How Mutual Fund SIPs have created wealth over the last 15 years: Large Cap and Diversified Equity

Systematic Investment Plans (SIPs) were introduced in India almost 20 years back by Franklin Templeton. Since then, SIPs in good funds have generated excellent returns and created wealth for the investors. SIPs offer a simple and disciplined way to accumulate wealth over the long term. Mutual Fund SIPs work pretty much like bank recurring deposits, except they generate superior risk adjusted returns compared to recurring deposits. There are a number of benefits of retirement planning through Mutual funds Systematic Investment Plans (SIP):-

- The biggest advantage of SIPs is that, they make the need to time the market irrelevant. It is not possible to predict accurately how markets will behave. By investing at a regular frequency, e.g. monthly, one is invested both at the high and the low points of the market. SIPs work well in volatile markets, by averaging the cost of the investment.

- SIPs engender a disciplined approach to investing. By investing a fixed amount out of regular your savings, you will be able to build a corpus for your long term financial needs. Money not invested often gets spent on things that you may not need.

- Mutual Funds are very flexible instruments. There are no restrictions and penalties on regular SIP payments and withdrawals, unlike PPF or ULIPs. You can start a SIP with a monthly investment, as low as Rs 500. Some mutual funds have even lower minimum investment limit.

- For the smart investor, mutual funds offer more choices and transparency. You can select products based on your risk profile, track record, and fund objectives.

- Equity oriented mutual funds are more tax efficient than most other investment products. Long term capital gains for equity mutual funds are tax exempt. Most debt investments, with the exception of public provident fund, are taxable.

In this series of articles, we will look at how SIPs have created long term wealth for the investors in the last 15 years. In this article, we will discuss how SIPs in some large cap and diversified equity fund, have created wealth for their investors. For our discussion, we have selected 7 large cap and diversified equity funds that have given good returns in the last 15 years. This is, by no means, a comprehensive list of all the funds that gave good returns in the last 15 years. This just an illustration of how long term investments in SIPs, have created wealth for investors. Each of the funds in our selection has given SIP returns of nearly 20% annualized. Since SIP investments are made over a period of time, the method of calculating SIP returns is different from that of Lump Sum investments. SIP returns are calculated by a methodology called XIRR, which is a variant of Internal Rate of Return (IRR). XIRR is similar to IRR, except XIRR can calculate returns on investments that are not necessarily strictly periodic.

For our examples, we have assumed a monthly SIP of Rs 3000 only, made on first working day of every month in the funds that we will discuss. Let us assume the SIP start date was 15 years back in May 1999. Over this period, the investor would have invested Rs 5.43 lakhs in SIPs of the following mutual funds. Let us see how much wealth would they have accumulated, by investing in the following funds.

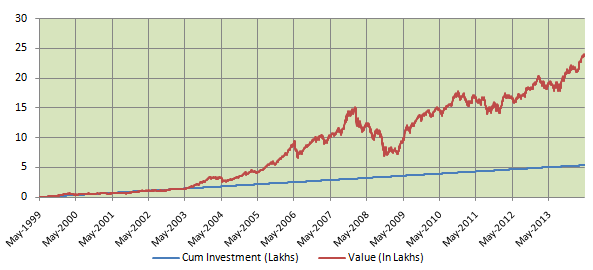

ICICI Prudential Top 100 Fund:

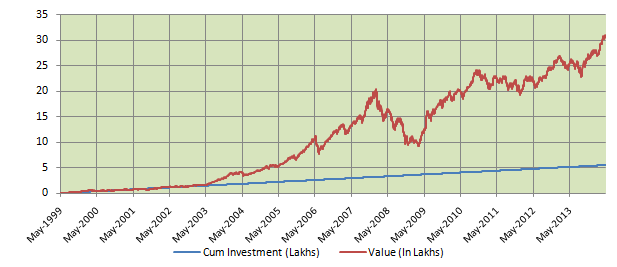

Within the ICICI Prudential stable, ICICI Prudential Dynamic Plan gave the highest annualized returns among all large cap and diversified equity funds in the last 10 years. But this fund has not yet completed 15 years, and so we were not able to select this fund. However, the ICICI Prudential Top 100 fund, a large cap fund launched in 1998, has also given excellent returns over the last 15 year period. The fund has an AUM base of nearly Rs 450 crores and is managed by Sankaran Naren. The chart below shows the SIP returns of the ICICI Prudential Top 100 fund, growth option, over the last 15 years.SBI Magnum Multiplier Plus Fund:

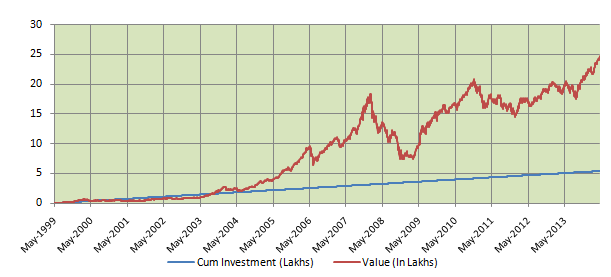

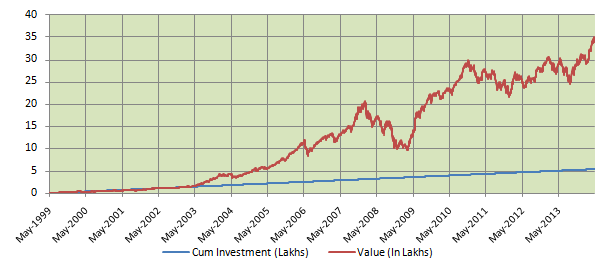

The SBI Magnum Multiplier Plus, a diversified equity fund was launched in 1993. The fund has an AUM base of over Rs 1000 crores and is managed by Jayesh Shroff. The chart below shows the SIP returns of the SBI Magnum Multiplier Plus fund, growth option, over the last 15 years.Franklin India Bluechip Fund:

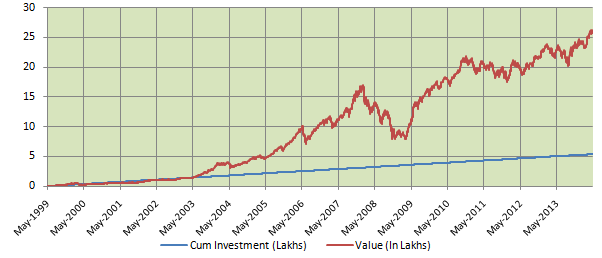

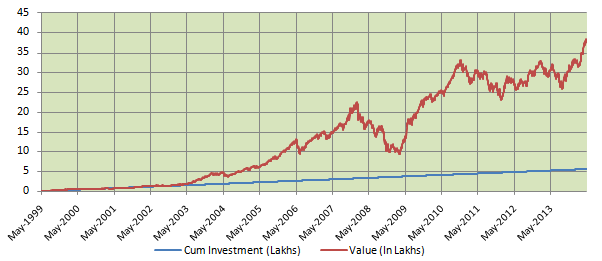

The Franklin India Bluechip fund, a large cap fund launched in 1993, has for long been a favourite with investors. The fund, proclaimed by many financial planning experts as one of the best ever mutual funds, its current relative under performance notwithstanding, has an AUM base of nearly Rs 4000 crores and is managed by Anand Radhakrishnan. The chart below shows the SIP returns of the Franklin India Bluechip fund, growth option, over the last 15 years.Birla Sun Life Equity Fund:

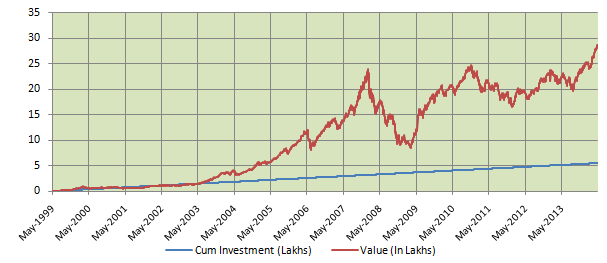

The Birla Sun Life Equity fund is a diversified equity fund launched in 1998. This fund from the Birla Sun Life stable has an AUM base of nearly Rs 650 crores and is managed by Anil Shah. The fund has been ranked No. 2 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, up one place from the ranking for the quarter ending December 31, 2013. The chart below shows the SIP returns of the Birla Sun Life Equity fund, growth option, over the last 15 years.Franklin India Prima Plus:

The Franklin India Prima Plus fund is a diversified equity fund launched in 1994. This fund from the Franklin Templeton stable has an AUM base of nearly Rs 1990 crores and is managed by R.Janakiraman and Anand Radhakrishnan. The chart below shows the SIP returns of the Franklin India Prima Plus fund, growth option, over the last 15 years.HDFC Top 200 Fund:

The HDFC top 200 fund, a large cap fund launched in 1996, has for long been a favourite with investors. This fund from India’s largest AMC, has often been proclaimed by many financial planning experts as one of the best ever mutual funds, its current relative under performance notwithstanding. The fund has an AUM base of over Rs 10,000 crores and is managed by Prashant Jain. The chart below shows the SIP returns of the HDFC top 200 fund, growth option, over the last 15 years.HDFC Equity Fund:

The HDFC Equity fund is a diversified equity fund launched in 1994. This fund from India’s largest AMC has an AUM base of nearly Rs 10000 crores and is managed by Prashant Jain. The chart below shows the SIP returns of the HDFC Equity fund, growth option, over the last 15 years.

If you had started a monthly SIP of Rs 3000 in ICICI Prudential Top 100 fund back in May 1999, by now you would have accumulated nearly Rs 24 lakhs corpus, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of Rs 15 lakhs by the end of 2007 and despite the severe financial crisis, a corpus of Rs 20 lakhs by the end of 2012. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 17.8%.

If you had started a monthly SIP of Rs 3000 only in SBI Magnum Multiplier Plus fund back in May 1999, by now you would have accumulated a corpus of over Rs 24 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of Rs 15 lakhs by the end of 2007 and a corpus of Rs 20 lakhs by the end of 2010. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 18.1%.

If you had started a monthly SIP of Rs 3000 only in Franklin India Bluechip fund back in May 1999, by now you would have accumulated a corpus of nearly Rs 26 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of over Rs 15 lakhs by the end of 2007 and despite the severe financial crisis, a corpus of Rs 20 lakhs by the end of 2010. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 18.7%.

If you had started a monthly SIP of Rs 3000 only in the Birla Sun Life Equity fund back in May 1999, by now you would have accumulated a corpus of over Rs 28 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of over Rs 15 lakhs by the end of 2007 and despite the severe financial crisis, a corpus of Rs 20 lakhs around the end of 2009. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 20%.

If you had started a monthly SIP of Rs 3000 only in the Franklin India Prima Plus fund back in May 1999, by now you would have accumulated a corpus of nearly Rs 31 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of over Rs 15 lakhs by the end of 2007 and despite the severe financial crisis, a corpus of Rs 20 lakhs around the end of 2009. Your corpus would have crossed the Rs 25 lakhs mark by the end of 2012. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 21%.

If you had started a monthly SIP of Rs 3000 only in the HDFC top 200 fund back in May 1999, by now you would have accumulated a corpus of nearly Rs 35 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of Rs 10 lakhs by the end of 2006, a corpus of nearly Rs 20 lakhs by the end of 2007. Despite the severe financial crisis, your corpus would have crossed the Rs 30 lakh mark by the end of 2010. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 22%.

If you had started a monthly SIP of Rs 3000 only in the HDFC Equity fund back in May 1999, by now you would have accumulated a corpus of nearly Rs 38 lakhs, with an investment of only Rs 5.4 lakhs. You would have accumulated corpus of nearly Rs 10 lakhs by the end of 2005, a corpus of nearly Rs 15 lakhs by the end of 2006 and a corpus of Rs 20 lakhs by the end of 2007. Despite the severe financial crisis, your corpus would have hit the Rs 25 lakhs mark by the end of 2009 and crossed Rs 30 lakhs by the end of 2010. Over the 15 year period the compounded annual returns on your SIP investment in this fund would be 23%.

Conclusion

In this article, we have seen how SIPs in large cap and diversified equity funds over the long term have created wealth for the investors. SIPs benefit from the power of compounding, and therefore the earlier we start our SIP, the greater is the potential for wealth creation. However, it is important to select a good fund for our SIPs. Your financial advisers can help you select a good fund that is suitable for your risk profile. As your risk profile changes over time, you should re-balance your portfolio to align with your risk profile. Tomorrow, we will discuss how SIPs in small and midcap funds have created wealth for the investors.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team