RBI Monetary Policy: Status quo as widely expected

Mutual Fund

October 2023

As widely expected and concurrent to our view, the Reserve Bank of India (RBI) continued with a pause on interest rates, but with a hawkish bias. The governor highlighted uncertainty around inflationary pressures and added that the policy remains focused on aligning inflation to 4% target on durable basis and not in the band of 2-6%.

Policy Decision

- Repo rate unchanged at 6.5%

- SDF rate unchanged at 6.25% and MSF rate unchanged at 6.75%

- All six members voted in favor of the pause.

- Five members voted to “remain focused on withdrawal of accommodation to ensure inflation progressively aligns with the target, while supporting growth”

- Possibility of OMO sales to keep liquidity in check

RBI could consider OMOs

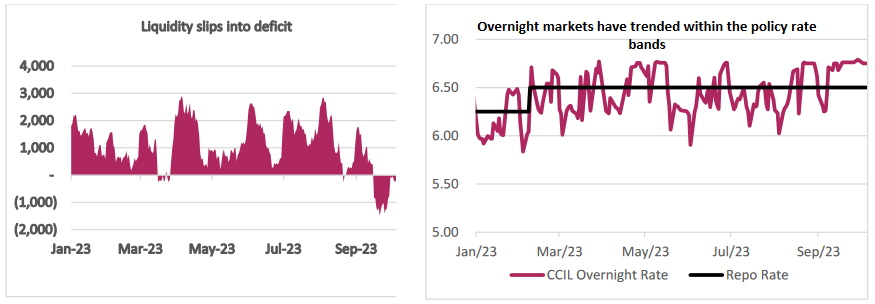

The central bank could consider Open Market Operations (OMOs) of government securities to manage liquidity. The timing and quantum of such operations would depend upon evolving liquidity conditions. The governor phased out the I-CRR initiated in its last MPC.

Source: RBI, Axis MF Research, Bloomberg. Data as of 6th October 2023.

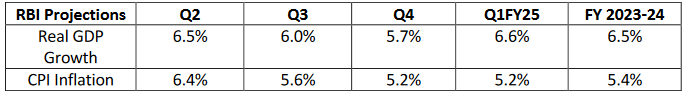

Outlook on growth and inflation unchanged

The governor reiterated concerns from his earlier MPC statement on global growth highlighting divergent and slowing trajectories across regions amidst moderating but above target inflation, tight financial conditions, ongoing geopolitical conflicts, geo-economic fragmentation and high public debt. The central bank retained its estimates both on growth and inflation but pointed out risks to the outlook from external sector.

Source: RBI Governor’ Statement dated 6th October 2023

The measures taken by the government have helped correct vegetable prices. The central bank expects inflation to fall lower over the near term but the future trajectory could be dependent on factors such as sub-normal monsoon, and a lower area sown under pulses, low reservoir levels, and volatile global energy and food prices. While vegetable prices may undergo further correction and core inflation is easing, the MPC noted that headline inflation is ruling above the tolerance band and its alignment with the target is getting interrupted. Domestic economic activity is holding up well and is expected to be boosted by festive consumption demand, pick up in investment intentions and improving consumer and business outlook.

Market Reaction

The headline policy action was in-line with market consensus. Money markets have seen an uptick of 5-10 bps within bonds of up to 5 years while the 6-10-year government bonds saw a rise of 10-14 bps. The benchmark 10-year G-Sec stood at 7.35%.

Our View

Though status quo was widely expected, policy action in the form of OMOs were completely unexpected by the markets and even by us. The immediate reaction has been a rise in yields and we believe that the yields would shift higher leading to a steeper yield curve and some nervousness should persist in the near term. Accordingly, we expect the 10-year benchmark to trade in a range of 7.25-7.45%. We retain our view that interest rate cycle in India and across the globe has peaked and will remain higher for longer. Inflation, as evidenced by core inflation continues to fall and this augurs well for policy rates to be on hold. Rising US Treasury yields and a stronger US dollar will have an indirect impact on the external sector which is one of the risks highlighted by the governor. Given the inclusion of Indian government bonds to the JP Morgan Emerging Market Indices and various news suggesting the likely inclusion into Bloomberg Indices as well, we expect stability in bond yields over the medium to longer term.

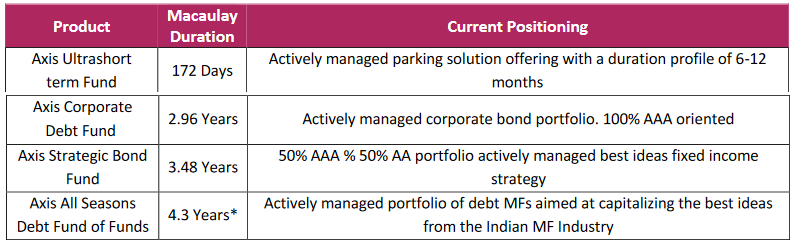

With policy rates remaining incrementally stable, we have added duration gradually across our portfolios within the respective scheme mandates. Investors can look at actively managed strategies to capitalize from fluctuations in rate movements. While the overall call is to play flat to falling interest rate cycle over the next 18-24 months, markets are likely to see sporadic rate movements. In such a scenario, active funds are ideally positioned to toggle across duration and the ratings curve to optimize medium term returns.

Allocation and strategy is based on the current market conditions and is subject to changes depending on the fund manager’s view of the markets. Data as on 30th September 2023 *Mac Duration computed basis look through portfolios of underlying funds with a portfolio date of 31st August 2023.

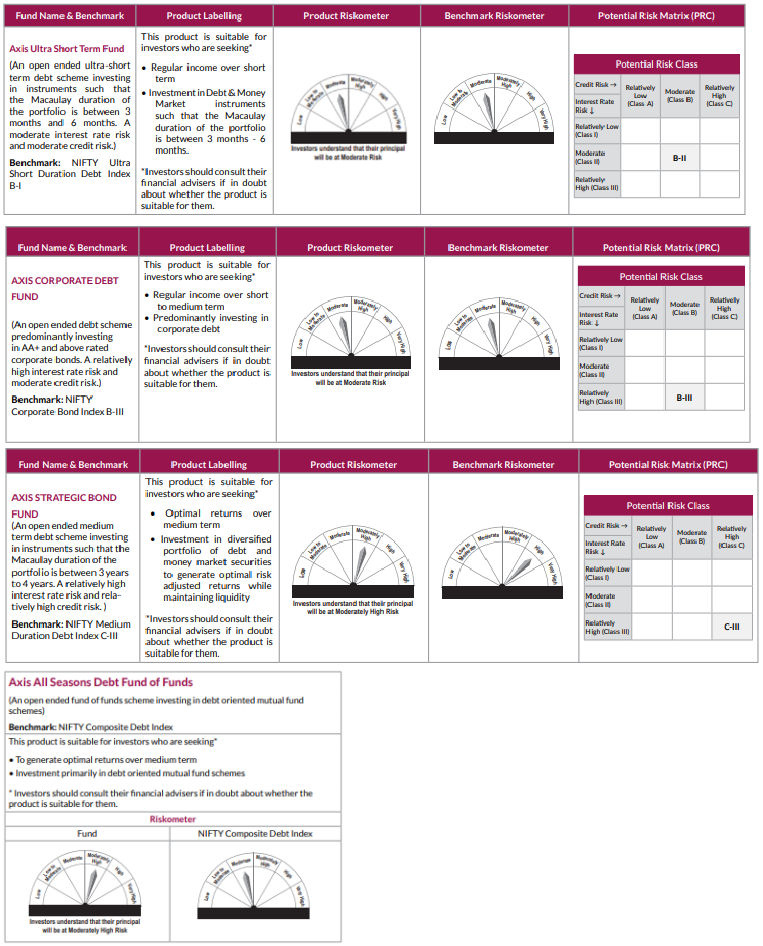

Product Labelling

Disclaimer

Source of Data: Axis MF Research, JP Morgan, Bloomberg.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025