Global Supply Chain Situation: A Status Check

Mutual Fund

Background

Why should you keep your eye on what's happening to global supply chains?

- Supply chains are increasingly important to the product manufacturing & delivery setup

- Disruptions have a direct bearing on supply & demand

- Inefficiencies result in a cascading impact on global inflation

One of the primary reasons for global inflation rising has been a supply shock in the logistics markets as companies and economies scrambled to get back to business. In today’s world, this is easier said than done as regulations across individual jurisdictions and free movement was hampered by divergent waves of Covid hitting nations. Even the non-synchronized nature of gradual re-openings of economies played havoc for shippers and traders.

The sector itself has faced several challenges. A little over a year ago, the world was terrified of a 6-day blockage in the Suez Canal disrupting world trade. The current month long lockdown in Shanghai, the world's busiest container port, and China's primary cargo airport, has also hampered the industry’s recovery. As the slow normalization process continues, we infer, elevated costs of transportation and delivery times should fall. The resulting benefits to the global economy would mean – lower inflation pressures. Encouragingly, we are seeing signs that major parcel carrier networks are starting back up in key China market.

Two years into COVID, facing geopolitical and supply chain uncertainties, global supply chain has become more dependent on China, foreign direct investment into China has increased, and China has refocused its strategy on manufacturing. At the aggregated level, China is expanding its role from a "final assembler" to one with increasingly complete supply chain capabilities, rising especially in tech and industrial components.

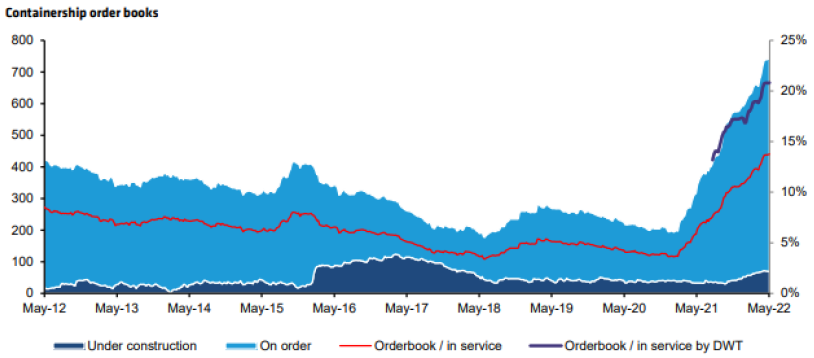

The World is not sitting idle

Even as fears of near term recession cause concerns for policy makers, the global logistics industry is seeing its largest capacity addition in 15 years. Orders for large container vessels have sky rocketed since the start of the pandemic. Given the long gestation periods, much of the pending order books have now gradually started entering service lines from Hong Kong harbor to the port of Los Angeles and every major port in between.

Improving supply of container ships traversing the seas does help the de-bottlenecking the entire system, but ports also play a vital role in alleviating the stresses. A container ship anchored outside port unable to dock, unload and re-load for lack of berthing facilities at port makes transportation expensive, time consuming and inefficient. Furthermore, in case of perishables, idling can lead to loss of quality and damages.

Source: IHS Global, Bernstein, Axis MF Research. Data as of 31st May 2022 DWT – Deadweight Tonnage

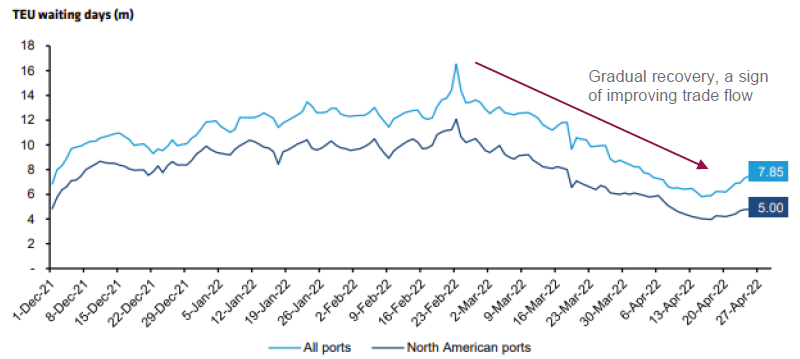

Fortunately, Port handling, another key component of intercontinental logistics is also seeing a significant improvement since the start of the calendar year. Time spent by cargo containers (TEU’s) on the port berth have seen a gradual fall since the start of the year as ports have been able to load and unload with greater efficiency. Connection frequencies of trucks across ports has also improved materially resulting in significant improvements in efficiency times for the entire supply chain network.

Source: Kuehne+Nagel, Bernstein analysis Ports covered include Prince Rupert, Vancouver/Seattle, Oakland, Los Angeles/Long Beach, New York, Savannah, Hong Kong, Shanghai/Ningbo and Rotterdam/ Antwerp. Data as of 30th April 2022.

China Remains Key

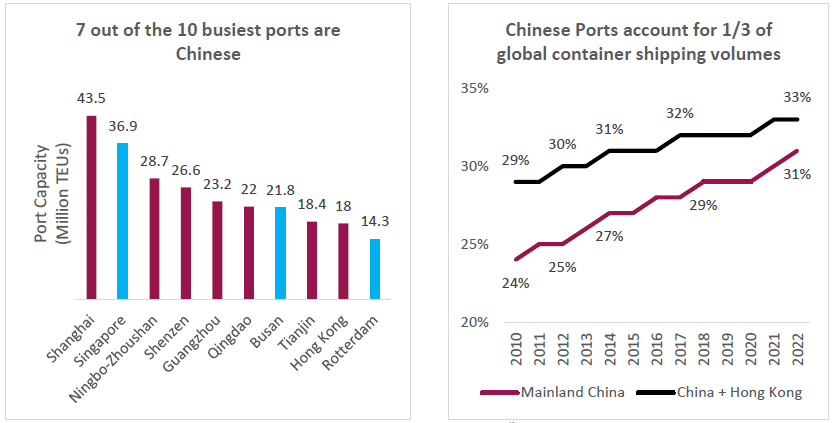

China is the world’s largest trading partner and is one of the few countries globally that continues to follow strict lockdown protocols as it battles Covid. Two years into COVID, facing geopolitical and supply chain uncertainties, global supply chain has become more dependent on China, foreign direct investment into China has increased, and China has refocused its strategy on manufacturing. At the aggregated level, China continues to expand its role from a "final assembler" to one with increasingly complete supply chain capabilities, rising especially in tech and industrial components. China is also home to 7 out of the 10 busiest ports in the world, reinforcing the importance of ‘China’ in the global supply chain

Source: UNCTAD, Hamburg Hafen, Axis MF Research. Data as of 30th April 2022.

We believe, the macro impact of China lockdowns could be quite high. China remains a key risk to the supply chain given its dominance in this space. Any gradual re-opening in China will give shipping lanes much needed breathing space.

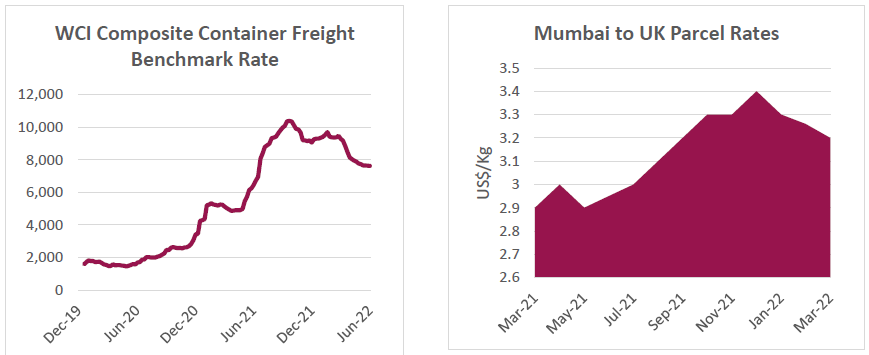

Freight Rates Have come off from peaks

Freight rates have seen a drop from December 2021 peaks as additional capacity comes on stream and efficiencies in operations improve. However key trigger for normalization will depend on fast Chinese ports and operators get back to business.

Source: Dewery, World ACD, Bernstein Research, Axis MF Research Data as of 2nd June 2022

Implications for India

The external sector is critical to the development of the Indian economy. The linkages to supply chains affect the Indian economy via inflation despite the linkage currently being relatively low. The China + 1 strategy that is currently being spoken about by global strategists is a direct response to the current issues plaguing the world due to its over reliance on China

For a developing economy like India, promotions like the PLI scheme and the export push is a medium to plug India further into the global supply chain. As this plug-in takes place, India will achieve the benefits of this and will also be subject to the vagaries brought on by shocks to the chain.

Disclaimer

Source of Data: Axis MF Research, Bloomberg.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025