Unaltered path: Continuity in budget policies

Mutual Fund

In the first budget under the new coalition government, the finance minister continued on the path of fiscal consolidation, highlighting the continuity and consistency in direction of policy making. Large windfall gains from RBI’s dividend payout and surge in tax revenues provided the government sufficient room to bring down the deficit from 5.1% to 4.9%. However, the tweaks to the taxation structure, even if few of the changes were expected, led to a knee jerk reaction in the equity markets at the time of announcement. Tax buoyancy will enable the government to boost economic growth with capex allocation and added focus to job creation with ELI (Employee linked incentive) schemes and tax breaks for salaried class will lead to pickup in consumption. Overall the focus on fiscal consolidation, the incentive to boost employment, focus on incentivizing the MSME and manufacturing sectors, will continue to structurally build a strong growth prospect for India.

On Fiscal Consolidation:

- Fiscal consolidation continues to be a strong theme visible in the budget

- The government aims to reach a fiscal deficit of 4.5% in FY26, from 4.9% of GDP estimated for this FY.

- For FY25, the total receipts (other than borrowings) are estimated at INR 32.07 lakh crore, a growth of around 15% over previous FY and the total expenditure are estimated at INR 48.21 lakh crore, 9% growth over previous FY.

- The gross and net market borrowings in FY25 are estimated at INR 14.01 lakh crore and INR 11.63 lakh crore respectively. There has been a marginal reduction of borrowings (dated securities) of INR 12,000 cr.

On Taxes:

- With improvement in gross tax collection, net tax receipts as % of GDP have also moved higher. The budgeted net tax number for FY25 is 11% higher than FY24.

- The buoyancy in tax avenues is also providing the government ability to support economic growth.

- On GST, the government will endeavor to simply, rationalize and expand it to remaining sectors. On customs duty, various sectors like medicines and medical equipment, mobile phones, critical minerals, metals, solar energy and few others saw Unaltered path: Continuity in budget policies reduction or exemption on custom duties.

- The budget has proposed to complete a comprehensive review of the Income Tax Act, 1961 to make it more concise and lucid to reduce disputes and litigation.

- The long term capital gains (LTCG) tax has been increased from 10% to 12.5% for all financial and non-financial assets (indexation benefit is not available) and the short-term capital gains (STCG) has been increased to 20% from 15% on certain financial assets. Unlisted bonds and debentures, debt mutual funds and market linked debentures, irrespective of holding period, however, will attract tax on capital gains at marginal rates.

- For listed financial assets, long term capital gains tax will be applicable if held for more than a year and for unlisted and non-financial assets, LTCG will be applicable if held for more than two years.

- While the increase in rate of long-term capital gains is moderate, a change in this shows that it is potentially variable rate and opens up the prospect of this potentially going up further in coming years, in our opinion.

- The limit on exemption on capital gains on certain financial assets like equities has been increased to INR 1.25 lakh from INR 1 lakh earlier.

- The STT on Futures & Options has been increased to 0.02% and 0.1% respectively. This was largely expected by the market as a step to curb excessive speculation in the derivatives segment.

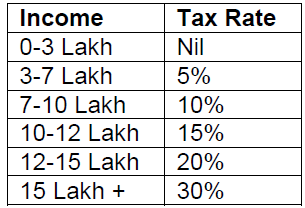

- On personal Income tax, for those opting the New Tax Regime, the Standard Deduction has been increased from INR 50,000 to INR 75,000, with a revision in the tax rate slabs as below (savings of INR 17,500):

![On Taxes On Taxes]()

- Angel tax has been abolished, this will boost the start-up ecosystem.

- Proposed to reduce Corporate rate tax on foreign companies to 35% from 40%

The budget specifically focused on employment, skilling, MSMEs, and the middle class. It laid out 9 Priorities for generating opportunities for all and with the intention that future budgets will also build on these priorities. In addition to the production linked incentives (PLI) the government this time has focused on Employment linked incentives (ELI).

Productivity and resilience in agriculture:

- Provision of INR 1.52 lakh crore for agriculture and aliled sectors

Employment and Skilling

- 3 schemes for ELI focused on First time employees, job creation in manufacturing sector and support to employers to support additional employment

Inclusive human resource development and social justice

- Development of eastern parts India and schemes benefitting women girls

- Implementation and stepping up various schemes meant for supporting education,health and economic activities such as PM Vishwakarma, SVANidhi, etc

Manufacturing and services

- Focus on MSMEs in the manufacturing sector; scheme for providing internship opportunities to the youth

Urban development

- PM Awas Yojana 2.0 for urban housing needs through financial assistance and interest subsidies

Energy security

- Focus on research and development of small medium nuclear reactors and roadmap for emission targets by providing financial support for shifting to cleaner forms

Infrastructure

- FY25 capex spend target unchanged from interim budget at Rs 11.1tn (3.4% of GDP). However, it is a strong growth of 17% YoY

- Private investments in infrastructure to be promoted through viability gap funding and enabling policies and regulations

Innovation and R&D

- Venture Capital Fund of INR 1000 crores to be set up with emphasis of expanding the Space economy 5 times in the next 10 years

Next generation reform

- Legislative approval for providing flexibility for financing leasing of aircrafts and ships, and pooled funds of private equity through a 'variable company structure'.

- Simplify regulations for Foreign Direct Investment and Overseas Investment to facilitate FDI, nudge prioritisation and promote use of Indian currency for overseas investment

Equity Markets

The most awaited event post-elections, the budget, has finally passed. India remains one of the fastest growing economies globally. Macros remain strong with an easing inflation cycle, progress of monsoons and robust economic growth. The fiscal discipline by government will translate to crowding in for private investments. With the government also emphasizing on private capex, the entire curve of the capex cycle stands to benefit in light of multiple enablers such as deleveraged corporate balance sheets, healthy profitability, rising domestic demand, and increasing capacity utilization. Even though there is no change in the capex expenditure, compared to the interim budget, it is a 17% growth on YOY terms, which in itself is a healthy figure. Tax benefits to salaried class, focus on employment generation, and continuation of policies directed towards housing and rural reforms (agri/allied sectors) can have a positive impact on the consumption theme.

Companies that have witnessed growth, are today seeing high multiples. Whereas segments where multiples are low, growth is not yet delivered. Hence, in the near term we believe returns could be muted; while we continue to be positive on the long-term growth potential of the Indian equity market.

Debt Markets

The government has reduced the fiscal deficit from 5.1% to 4.9%. Gross and net borrowing numbers haven't changed much hence market reaction today was muted. The government is committed to stay on course of the fiscal consolidation path, gliding down from 4.9% in FY25 to 4.5% in FY26. This was in line with our expectations. We continue to remain constructive on rates on the back of sustained FPI flows in debt post index inclusion of Indian G-Secs, stable outlook on external front and the recent S&P sovereign outlook upgrade. Accordingly, from a strategy perspective, we will maintain an overweight duration stance within the respective scheme mandates. We do expect the 10-year bond yields to trade in a narrow range in the near term and to soften to 6.75% over the next few quarters.

Disclaimer

Source of Data: Axis MF Research, India Budget 2024-25. Date: 23rd July 2024

The Information set out above is included for general information purpose only and does not constitute legal advice.

Please note the rates provided are for generic type of investors, In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the scheme. Axis AMC shall not be responsible for any action taken by you on the basis of the information contained herein.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

The Sector/Stocks mentioned above are used to explain the concept and is for illustration purpose only and should not be used for development or implementation of any investment strategy. It should not be construed as investment advice to any party. The stocks may or may not be part of our portfolio/strategy/ schemes.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025