Mirae Asset Mutual Fund garners more than Rs. 1,393 crore in Mirae Asset Multicap Fund NFO

Mutual Fund

If the NFO aligns with your investment objective that suits your financial goals and risk appetite, then it can be a good investment. A similar case has unfolded for Mirae Asset Mutual Fund, known as One of the fastest growing fund houses in India, back with another equity fund after an extended period. Mirae Asset Multicap Fund was launched on 28th July 2023, the responses for this NFO has been remarkable.

This is one of the most successful NFOs for Mirae Asset Mutual Fund as it garnered Rs. 1,393.93 crore and also attracted 74,610 number of applications (as on 21st Aug 2023). There has been a tremendous support from the distribution channel across pan India. Nearly 5,030 distributors across channels actively participated and made this NFO to reach this height.

Swarup Mohanty, CEO & Director, Mirae Asset Mutual Fund said, “I am delighted to share with our partners that, your untiring efforts and focus has helped our sales team & resulted in such an overwhelming response for Mirae Asset Multicap Fund NFO. We received more than 74,000 applications reflecting the enthusiasm to be part this NFO. I thank you for all your continuous support.”

Ms. Suranjana Borthakur, National Head – Banking & NDs said “We are grateful to our partners for such an overwhelming response to the recently closed Mirae Asset Multicap Fund NFO. The granularity of the business with over 100 Banking & ND partners supporting this NFO is our key take away. This is also an opportunity for investors who do not want their portfolio to be very wide spread but enjoy the best of all sectors in one fund.”

There has been a very positive and unprecedented support from the Retail MFD partners as well, in this regard Mr. Makhdoom Ansari, National Head – Retail Sales said, “Mirae Asset Multicap Fund NFO evoked tremendous response from investors with retail segment showing great interest. The contribution from our MFD partners seems to be widespread across segments and geography. More than 4900 MFDs have contributed to this success. We are humbled and overwhelmed with this kind of response. We thank all our partners for trusting us with their continued support.”

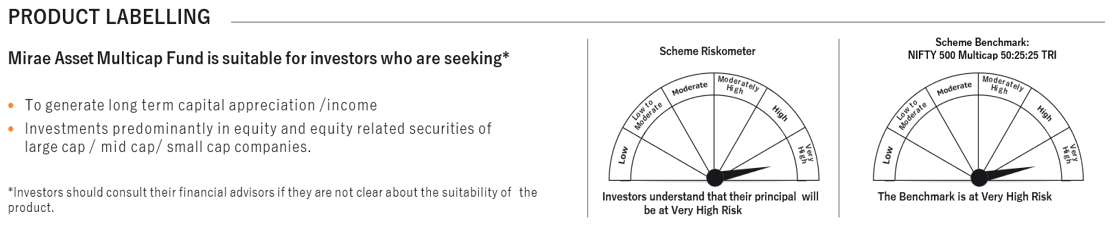

Mirae Asset Multicap Fund is now open for investments & available to investors in both, Regular Plan and Direct Plan. The scheme is already re-opened for continuous sale and repurchase from 22nd August 2023. The fund is managed by Mr. Ankit Jain. The benchmark Index for the fund is NIFTY 500 Multicap 50:25:25 TRI.

DISCLAIMERS & PRODUCT LABEL:

NSE Indices Ltd Disclaimer: NSE INDICES LIMITED do not guarantee the accuracy and/or the completeness of the Index or any data included therein and NSE INDICES LIMITED shall have not have any responsibility or liability for any errors, omissions, or interruptions therein. NSE INDICES LIMITED does not make any warranty, express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person or entity from the use of the Index or any data included therein. NSE INDICES LIMITED makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the index or any data included therein. Without limiting any of the foregoing, NSE INDICES LIMITED expressly disclaim any and all liability for any claims, damages or losses arising out of or related to the Products, including any and all direct, special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages

Statutory Details: Trustee: Mirae Asset Trustee Company Private Limited; Investment Manager: Mirae Asset Investment Managers (India) Private Limited (AMC); Sponsor: Mirae Asset Global Investments Company Limited.

For further information about other schemes (product labelling and performance of the fund) please visit the website of the AMC: www.miraeassetmf.co.in

Please consult your financial advisor or mutual fund distributor before investing

Mirae Asset Multicap Fund

(Multi Cap - An open-ended equity scheme investing across large cap, mid cap and small cap stocks)

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025

-

Axis AMC Partners with NISM to Launch Industry-First Talent Development Program "Unnati"

Mar 4, 2025

-

Axis MF launches Axis NIFTY AAA Bond Financial Services: Mar 2028 Index Fund

Feb 27, 2025

-

RBI Monetary Policy: Feb 2025 New Governor ushers in a softer rate regime

Feb 7, 2025