FED SETS THE RATE CYCLE IN MOTION WITH 50 BPS CUT

Mutual Fund

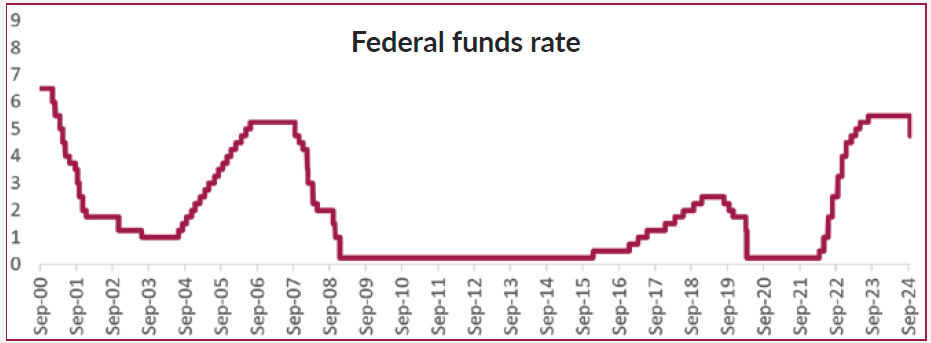

In a much anticipated decision, the US Federal Reserve (Fed) made significant adjustments to the monetary policy during the FOMC meet. The key action was a 50 bps cut in the federal funds rate bringing it down to a range of 4.75% to 5%. This was the first rate cut since 2020, marking a pivot from the Fed's previous focus on combating inflation, which had kept rates at a 23-year high.

Source: Bloomberg

The Fed’s decision was driven by signs of cooling inflation and a desire to support economic growth, particularly as the labor market stabilizes and wage pressures ease.

In his press conference, Fed Chair Jerome Powell highlighted growing confidence that inflation is continuing to decline, allowing the Fed to act more aggressively in reducing borrowing costs. The cut aims to stimulate the economy by lowering costs for businesses and consumers, potentially boosting areas like home and auto sales. However, Powell also cautioned against assuming this cut marks the start of a rapid easing cycle, emphasizing a measured approach going forward based on economic conditions.

The Fed’s economic projections reflect key updates for GDP growth, inflation, unemployment, and interest rates over the coming years.

Key Changes

GDP Growth

The Fed expects the U.S. economy to grow by 2.0% in 2024, a slight decrease from the previous projection of 2.1%. Growth is projected to remain steady at 2.0% through 2026. This reflects expectations of moderate but stable economic expansion.

Unemployment Rate

The Fed now anticipates the unemployment rate will rise to 4.4% by the end of 2024, up from the earlier projection of 4.0%. The rate is expected to decrease slightly in the following years, reaching 4.2% by 2027, as the economy stabilizes.

Inflation

The Fed revised its inflation forecast lower, with PCE inflation expected to fall to 2.3% in 2024 (from 2.6% previously). By 2026, inflation is projected to settle around the Fed’s long-term target of 2.0%.

Interest Rates

The Fed's "dot plot" signals further rate cuts ahead, projecting the federal funds rate to fall to 4.4% by the end of 2024. Additional cuts are expected in 2025, with rates potentially dropping by another 1%.

Fed’s dot plot

Source: US Federal Reserve

Our assessment of Fed rate cuts and Impact on Indian Bond markets

The Fed has kicked off the interest rate cut cycle with a 50 basis point rate cut. This is only the THIRD time in recent history that the Fed has started rate cuts with a 50 bps cut. The previous two times, the economy was in recession.

What does it imply?

We believe that 50 bps rate cut is largely seen as a pre-emptive measure to insulate the economy rather than signaling an imminent recession.

Markets view this move as a strategic pivot to sustain economic momentum while inflation moderates. The Fed’s actions act as a cushion to the economy against potential downside risks, such as global economic uncertainties or slowing domestic growth, without necessarily expecting a sharp downturn. While some market participants had speculated on recession risks, the prevailing economic data on both employment and growth continues to be robust and we believe that the Fed's cuts aim to strike a balance supporting growth while inflation pressures ease.

Impact on markets

The 50 bps cut was widely expected and hence market reaction on US Treasuries has been muted. In fact, yields on US Treasuries were 2-5 bps up across the curve post Fed governor conference, as we believe that the exuberance of the market participants was toned down, given that the “dot plot” is not showing aggressive rate cuts until December 2024.

Indian bond markets yields are lower by 3-5 bps across the curve; we believe that Reserve Bank of India (RBI) may indeed consider changing stance/cutting interest rates in October-December policy given recent global monetary easing, such as the surprising rate cut by Indonesia and the Fed's 50 bps cut.

Several factors could justify such a move

Global monetary easing

With other central banks, including Fed, European Central Bank, Bank of England and Indonesia cutting rates, there is potential for India to follow suit. This could help maintain India's competitive position in attracting investment and boost economic growth.

Inflation under control

India's inflation, which had spiked due to food price surges earlier in 2024, has shown signs of stabilizing. Monsoon fears, which initially threatened inflation through food supply disruptions, appear to have diminished. If inflation remains within or close to the RBI's target band of 2-6%, this could provide the space for a rate cut. We believe that inflation in the second quarter would substantially undershoot RBI projections, which can lead to RBI being dovish and guide for monetary easing.

Monsoon impact

Although monsoon was erratic, late-season rains have eased concerns over food inflation, one of the primary factors that drove up prices earlier. With inflation fears subsiding, the RBI may be more comfortable easing monetary policy.

Economic growth support

India’s economic growth outlook, while positive, faces headwinds from global uncertainty, including a slowdown in key export markets. A rate cut could stimulate domestic demand, especially in sectors like real estate and consumption, where borrowing costs play a significant role.

Stability in currency

Weak commodity prices and China macro along with positive FPI flows and huge foreign exchange reserves cushion has led to stability in external sector and currency which allows RBI to tilt its focus on supporting economic growth.

Our view

Our core view on bonds remains constructive, driven by lower-than-expected inflation in the second quarter, Fed rate cuts and favourable demand supply dynamics for bonds. We expect 50 bps rate cut in the near term and advise clients to hold on to duration bets for next 6-12 months.

DISCLAIMER

Source of Data: Axis MF Research, Bloomberg. Date: 19 September 2024

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

The Sector/Stocks mentioned above are used to explain the concept and is for illustration purpose only and should not be used for development or implementation of any investment strategy. It should not be construed as investment advice to any party. The stocks may or may not be part of our portfolio/strategy/ schemes.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Union Mutual Fund Forays into Specialized Investment Funds (SIF) with Launch of 'Arthaya SIF'; Appoints Rajesh Aynor to Lead the Platform

Jan 31, 2026

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025