Groww Mutual Fund introduces ETF and FOF Schemes based on the Nifty EV & New Age Automotive Index

Mutual Fund

Bengaluru, July 24, 2024 : Groww Mutual Fund is pleased to announce the NFO launch of Groww Nifty EV & New Age Automotive ETF and the Groww Nifty EV & New Age Automotive ETF FOF. The NFO period of Groww Nifty EV & New Age Automotive ETF will be open till August 2, 2024, and the NFO period for Groww Nifty EV & New Age Automotive ETF FOF will be from July 24 - August 7, 2024.

The Indian government has been significantly supporting the Electric Vehicle (EV) sector with various initiatives. Under the Electric Mobility Promotion Scheme 2024, र500 crores have been allocated from 1st April to 31st July 2024 to accelerate the adoption of electric two-wheelers and three-wheelers1. Additionally, the government has set an ambitious target of 30% electric vehicles by 20302 with annual sales expected to surpass 16 million units 3. To further incentivize this transition, approximately र18,000 crores have been dedicated to boosting EV battery production 4

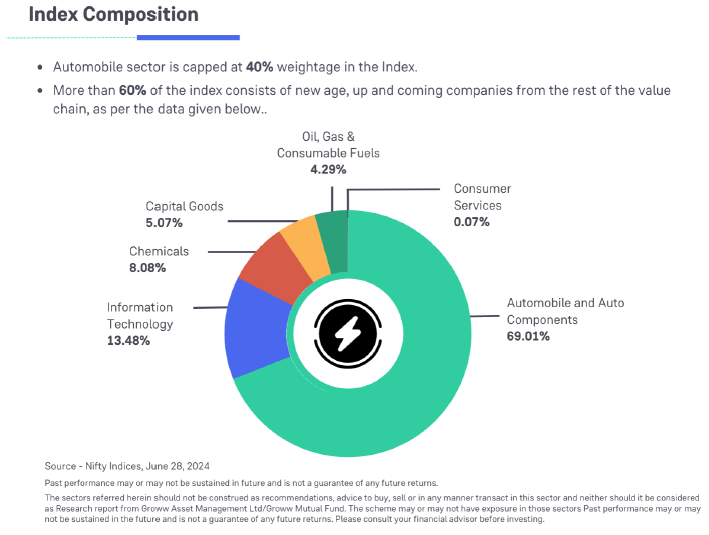

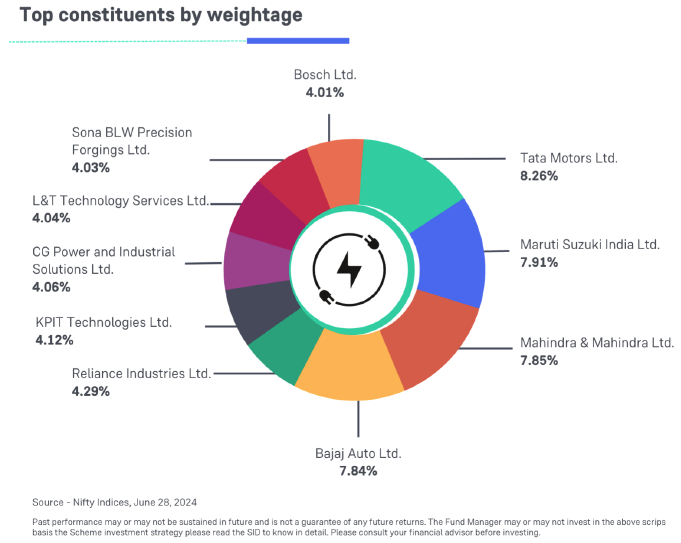

Both schemes’ underlying benchmark index is Nifty EV & New Age Automotive index - TRI, which aims to track the performance of companies that are part of the EV ecosystem or are involved in the development of new-age automotive vehicles or related technology 5

The Nifty EV & New Age Automotive Index is designed to monitor ~33 companies from the Nifty 500 index, which are engaged in EV manufacturing, hybrid and hydrogen fuel-based vehicles, charging infrastructure, battery production, and other crucial areas of the EV ecosystem. The index is predominantly composed of companies from the automobile and auto components industry.5

Varun Gupta, CEO, Groww Asset Management Ltd said, "With the rapid growth in the electric vehicle sector, these new funds aim to offer investors opportunities to benefit from this dynamic and evolving industry. Our ETF and FOF are specifically designed to help investors capitalize on the potential future of electric mobility and related technologies. By investing in these funds, investors can seek to gain exposure to a diverse portfolio of companies driving innovation in electric vehicles, battery technology, charging infrastructure, and other critical areas of the EV ecosystem”.

India is currently focused on becoming more sustainable, and as a country where transportation contributes to 13.5%6 of the country’s total carbon emissions, transitioning to electric vehicles is the need of the hour. This has directed a lot of encouragement, especially from the government to the country’s expanding EV ecosystem, which currently includes batteries, charging infrastructure, and more. As a sign that this sector is poised for growth, in 2023, EV sales in India nearly doubled, reaching 2% of all passenger vehicle sales.7

Details about the underlying index - Nifty EV & New Age Automotive Index

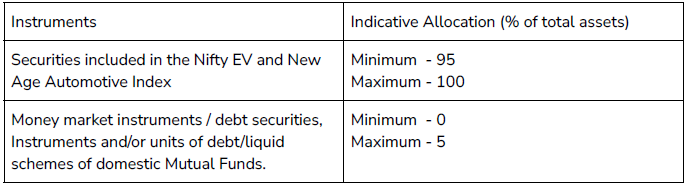

About Groww Nifty EV & New Age Automotive ETF

The investment objective of the Scheme is to generate long term capital growth by investing in securities of the Nifty EV & New Age Automotive Index in the same proportion / weightage with an aim to provide returns before expenses that track the total return of Nifty EV & New Age Automotive Index, subject to tracking errors. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved.

This scheme is suitable for investors seeking long-term capital appreciation and investment in equity and equity-related instruments of the Nifty EV & New Age Automotive Index. However, investors should consult their financial advisor before investing

Allocation of the scheme in the securities

Extract of the Asset allocation provided. For more information refer to the scheme information document.

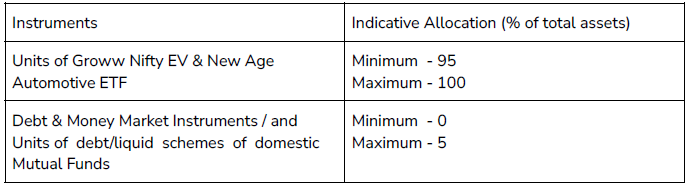

About Groww Nifty EV & New Age Automotive ETF FOF

The investment objective of the Scheme is to generate long term capital gains by investing in units of the Groww Nifty EV & New Age Automotive ETF. However, there can be no assurance or guarantee that the investment objective of the scheme will be achieved.

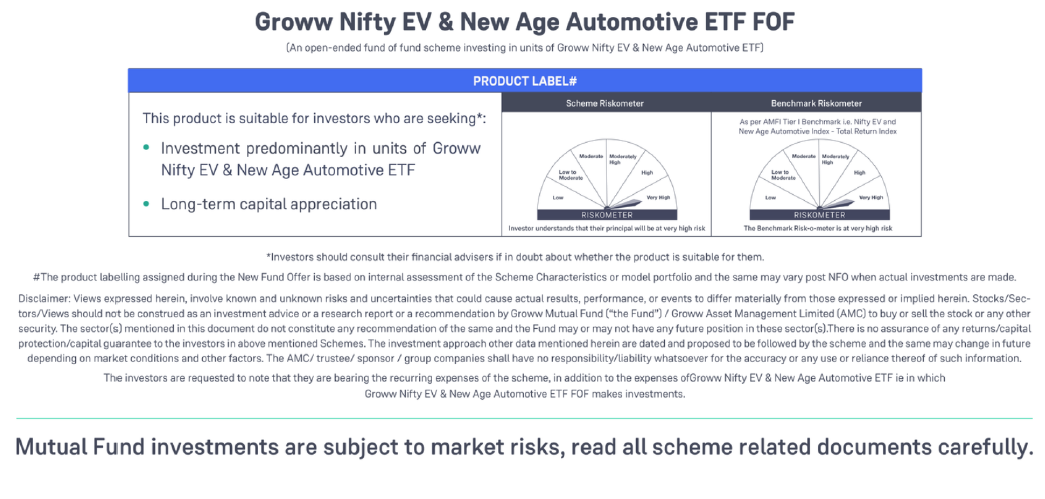

This scheme is suitable for investors seeking long term capital appreciation and to invest predominantly in units of Groww Nifty EV & New Age Automotive ETF. Further, the risk associated with the Scheme is very high

Allocation of the scheme

For more information refer to the scheme information document

For more information refer to the scheme information document

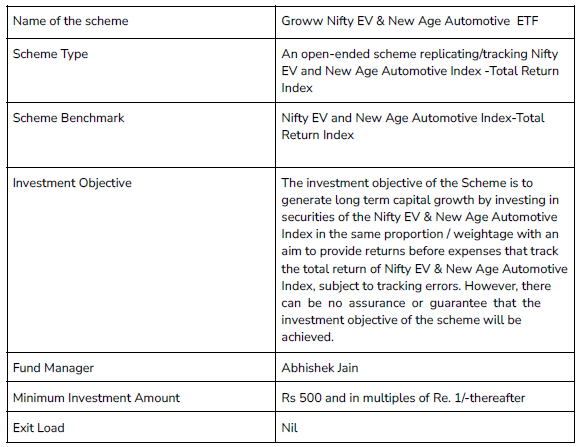

Fund Details : Groww Nifty EV & New Age Automotive ETF

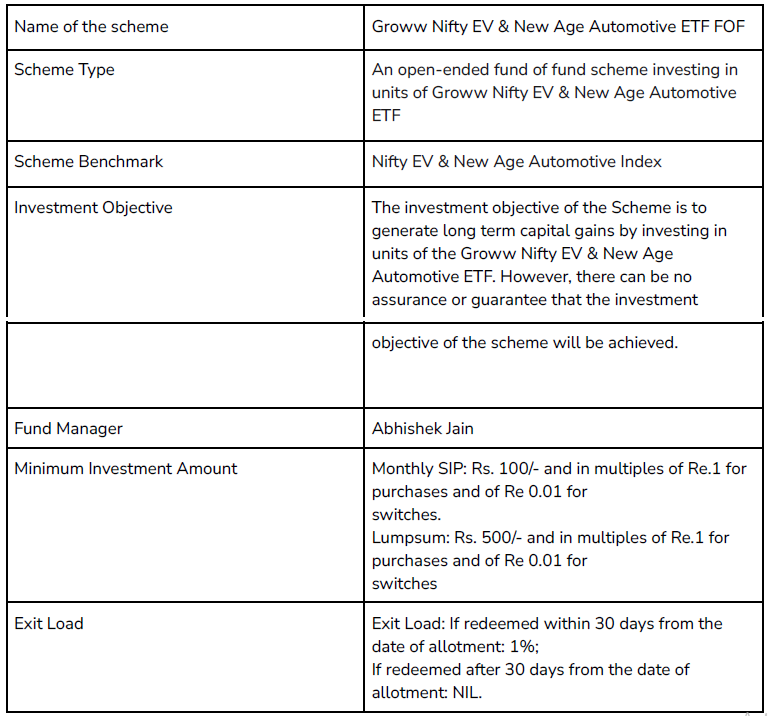

Fund Details : Groww Nifty EV & New Age Automotive ETF FOF

Investors should read Scheme Information Document/Key information Memorandum before investing in the Schemes(https://www.growwmf.in/downloads/sid)

Investors can start investing in the NFO of Groww Nifty EV & New Age Automotive ETF from till August 2 and in the NFO of Groww Nifty EV & New Age Automotive ETF FOF from July 24 till August 7, via any mutual fund investing platform or directly through Groww Mutual Fund.

For more information, please visit www.growwmf.in

Sources

1Source - Ministry of Heavy Industries, Government of India, data as of March 13, 2024

2Source - Economic Times, March 31, 2024

3Source - Economic Times, March 24, 2024

4Source - Invest India, June 20, 2024

5Source - Nifty Indices, June 21, 2024

6Source : Excerpt, TOI article, 15th Feb 2024

7Source : Excerpt, The Economic Times, 15,sup>th April 2024

For editorial queries, please contact:

Amogh Yenagi | amogh.yenagi@groww.in | 9113649626

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025

-

Aditya Birla Sun Life AMC Press Release Q2 FY26 Final

Oct 28, 2025