Is the FII impact on Indian equities waning

Mutual Fund

Background

The past few months have been nothing short of extraordinary. The world seemed to have finally moved past the 2 year long pandemic with restriction easing worldwide. But then, little did we know that a potential border conflict between Russia and Ukraine will escalate into a full blown war. In a matter of days, the world is a completely different place as other countries weigh in and have their say.

In times of global uncertainty, foreign investors (particularly FII’s) embrace a risk-off trade, meaning, they move money from risky assets like equities and add more of bonds and gold (considered to be safe havens during times of distress). The global investing scenario has been plagued by the risk-off trade since October 2021, as central bankers hinted at policy tightening with inflation moving from being “transitory” in nature to somewhat of a medium term headache. This aided the bond trade globally as yields started to become attractive, nudging investors to allocate a higher portion towards Fixed Income as an asset class.

India opened its financial markets to foreigners in 1991 and ever since then FII’s have seen India as a compelling investment destination and have gained steady ownership in Indian equities. Just to put a number, the FII holding in India equities stood at 20.9% in NSE 500 stocks (Dec-21), highlighting their importance in market participation. Historically, when FII’s have turned net sellers, Indian equities have borne the brunt and seen sharp corrections.

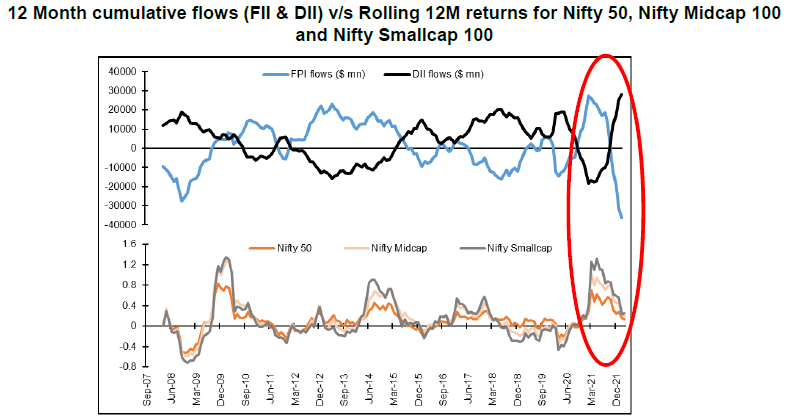

The ongoing FPI selling in Indian equities is turning out to be the highest selling spree (TTM FPI cumulative selling of US$36bn) since the global financial crisis (GFC) of CY08 (US$28bn). However, the impact on benchmark indices (NIFTY50, Nifty Midcap, Nifty Smallcap) is much lower compared to GFC and other instances of risk-off environment seen in CY13, CY16, CY18, etc., which led to FPI outflows. Especially for mid and small cap indices, the sensitivity to FPI outflows of such magnitude has been considerable in the past. (Chart below)

Source: Bloomberg. Data as on 15th March 2021

Why is it different this time?

In times of such global volatility, every market participant dreams of decoupling – an illusory feeling that tells you India is an island of calm amid stormy seas, a place with a moat so big that it makes the place unshakeable. This decoupling illusion has been shattered many times especially when foreign investors decide to offload their holdings.

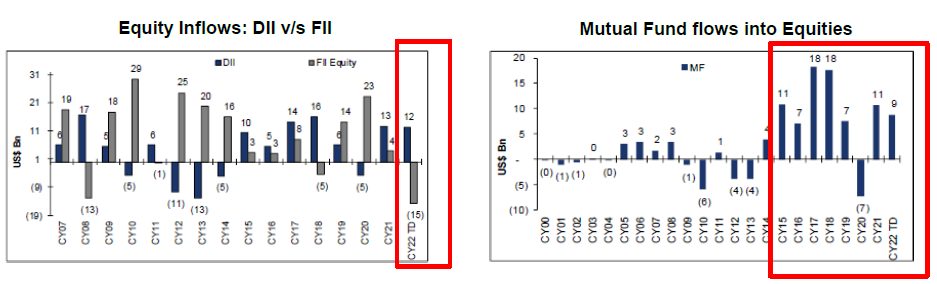

This time around though, there seems to be a semblance of domestic strength in ultra-stressed times. The Indian markets have been relatively immune to the global devastation wrought on currencies, equities and bonds this time around, compared with similar stresses in the past. While these flows still determine broad market direction, the impact seems to be relatively muted this time around. A major source for this is the positive surprise of consistent Domestic Institutional Investors (DIIs) money over the past few years. The rise in SIP flows appears to be more structural in nature which is offsetting most of the selling pressure from foreign investors. The below charts justify the changing nature of Indian investors towards equity assets.

Source: Bloomberg, Data as on 15th March 2022

Conclusion

We are witnessing consistent buying by domestic investors in the face of unprecedented selling by FPIs during rare and extreme fear-inducing events seen over the past few years (covid pandemic, Russia-Ukraine conflict, Monetary tightening). This is a clear positive surprise and heralds the structural deepening of domestic savings into equities in India. Such behavior of aggressive buying during declining stock prices by domestic investors should result in improved long-term outcomes for their portfolios vs buying in a high-optimism phase of the market, and thereby setting off a virtuous cycle. While the near term negative impact has been negated, it remains to be seen if Indian investors can put up this resolve in case the selling continues for a longer period of time.

Disclaimer

Source of Data: Axis MF Research, Bloomberg.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025