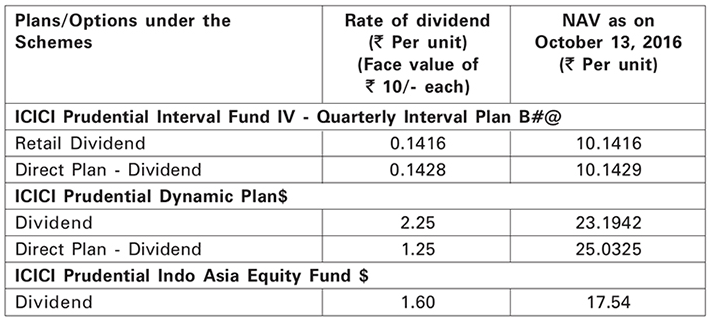

ICICI Prudential Mutual Fund Announces Dividends

Mutual Fund

Notice is hereby to all the investors/unit holders of the Schemes that October 21, 2016* has been approved as the record date for declaration of the following dividend under the Schemes. Accordingly, dividend will be paid to all the unit holders/beneficial owners whose names appear in the register of unit holders/statement of beneficial owners maintained by the Depositories, as applicable under the dividend option of the Schemes, at the close of business hours on the record date.

$ The dividend payout will be subject to the availability of distributable surplus and may be lower depending upon the extent of distributable surplus available on the record date under the respective Schemes.

@ The dividend amount payable will be dividend per unit as mentioned above or the entire distributable surplus to the extent of NAV movement since previous record date, available as on record date.

# Subject to deduction of applicable dividend distribution tax.

It should be noted that pursuant to payment of dividend, the NAV of the dividend option of the respective Schemes would fall to the extent of dividend payout and statutory levy, if any.

The Specified Transaction Period (STP) of ICICI Prudential Interval Fund IV - Quarterly Interval Plan B (IPIFIV-QIPB) is October 21, 2016 to October 24, 2016. Since the record date for declaring dividend and STP date under IPIFIV-QIPB coincides, the following provision (i) and (ii) will be applicable, for payment of dividend under IPIFIV-QIPB:

- In respect of valid purchase/switch-in applications received till 3.00 p.m on October 21, 2016* the ex-dividend NAV** of the respective date of receipt of application will be applicable and the investors shall not be eligable for dividend declared, if any, on the record date; and

- In respect of valid redemptions/switch-out requests received till 3.00 p.m on October 21, 2016* the ex-dividend NAV of the respective date of receipt of application will be applicable and the investors will be eligable to receive the dividend

**In respect of applications for an amount equal to or more than र 2 Lakh, the Applicable NAV shall be subject to the provisions of SEBI Circulars No. Cir/IMD/DF/21/2012 dated September 13, 2012 and no Cir/IMD/DF/19/2010 dated November 26, 2010 as may be amended from time to time, on uniform cut-off timings for applicability of NAV.

* or the immediately following Business Day, if that day is a Non-Business Day

Investors are requested to take a note of the above.

Please check out below Historical Dividends of ICICI Prudential Schemes -

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025