ICICI Prudential MF aim to provide your money the protection it deserves

Mutual Fund

ICICI Prudential Mutual Fund launches Capital Protection Oriented Fund V NFO (Plan F – 1100 Days)

NFO Period: 25th April 2014 to 9th May 2014

What does Capital Protection Fund works?

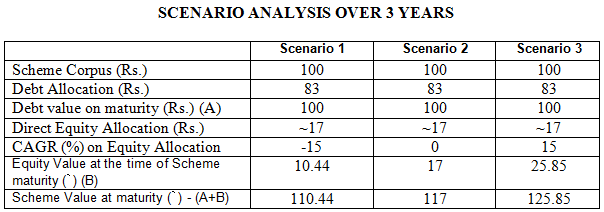

Let's assume that the Scheme invests 83% in highest rated Debt and Money market instruments. The 83% of the debt portfolio will be structured with an aim to grow over the tenure of the Scheme to 100% (net of annual recurring expenses) thereby aiming to protecting the capital invested.

Rest 17% will be invested in equities and equity related instruments. As explained in the scenarios given below, over three years the initial Scheme investment has remained intact and the value of portfolio appreciated, despite positive or negative equity returns. Thus, as illustrated below fixed income allocation in this Scheme aims for capital protection and equity provides potential upside to the portfolio.

The illustration given above is to explain the concept and working of Capital Protection Oriented Fund. This orientation towards protection of capital originates from the portfolio structure of the Scheme and not from any bank guarantee, insurance cover etc. There is a possibility of issuer default even in case of investments made in highest rated securities. It is also possible that equity markets correct more significantly that what is explained in above illustration. A variety of market factors may affect this analysis and this does not reflect all possible loss scenarios. There is no certainty that any of the above mentioned scenarios can be achieved. Investors are requested to refer the Scheme Information Document to understand various risks associated with investing in the Scheme.

Fund Suitabililty

- The Scheme is suitable for investors who do not want to take interest rate risk and aim to earn prevailing yields over the tenure of the Scheme

- It offers investors to participate in equities and an aim for stability in the portfolio being provided by investing in highest rated debt securities.

- Investors can take benefit of indexation and get an opportunity to earn tax-adjusted returns

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025