in our analysis.

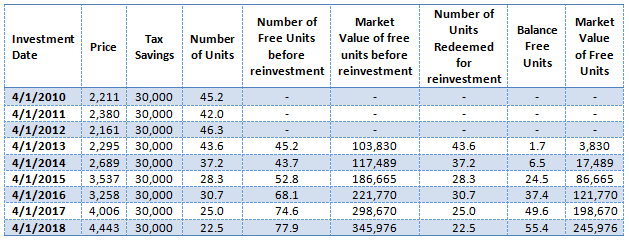

In FY 2010-11 therefore, you would have been able to save Rs 30,000 with your investment of Rs 1 Lakh. On April 1, 2010 the value of BSE 200 was 2,211. You would have bought approximately 45 units of BSE 200, with your investment of Rs 1 Lakh. These units will be locked in till April 1, 2013; after April 1, 2013 your units will be free - ready to be redeemed.

Similarly on April 1, 2011 and April 1, 2012 you invested another Rs 1 Lakh each year for tax saving purposes. With these investments you would have bought around 42 and 46 units of BSE 200 in 2011 and 2012 respectively. Your total investment in 2010 – 2012 was Rs 3 Lakhs. In April 2013, your first tranche of tax savings would complete their lock in periods. Let the magic of rollovers begin.

The value of 45 units of BSE 200, which you bought in 2010 and became free (eligible for redemptions), was Rs 103,880. You need to make an investment of Rs 1 Lakh for tax savings in 2013. At the then value of BSE – 200, you needed to redeem 43 units and re-invest again for tax saving purposes. That leaves you with 2 free units in 2013. You have the option of redeeming these two units, if you need cash-flows. In this example, we have assumed that you do not cash-flows and so these free units remain invested in the fund (ready to be redeemed at any time) as per your convenience. The value of these two free units at the then price was Rs 3,830.

In 2014, the units which you bought in 2011 became free. The value of the 42 units which you bought in 2011 plus the 3 free units is 117,489 out of which you need Rs 1 Lakh for tax saving purposes. At April 2014 price, you would need to redeem 37.2 units and re-invest for tax savings. That leaves you with total 7 free units, the value of which at the then prices was Rs 17,489. Note how with Rs 2 Lakhs investments made in 2010 and 2011, you were note only able to get Rs 60,000 of tax savings in those two years, but a further Rs 60,000 of tax savings in 2013 and 2014. So the total tax saving from your Rs 2 Lakh investment made in 2010 and 2011 was Rs 1.2 Lakhs. In addition you had Rs 17,489 of gains ready to be realized at any time, as per your requirements.

In 2015, the units which you bought in 2012 became free part of which you redeemed for FY 2015 - 16 tax savings and balance remained invested along with the free units from the previous tranches. Total number of free units in 105 was 25 and its market value was around 87,000. In 2016, your re-investment made in 2013 would be free from the lock-in period and you can continue your rollover strategy as described above. The table shows the results of this simple strategy from 2010 to 2018.

Source: BSE 200 data from Bombay Stock Exchange

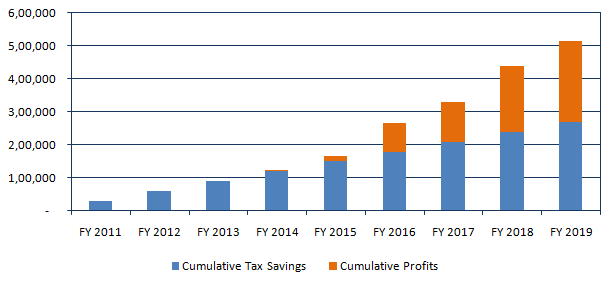

With an investment of just Rs 3 Lakhs in ELSS Funds made in 2010 to 2012, you were able to achieve tax savings of Rs 2.7 Lakhs over the last 9 years. In addition your wealth grew by Rs 2.5 Lakhs. The most remarkable thing about this is not the terrific financial benefits you got from your investments; the most remarkable feature is that you will continue to get these financial benefits for as long as you want. Over 15 – 20 years, you can imagine that the benefits will be enormous. The chart below reveals the true potential of this rollover strategy and of ELSS as a tax saving investment in the long term.

You can see that while the rollover strategy, prima facie seems to be tax planning strategy, in the long run it is a wealth creation strategy. Look at the orange bars (profits). They are growing faster than the blue bars (tax savings). The other remarkable of this strategy is the tax advantage. Since you will be redeeming only Rs 1 Lakh every year after the first three there will be no incidence of capital gains taxation.

Summary

For most taxpayers 80C investments are mostly about reducing their tax obligations, but ELSS enables investors to not only to save taxes but also create wealth in the long term. The rollover strategy discussed in this blog post is not rocket science; it is simple to understand and execute. The beauty of this strategy is that it will make tax planning convenient, instead of it being a headache every year. With the investments you make in the initial years, you will be able to create a long term tax planning solution for yourself and create wealth over a long investment tenor. What enable this magical solution are the triple advantages of investing in ELSS Funds, i.e. superior returns, superior liquidity and tax advantage.

Suggested reading: How ELSS Mutual Funds can help you in tax saving and retirement planning

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- The rising importance of having Gold in the portfolio

- Why should investors consider Smart Beta Index Funds over broad market indices in their portfolio

- Navigating market uncertainties: A case for hybrid mutual funds

- Why should you consider Sectoral funds for your portfolio

- Importance of investing in factor based Index Funds

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY