Is the Best of Banking liquidity behind us

Mutual Fund

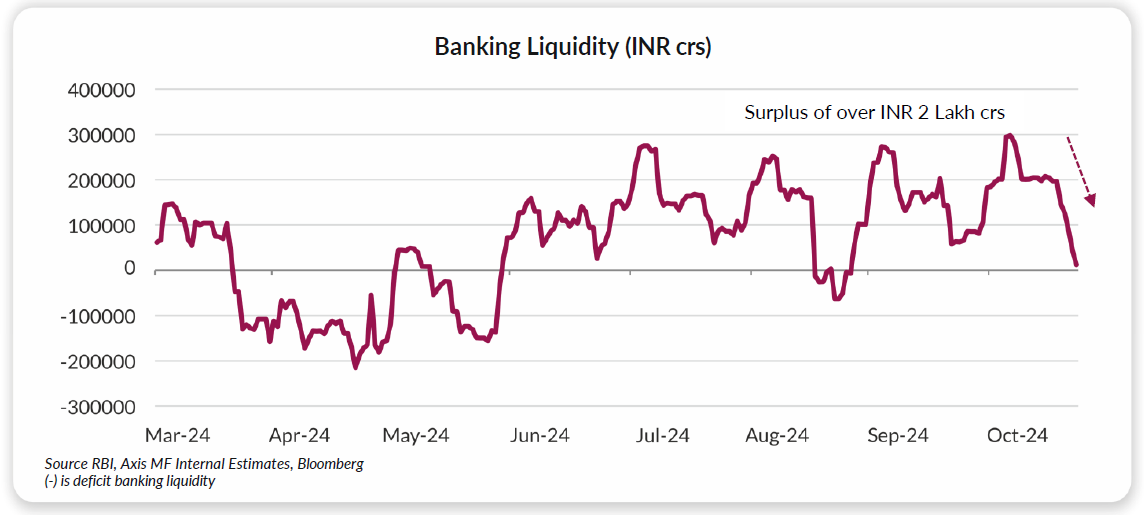

Banking liquidity is one of the important tools used by the Reserve Bank of India (RBI) to drive the operative rate and at times monetary policy stance. However, the fiscal year has seen significant fluctuations in banking liquidity, influenced by various macroeconomic factors:

- Deficit Banking liquidity in Q1 because of lower Government spending due to Elections embargo

- Huge build of Government Surplus post transfer of RBI dividend (Govt Surplus touched a high of INR 5 trillion in June 2024)

- Fall in durable liquidity in Q3 on account of huge FX outflows (Oct/ Nov 2024)

- Currency in Circulation (CIC) increase due to elections

Banking liquidity has remained in surplus since Q2 FY 2024, which has led to the operative rate trading below Repo rate of 6.5%.

Best of Banking liquidity is behind us as we see a further fall in core liquidity and build-up of Govt balances in Q4.

Core/durable liquidity from a peak of INR 5 trillion in Sep/Oct 2024, is now below ~ INR 2 trillion.

Government liquidity last week turned into ways and means advances (WMA) (deficit) from a surplus of INR 5 trillion in June 2024 due to accelerated spending and buybacks of INR 0.5 trillion announced by the Government.

What led to fall in durable liquidity from highs of INR 5 trillion?

Source RBI, Axis MF Internal Estimates

We expect durable/core liquidity to fall further, and it might reduce to INR 1 trillion in next quarter due to CIC and deposits growth.

Fall in durable/core liquidity below INR 1 trillion impacts banking liquidity and generally leads the overnight operative rate to trade above Repo rate or closer to MSF rate.

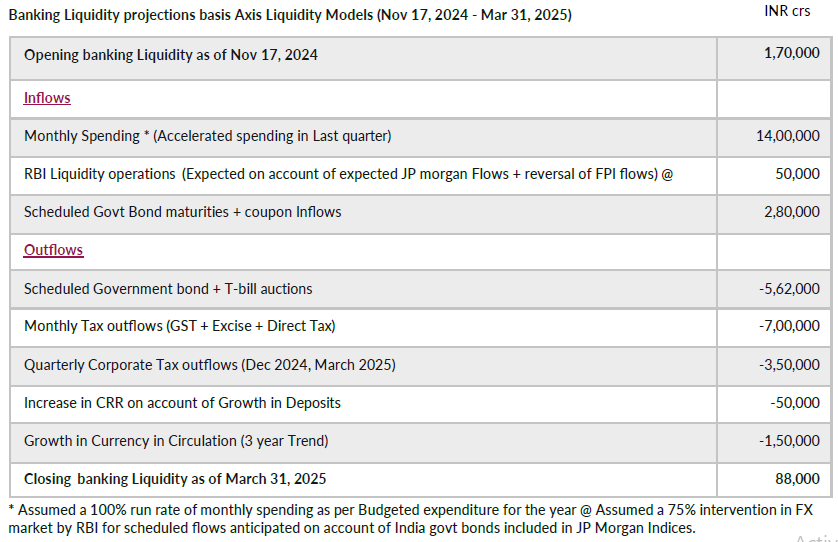

Banking liquidity projections: Dec 2024 to March 2025

We expect banking liquidity to be neutral to deficit for most part of Jan -March 2025.

- Strong seasonal growth in currency in circulation,

- Increase in Cash Reserve Ratio (CRR) maintenance on account of strong deposit growth in Q4 and

- Build-up of Government balances in Q4

would lead Banking liquidity to remain neutral to deficit for most part of quarter.

Source RBI, Axis MF Internal Estimates

What Can RBI do to manage Liquidity?

From a macro perspective, the RBI is currently facing several headwinds. These include FPI outflows, particularly in equity markets, and potential INR depreciation due to the strengthening of the dollar following the US elections.

Additionally, high-frequency data is indicating a possible slowdown, especially in GST collections and urban consumption. There is also a near-term hump in the CPI due to increasing food and vegetable inflation.

RBI has many tools to address the current liquidity situation, but as Growth has started to weaken, we believe RBI would keep liquidity close to neutral.

Various Tools RBI can use:

- 14 days/ 1 month long variable rate repo (VRR) auctions to infuse liquidity

- FX swap facility

- Reduction in CRR ratio (from 4.5% to 4%)

- Open market operations, especially OMO purchases

In the current macro environment, we expect RBI to use 14 days/ 1-month Variable Rate repo auctions to keep the liquidity close to neutral.

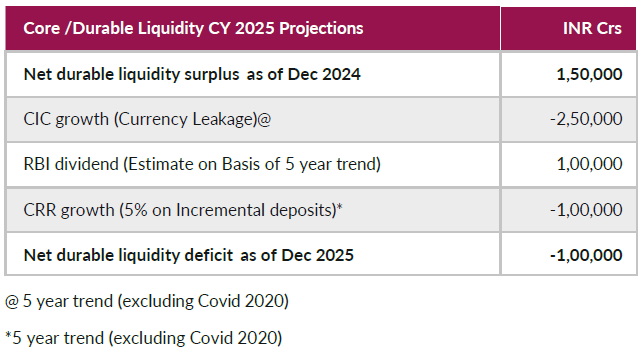

Case for core/ durable liquidity injection by RBI for Calendar Year (CY) 2025

CRR cut, Open Market Operations (OMO’s) are likely next year in case we don’t see FX inflows.

Source RBI, Axis MF Internal Estimates

Last couple of years we didn’t have any need of durable liquidity injection through CRR/OMO’s as we had witnessed huge FX inflows and bumper RBI dividend this year (Average FX inflows over last 5 years – INR 75000 crs) and RBI reserve money had been growing at a slower pace.

Durable / Core liquidity would turn into deficit next CY if we don’t get any FX flows next year and RBI might have to intervene through CRR cut of 50 bps / OMO’s of INR 1 Trillion.

RBI has a cushion of 50 bps of additional CRR which they have been maintaining since May 2022, CRR cut might be the right tool which also helps banks to manage liquidity in lieu of tweak in LCR guidelines expected next year.

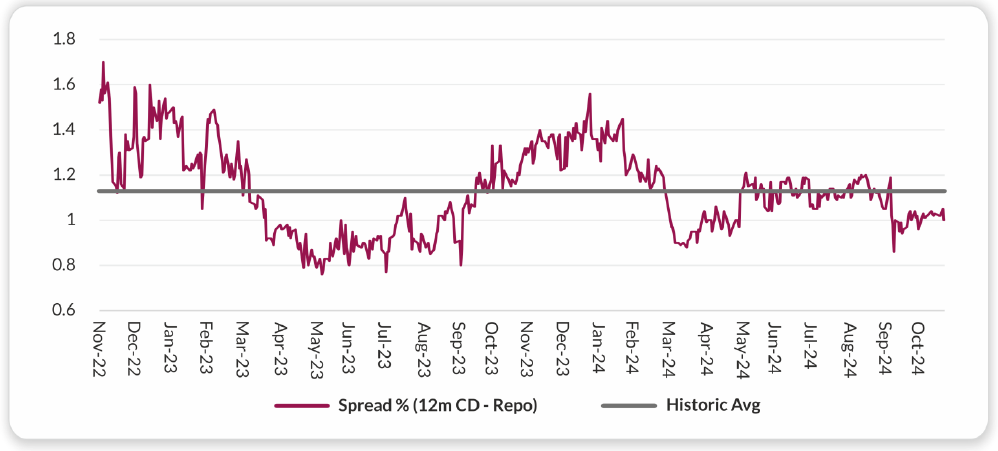

Impact on money market yields and operative rate

Banking liquidity can be neutral to deficit for most part of Jan -March 2025 and hence expect the operative rate to be close or higher than repo rate which can lead to rise and volatility in the money market yields.

We are witnessing relatively slower credit growth this financial year. Incremental FY Credit/Deposit ratio is at ~ 60 % v/s more than 85% last year, deposits growth has been robust.

12 months CD’s / 2-year corporate bonds are trading at 100 bps over current operative rate/ repo rate, spread is closer to its historical average and as the credit growth is weak and with the possibility of rate cuts in the next 6 months we don’t expect significant rise in money market yields.

Source: Bloomberg

If banking liquidity tightens significantly more than our expectations, we can expect some uptick in yields in 1 year CD/ 2-year Corp Bonds but do not expect any major sell off or rise in yields.

Disclaimer

The note is dated 25th November 2024

Past performance may or may not be sustained in future.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to र 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. This document represents the views of Axis Asset Management Co. Ltd. And must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025

-

Aditya Birla Sun Life AMC Press Release Q2 FY26 Final

Oct 28, 2025