EQUITY MARKET OUTLOOK

Mutual Fund

From the desk of Sunil Singhania, CIO - Equity Investments at Reliance Mutual Fund

Either be down or use the down to your advantage!

The last few weeks have been very volatile and especially the August 24th global market crash has shaken the confidence and patience of the biggest equity bulls. The Indian markets also fell sharply with the Nifty/Sensex crashing by almost 6% in a day and the mid cap and small cap indices falling even more.

The obvious question - what is happening? Where does this end? What should an investor do?

In hindsight it is easy to decipher the reasons behind the fall. Chinese markets, Chinese currency devaluation leading to a contagion effect to other emerging market currencies, commodities collapse and eventually a global risk-off trade. India, initially was very resilient. However, it finally gave way because of the huge outperformance vis-a-vis its emerging market peers and we had yet another "Black Monday".

Many are even calling the current environment as it is 2008-09 type of scenario!

We surely and confidently believe it is not even closer to that. This sharp correction is more China led and will at worst impact global markets for a short period of time. Some emerging markets had fundamental problems and therefore they are under severe pressure. Commodities are under pressure and economies which are commodity dependent are at the epicenter of this fall. The reasons why we strongly believe that we are unlikely to be headed for global recession:

- Growth in World’s two biggest regions, namely US and EU remains steady.

- While manufacturing is weak, the service sector globally is performing very well. In fact, even Chinese service sector is doing well.

- The recent oil price is decline is supportive for most major economies, including a number of emerging markets.

- Global interest rates remaining close to record low levels and monetary easing by major central Banks will extend further. Lastly, regions where growth is under pressure, market valuations are comparable to previous extreme bear markets (e.g. Brazil, Russia, Indonesia).

As a matter of fact, India's attractiveness has increased owing to these global developments. Commodities have been more badly hit and in fact that is the most positive news for India.

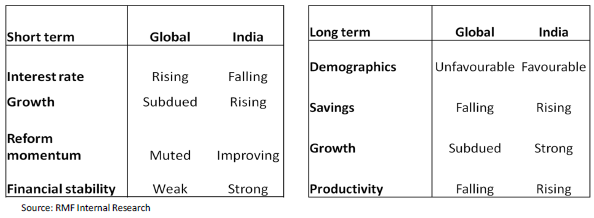

We believe India is in a sweet spot compared to the rest of the world.

In the history of financial markets, there will be very few markets like India which offer these kinds of edges over the rest of the world both on short and long term basis.

Sharp corrections with a structural uptrend offers a compelling opportunity:

Sharp corrections (10-20%) are seen often within the structural uptrends seen in global as well as Indian equity markets. We have analyzed similar corrections seen over the last 15 years that have proven to be the best time to increase equity exposure.

Table: Bull market phases in Indian equities and corrections (Sensex Index)

The above table highlight that there have been three bull phases (including the ongoing one) in Indian equities in the last 15 years. While markets rallied 7 times in the bull phase of 2003-2008, there were few instances when the market corrected sharply (more than 15%). However, in these cases market regained their previous peak in a short period of time (3-4 months). Data suggests that this is a typical characteristics of any bull market. Market movement is not linear and corrections are inevitable in any bull run. Correction in a bull market is an opportunity to build positions.

Volatility is a part and parcel to investing but it's not a negative thing as it is generally perceived. In general, it provides right opportunity to build positions in otherwise great companies. To reiterate, it provides a welcome opportunity to increase allocation to equities.

Conclusion: Indian macros have never been better; Oil at $43 and falling further , current and fiscal deficit trending lower, subsidy burden falling, inflation at multi-year lows and a falling interest rate environment. On the reform and growth front, things can only improve from here. Yes, it is taking some time to get the economy kick-starting, but the direction is clear and trending up.

Source: Bloomberg

Keep the faith and Be Positive!

Disclaimers:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines,recommendations or as a professional guide for the readers. Certain factual and statistical information(historical as well as projected) pertaining to Industry and markets have been obtained from independent third-party sources, which are deemed to be reliable. It may be noted that since RCAM has not independently verified the accuracy or authenticity of such information or data, or for that matter the reasonableness of the assumptions upon which such data and information has been processed or arrived at; RCAM does not in any manner assures the accuracy or authenticity of such data and information. Some of the statements & assertions contained in these materials may reflect RCAM’s views or opinions, which in turn may have been formed on the basis of such data or information.

The Sponsor, the Investment Manager, the Trustee or any of their respective directors, employees, affiliates or representatives do not assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such data or information. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and opinions given are fair and reasonable, to the extent possible.

This information is not intended to be an offer or solicitation for the purchase or sale of anyfinancial product or instrument. Recipients of this information should rely on information/ dataarising out of their own investigations. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

None of the Sponsor, the Investment Manager, the Trustee, their respective directors,employees, affiliates or representatives shall be liable in any way for any direct, indirect, special,incidental, consequential, punitive or exemplary damages, including on account of lost profitsarising from the information contained in this aterial.

The Sponsor, the Investment Manager, the Trustee, any of their respective directors, employees including the fund managers, affiliates, representatives including persons involved in the preparation or issuance of this material may from time to time, have long or short positions in,and buy or sell the securities thereof, of company(ies) / specific economic sectors mentioned herein, subject to compliance with the applicable laws and policies.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025