Should India be worried about rising US Treasury yields?

Mutual Fund

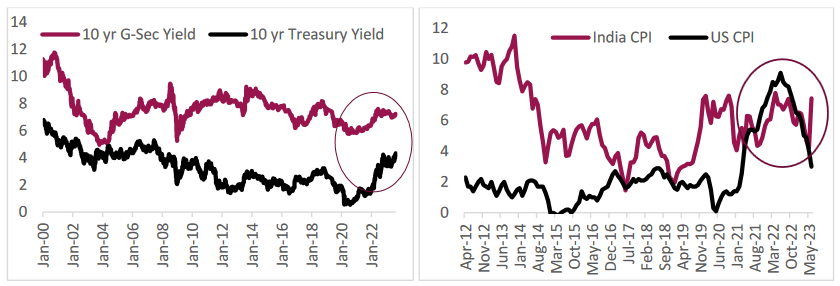

The significant rise in 10-year US Treasury yields have caught markets in general off-guard. While yields did retreat from 15-year high of 4.34% to ~4.12%, these are quite high compared to 1.7-2% levels seen in early 2022. What are the factors that led to the rise in yields and should higher yields be a concern for India?

The upsurge in yields has been a culmination of few factors - consistent interest rates hikes (11 times since March 2022) by the US Federal Reserve (Fed) to curb inflation, a high fiscal deficit and increased debt issuance from $733 million to $1 trillion in the July-September period. The changing narrative of the US economy – from pricing in a recession to a soft landing to incoming data showing a relatively resilient economy – the markets have seen and priced it all. Expectations of a slowdown have now been pushed towards the next year given the strong macroeconomic picture and markets now expect interest rates to remain elevated.

The sell-off in US Treasuries spread to many countries globally, including the UK and Europe. In India, the spreads between the 10-year Indian government bonds and the US Treasuries narrowed to less than 290-300 basis points, given that the Reserve Bank of India (RBI) has maintained a pause since April 2023 as against the Fed’s hikes.

Source: Bloomberg. The above graph is used to explain the concept and is for illustration purpose only and should not used for development or implementation of an investment strategy. Past performance may or may not be sustained in future.

It is pertinent to note that the US has faced unprecedented inflation since 2022; these levels have not been seen in the last 40 years and the average American has seen flat to low inflation and near zero interest rates thereof in the last decade. India on the other hand, as an emerging economy has been witness to periods of high inflation and high interest rates. For 16 consecutive months between September 2021 to December 2022, US inflation has been ahead of India which has not been the case in the last decade. India’s interest rate trajectory has seen a measured rise when compared to that of the US and the same goes for inflation too.

Contrary to the belief that a narrowing differential may not be good for the rupee, the currency has stayed in a narrow range through 2023. Furthermore, FPI inflows into Indian markets since April have been quite strong allaying fears that FPIs could withdraw if the differential narrows due to rates hikes by the Fed. The inflows have largely been on account of the robust macroeconomic scenario in India and its potential in the face of slowing growth globally.

Given that Indian bonds are largely domestic owned, one shouldn’t expect any sell-off in response to US nor should one expect a dramatic depreciation in the rupee. India’s external sector is in a much better situation today - a lower current account deficit and improving foreign exchange reserves - these bode well for India. Furthermore, the Fed is almost at the top of its tightening cycle. We expect limited upside risk to yields for now but will be watchful of the price pressures and oil prices. Domestic factors than external could play a pivotal role in determining the direction of bond yields.

In the current scenario, investors may use this rise in yields to increase duration and stick to short to medium term funds with tactical allocation to long / dynamic bond funds. One can expect yields to be lower by 25-40 bps in next 6-12 months across the curve. Investors could look at actively managed strategies to capitalize from fluctuations in rate movements. While the overall strategy is to play flat/falling interest rate cycle over the next 18-24 months, markets are likely to see sporadic rate movements. In such a scenario, active funds are ideally positioned to toggle across duration and the ratings curve to optimize medium term returns.

Disclaimer

Source of Data: RBI Governor’ Statement, RBI Monetary Policy Statement & RBI post policy press conference dated 10th August 2023, Axis MF Research

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025

-

Axis AMC Partners with NISM to Launch Industry-First Talent Development Program "Unnati"

Mar 4, 2025

-

Axis MF launches Axis NIFTY AAA Bond Financial Services: Mar 2028 Index Fund

Feb 27, 2025

-

RBI Monetary Policy: Feb 2025 New Governor ushers in a softer rate regime

Feb 7, 2025