Let's talk about supply too

Mutual Fund

Equities are the talk of the town, from the bustling streets of Mumbai to the quieter corners of smaller towns. It appears the desire to be a part of India’s economic expansion through equities is widespread. Building on the substantial gains of 2023, frontline indices have been touching new lifetime highs, with the BSE Sensex crossing the 80,000 mark and the Nifty 50 surpassing 24,000. Within a span of six months, India’s equity market capitalization has grown from US$4Tn to US$5Tn.

In addition to the strong economic growth prospects, the surge in equity markets is attributed to the growth in domestic demand for equities. Consistent pool of domestic equity demand, an aggregate of mutual fund SIPs, equity contributions from pension schemes like EPFO/NPS, and insurance, is estimated to grow to ~Rs 3,30,000cr (US$40 billion) annually. This is also the primary justification for the valuation premiums in the market.

A less frequently discussed factor is the “supply” side of the market. A true “market” is a self-correcting one. Adam Smith’s proverbial invisible hand responds to an increase in demand and price with an increase in supply. This is now visible in the Indian market as well. The jump in valuations that the market and the companies are now commanding is enticing increasing number of private companies to list, strategic investors to take profits and even promoters – both local and multi-national to divest.

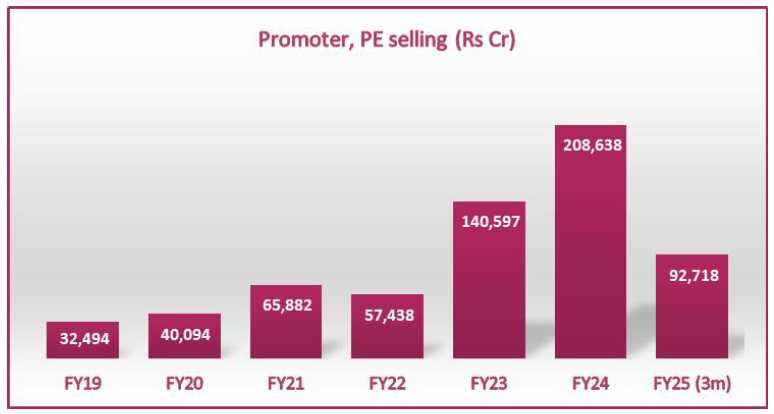

Stake sales by promoters of 20 companies’ aggregated to Rs 40,000cr in June itself. Since April 2022, secondary market sales by promoters and of private equity stakes has been Rs 4,42,000cr compared to gross SIP flows of Rs 4,17,728cr and overall net inflow of Rs 5,47,717cr into mutual funds. These have accelerated as market multiples have risen, stake sales were up 48% yoy in FY24 and Q1FY25 alone has seen supply equivalent to 45% of FY24 come to market.

This deluge is only likely to accelerate, the quantum of IPOs over the next quarter is 3x of IPOs in 1QFY25. The IPO pipeline over the next few months is over Rs 93,000cr. In addition, value of PE stakes of more than 3-year vintage in public companies is now Rs 2,17,000cr and with expiring pre-IPO lock-ins should be offered in the market sooner rather than later. These and the likely continued promoter stake sales will ensure that the “supply” will likely outstrip the domestic demand.

Insider selling at an unprecedented quantum

Source: Axis MF Research

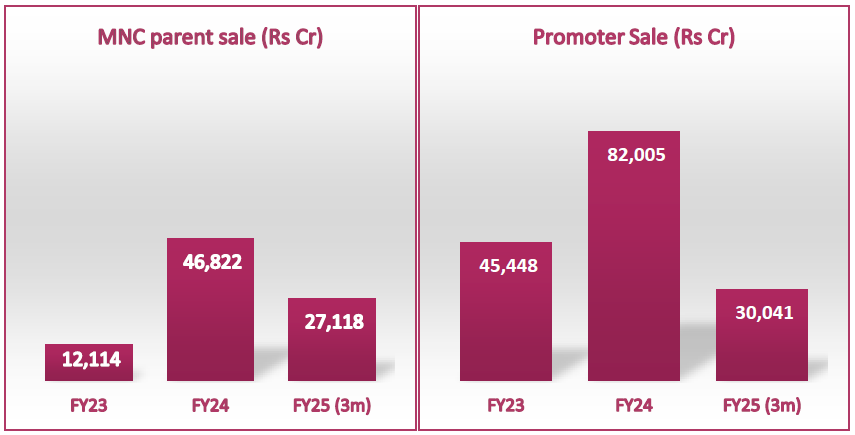

MNC parents selling stake given valuation premiums

The elevated multiples being commanded across various sectors is also enticing promoters both domestic as well as MNC parents to sell. A case in point is British American Tobacco, which divested its shares in ITC to raise Rs 17,500cr. Similarly, Whirlpool sold 24% of its stake and Timken reduced its stake by 16.7%. Stake sale by MNC parents in past 15 months amounted to nearly Rs 74,000cr. This is not surprising with nearly a dozen MNC ubsidiaries in India today trading at 4x the multiple their parents trade at in the home market.

More recently, MNCs are looking to IPO their Indian subsidiaries to raise funds to arbitrage the valuation gap in their home market vs India. Hyundai plans to divest 17.5% of its Indian subsidiary holding in its upcoming IPO and raise Rs 25,000cr for its parent. News reports indicate LG is also considering a similar raise through IPO of its Indian electronics subsidiary.

Indian promoters also trimming their holdings

The fact that over 100 companies are currently trading at over 50x their earnings has attracted Indian promoters to sell down or reduce their stakes. In the last 15 months, Indian promoters have sold over Rs 1,12,000cr of equity through secondary market, notably this amount is equivalent to the net SIP inflow during this period. In the last month alone, Indian and MNC promoters of 20 companies’ have sold upto 20% of their stakes in the secondary market raising Rs 40,000cr.

Promoter stake sales gaining momentum

Source: Axis MF Research

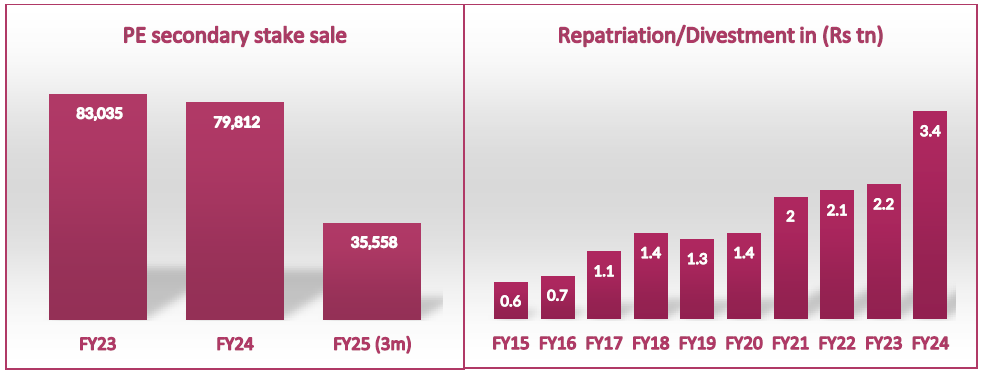

PE exits are now largely through public market

Private equity funds have arguably reaped the most benefits from rising equities. In the past 15 months, they have also divested Rs 1,15,000cr worth of equity stakes in the secondary market, in addition to the stakes offered in the IPOs. The accelerated pace of PE exits is reflected in the decline in net FDI over the past few years, with FDI outflows rising from Rs 2,25,000cr to Rs 3,40,000cr.

PE sales of over Rs 1,15,000cr in 15 months

Source: Avendus Spark, Axis MF Research

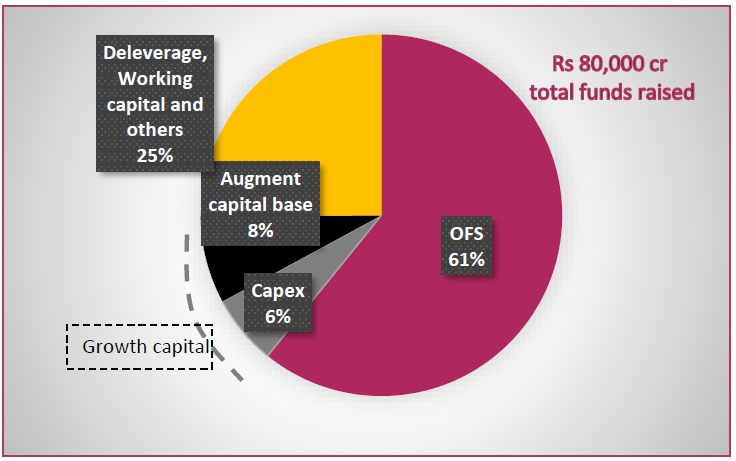

IPOs increasing and most of it is not “growth capital”

FY24 saw the number of IPOs double to 76 from 37 in FY23. In 1QFY25 alone, 15 companies have gone public and over 45 have filed their DRHPs with the regulator. The 91 IPOs that have come to the market in the past 15 months have raised Rs 80,000cr. Notably, unlike in the past most of this raise has not been growth capital. Two-thirds of these have been “offer for sale” from private equity investors and promoters. Of the remaining one third, only 20% of IPO proceeds are intended for capex and another 15% raised by financial companies to augment their lending capabilities. The balance 65% of the primary raise is for general corporate purpose, working capital and debt reduction.

Furthermore, after a lull in FY22 and FY23, Qualified Institutions Placement (QIPs) have picked up pace since FY24. More than Rs 1,00,000cr has been mobilized through QIPs and FPOs, in addition to the IPOs.

IPO raises have primarily been stake sales

Source: Antique, Axis MF Research

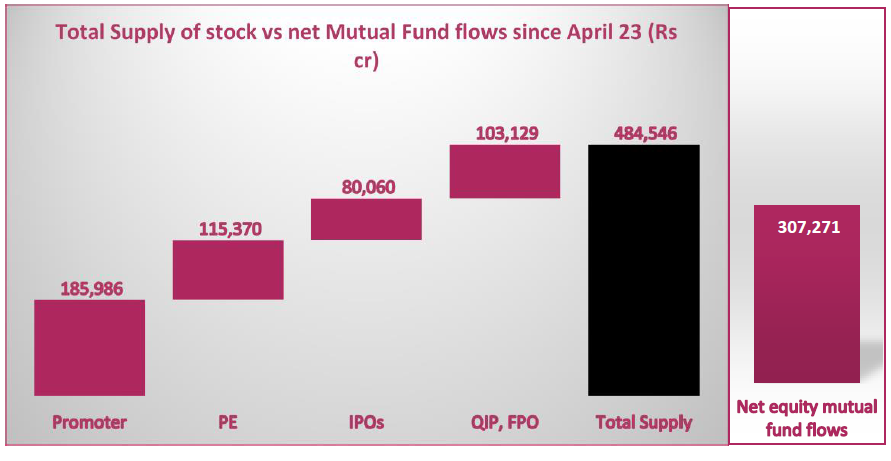

Since April 2023, the aggregate supply response to the increased retail equity flow has amounted to Rs 4,84,000cr. This includes Rs 1,86,000cr promoter stake sales, Rs 1,15,300cr from PE divestment, Rs 80,000cr raised via IPOs and Rs 1,03,000cr through QIPs. This figure is nearly 158% of the net flow to the equity mutual funds.

Total Supply has outpaced mutual fund flows

Source: Axis MF Research

Deluge only to rise…

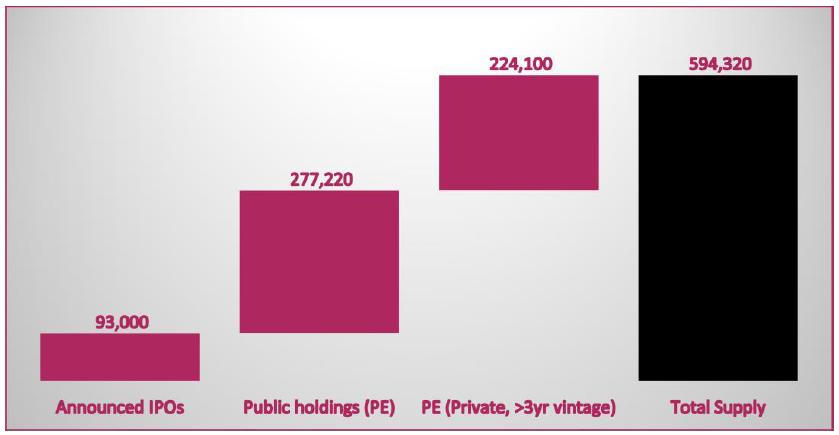

The pace of equity supply appears unlikely to slow down. As mentioned earlier, the IPO pipeline over the next few months is larger at another Rs 93,000cr. Private equity selling is likely to accelerate. These funds currently hold Rs 2,77,000cr worth of stakes in listed companies and of these over Rs 2,17,000cr are of more than 3-year vintage and therefore should be offered in the market sooner rather than later. In the coming months, pre-IPO locked in shares of the 91 recent IPOs will also come to the market given that on average these IPOs are up 79% from their issue price.

In addition, these funds have investments of Rs 4,67,000cr in companies that are still private. Of this, Rs 3,70,000cr is of more than 3-year vintage. Assuming, 60% of these are exited via the public market route and have MOIC (multiple of invested capital) of 2x, and 50% will be sold in IPOs these will be another Rs 2,24,000cr of potential supply.

Upcoming Supply

Source: Axis MF Research

Robust and well-developed financial markets play a pivotal role in the mobilization of capital and contribute significantly to a country’s economic growth. A growing equity culture will aid in this becoming a reliable source of growth capital. Nevertheless, it’s important to recognize that there are always contrasting perspectives: while some parties seek to acquire capital or invest, others aim to divest at favourable valuations. After all, it’s a fair game.

Disclaimer

Source: Axis MF Research, Avendus Spark, Antique. Data as on 30 June 2024.

Disclaimer: Past performance may or may not be sustained in the future. The Stocks mentioned above are used to explain the concept and is for illustration purpose only and should not be used for development or implementation of any investment strategy. It should not be construed as investment advice to any party.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025