Domestic flows: necessary but no longer sufficient

Mutual Fund

In the past few years, Indian equities have been immune to volatility given strong macros, robust earnings growth and importantly strong domestic flows. However, volatility appears to be back in Indian equities, with benchmark indices down by 8% in the past month. The broader market correction has been steeper and over 125 stocks in NSE500 are down more than 25% from their recent peaks (as on November 5, 2024).

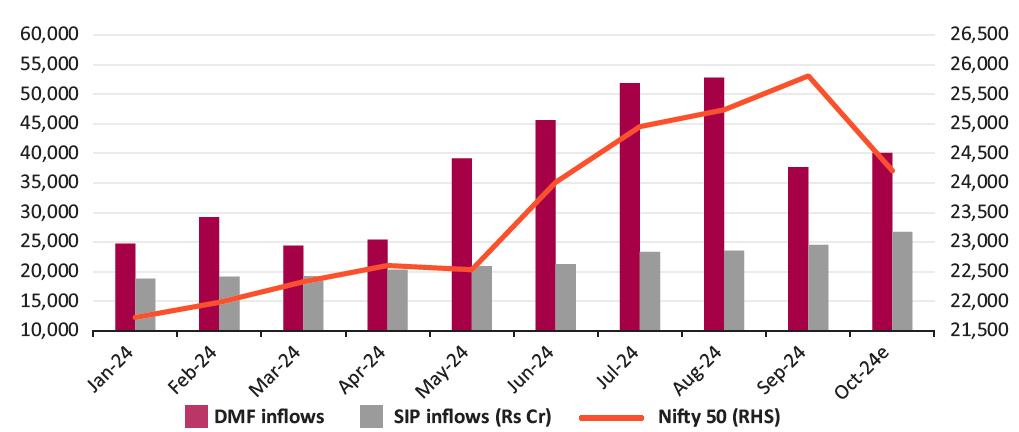

This swing in the market has come about despite sustained strong inflows into domestic mutual funds (Mfs). Domestic MFs witnessed Rs344 bn (US$4 bn) of inflows in the month of September taking the inflows in 1HFY25 to US$30 bn. SIP flows continue to grow – having reached a new high of Rs245 bn ($2.9 bn) in the month of September and this trend has continued in October as well. This is reflected in MFs net buying of US$9 bn month to date.

This turn in momentum is attributed to foreign selling –an unprecedented US$12 bn in the month of October. With this, the overall FII flows so far in FY2025 is just US$859 mn. One can ascribe multiple reasons for the swing in foreign flows – earnings disappointment, US 10-year yields are up approx. 80 bps since the mid-September, Dollar index has strengthened by 4.2% and policy changes have led to shift in flows to Chinese and Japanese markets.

Strong domestic flows had proved to be an adequate counterfoil for foreign flows all through FY22 and FY23. In FY22, FII outflows stood at US$18.5 bn while FY23 saw US$5 bn of outflows. However, mutual fund witnessing US$53 bn of inflows were able to absorb these outflows and markets registered a 18% upmove in these two years despite the foreign selling.

Markets declined despite strong MF inflows

Source : AMFI, NSE, Axis MF estimates Figures in Rs Cr

Equity supply outpacing MF inflows

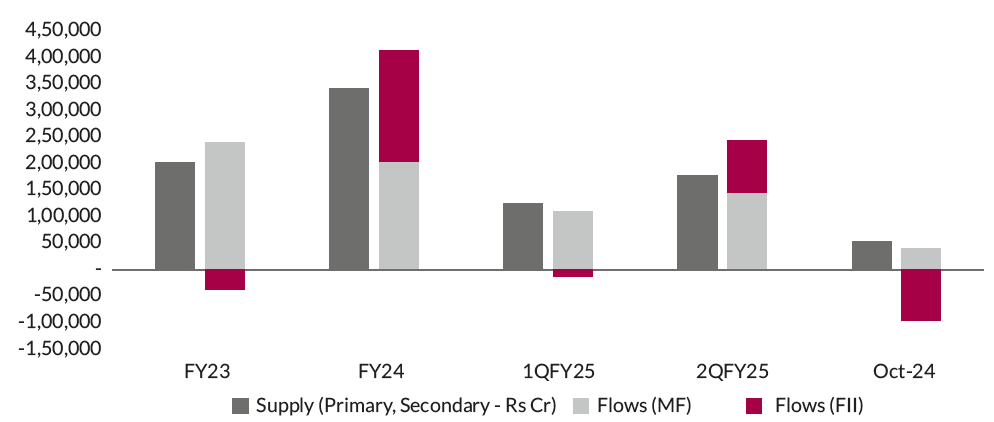

The accelerating pace of equity supply is the key reason domestic equity markets are again developing a vulnerability to the volatility in foreign flows.

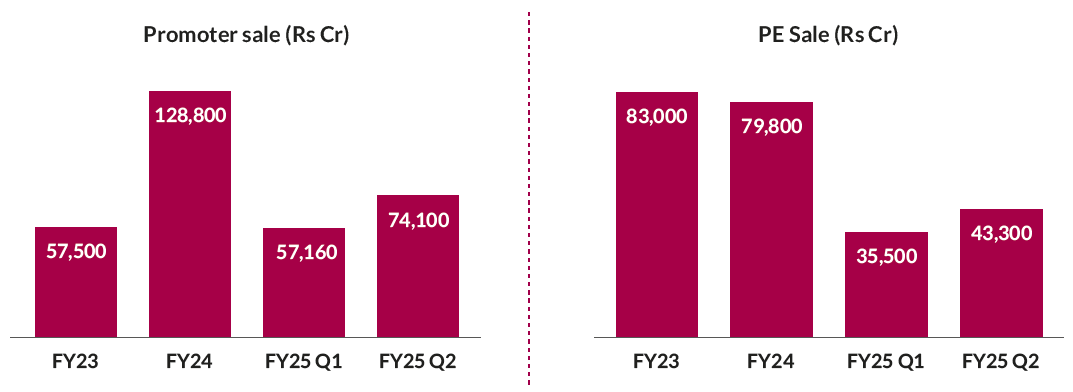

Q2FY25 saw supply increasing to US$21 bn (Rs177,000 cr) compared to US$15 bn (Rs125,000 cr) in 1QFY25. This comprised of US$4 bn (Rs33,000 cr) of IPOs, US$6 bn (Rs54,000 cr) of QIPs and US$11 bn (Rs90,000 cr) of secondary stake sales from private equity and promoters. These outstripped the US$18 bn (Rs142,000 cr) inflow into equity MFs during the quarter. However, as FPI flows were positive at $11.6 bn in the quarter, the upward market trajectory sustained.

Increased pace of secondary stake sales in Q2

Source : NSE, BSE, Axis MF estimates Figures in Rs Cr

As we highlighted in our July note ‘Let’s talk about supply too’ – Supply of equity in the form of IPOs, stake sale since FY2024 has been 1.5x times the net inflow into Mutual Funds. The impact of this on the market direction was masked as FII flows over the last 18 months (April 2023 to September 2024) had been positive at over US$35 bn. These aided in absorbing the increased supply. Over 40% of the IPO/QIPs raised during this period were subscribed by foreign inflows.

Rising pace of supply outpacing demand

Source : NSDL, Axis MF estimates Figures in Rs Cr

Supply is now turning into deluge

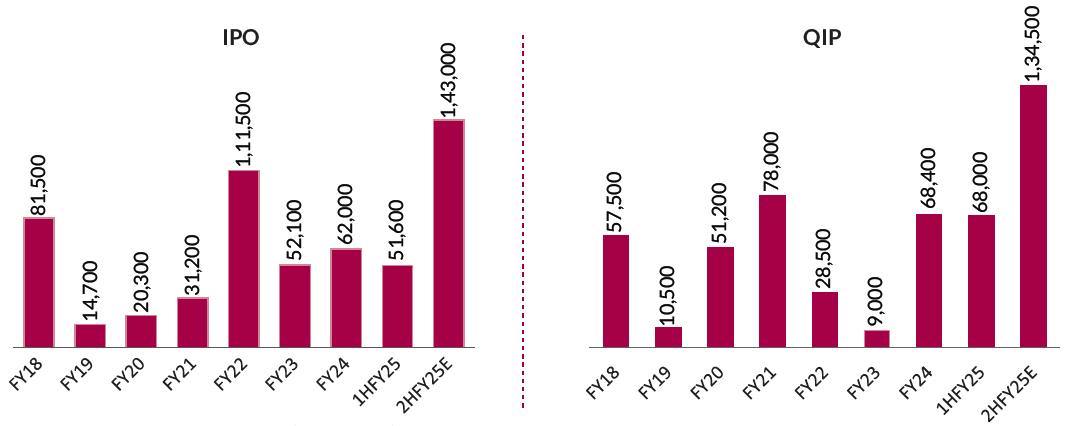

IPO pipeline for 2H is nearly 3x the amount raised in 1H with 91 companies looking to list and in aggregate raise US$17 bn. Another 70 listed companies in recent weeks have taken board approvals to raise in aggregate US$16 bn of equity through Qualified Institutional Placements (QIPs). Secondary stake sales from promoters and private equity is also only likely to grow larger given the expiring lock-ins and elevated trading multiples in the market.

Assuming secondary sales (by promoters and PEs) at US$22 bn in 2H stays similar to what we have seen in first half, the total supply will rise to US$55 bn in the second half of the year or about 2.5x the estimated inflows in MFs. Ensuring that equity supply will overwhelm domestic fund flows and market direction will again be subject to vagaries of foreign flows.

2HFY25 Pipeline is 2x that of 1HFY25

Source : Kotak Securities, Axis MF estimates Figures in Rs Cr

An equity fueled investment cycle?

This magnitude of equity raises possibilities of the private investment cycle gathering pace and unlike the past cycles this would be more equity funded rather than debt fuelled.

Of the US$39 bn raised by corporates (IPOs/QIPs), in past 18 months US$25bn was primary capital. 2HFY25 pipeline indicates another US$24 bn of investible capital being potentially available for capex, acquisitions and other purposes.

The breadth of companies looking for capital is wide. Power sector (US$4.7 bn) and real estate (US$4.1 bn) stand out with largest capital raises each planned for this year. Services companies (IT, Logistics) at US$2.3 bn, Retail (Q-commerce, FMCG) US$2.9 bn, Healthcare at US$2.3 bn, metals at US$2.2 bn and auto at US$3.1 bn are other sectors witnessing material capital raises.

Power and Real Estate seeing larger primary capital raise

Judicious use of this capital by corporates would be a key determinant for sustaining the earnings growth momentum as easy capital availability can tempt companies into low return capex, unrelated diversifications and expensive acquisitions.

Source : Axis Capital, Axis MF estimates Figures in Rs Cr

Disclaimer

Source: Axis MF Research, NSDL, NSE, BSE, company reports, Kotak, Axis Capital. Data as on 31 October 2024.

Figures rounded off to nearest value.

Disclaimer: Past performance may or may not be sustained in the future. The Stocks/Sectors mentioned above are used to explain the concept and is for illustration purpose only and should not be used for development or implementation of any investment strategy. It should not be construed as investment advice to any party.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to र 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025

-

Axis AMC Partners with NISM to Launch Industry-First Talent Development Program "Unnati"

Mar 4, 2025