Budget 2023: Strengthening the growth ship

Mutual Fund

Introduction

In yet another finely crafted budget, the actions outlined, strike a balance between the need for growth and fiscal consolidation. For the first time the budget also mentions the need to invest and incubate future-centric industries, new age technologies and data sciences.

On the infrastructure front, a mammoth 33% increase in capex spending without blowing out the budget math is commendable. We believe the budget is a declaration by the government for growth, inclusion, sustainability and fiscal consolidation.

Key Takeaways

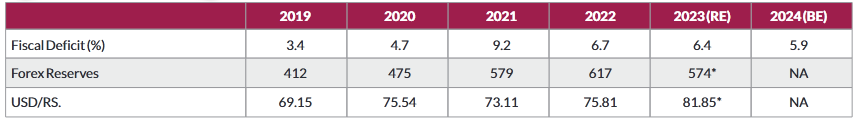

- Fiscal deficits for FY23 & FY24 at 6.4% and 5.9% of GDP, respectively. Subsidy reduction of 28% YoY is the primary reason for the 50bps fiscal deficit reduction.

- Net borrowing expected to be Rs. 12.5 lakh Cr for FY24 lower than market estimates.

- Government's assumptions for revenues for FY23 and FY24 appear to be quite reasonable with a tax revenue growth of 12% and 10% for FY23 and FY24.

- Capex growth of 33% YoY is the single biggest positive surprise from the budget. Non-capex expenditure excluding interest and subsidies is projected to grow at only 2% YoY. The government has done well to resist the temptation to be populist in a pre-election year.

Economic Agenda

Economic agenda focuses on three things - facilitating ample opportunity for citizens, especially the youth, providing a strong impetus to growth and job creation and third stabilising the macro economy. The finance minister bucketed the various schemes into 7 priority areas terming these as ‘Saptarishi’ to the Amrit Kaal.

Capex Boost – Continuing the push to create much needed Growth infra

The government has envisaged a massive 33% boost to Capex in FY24. 3 continuous years of large capex spending has resulted in spends now accounting for over 3% of India’s GDP a significant improvement in productive expenditure.

Key initiatives

- Rs 2.4 lakh Cr provided to railways

- 100 critical transport infrastructure projects, for last and first mile connectivity for ports, coal, steel, fertilizer, and food grains sectors have been identified. They will be taken up on priority with investment of Rs.75,000 crore, including Rs.15,000 crore from private sources.

- 50 additional airports, heliports, water aerodromes and advance landing grounds will be revived for improving regional air connectivity.

Fiscal Consolidation

Central government has laid out a fiscal path that envisages the Central deficit being brought down by ~2% of GDP to 4.5% of GDP by 2025-26 from 6.4% of GDP this year. A fiscal deficit of Rs. 17.9 lakh Cr (5.9% of GDP) – in FY24 is likely to necessitate net borrowing of about Rs. 12.5 lakh Cr, Rs. 1.3 lakh Cr more than the budgeted amount in the current fiscal FY23. This is expected to translate into gross borrowing of about Rs. 16 lakh Cr adjusted for bond repayments and other issuances.

Budget Takeaways

Budget 2023 continues to drive the investment push from the top as the government engages all levers to ensure that the Indian economy remains the fastest growing large economy on the planet. The sharp increase in capital expenditure could be seen as a ploy to complete and take credit for the vast investments in infrastructure done over the last 8 years rightfully so given that 2024 will be an election year.

In addition, we see 3 positives from the markets standpoint

- Gradual and realistic fiscal consolidation path,

- improving quality of spending with targeted schemes around key focus areas (Key to drive consumption), and

- Push for social and digital infrastructure and India's climate change targets (Long Term driver for Capex in India).

Way forward & Market View

Budget day saw equity markets yo-yo despite an inline budget from a markets standpoint. As is customary, select stocks tend to oscillate in line with budget announcements. The negativity in market sentiment can be identified by events not relating to the budget announcement.

The debt markets sought comfort in the road to fiscal consolidation and lower market borrowing targets. The benchmark 10 Year G-Sec ended the day at 7.277%.

Equity Markets

The Equity markets see the budget favourably primarily on 2 fronts – Higher capex spending by the government & status quo on direct taxes and no incremental taxes on capital gains. The booster shot by way of capex and a strong market signal to promote growth through structural reforms are key positives for domestic and foreign investors alike.

The budget is a strong indicator for growth potential of Indian companies. A 10% nominal growth in ~US$ 5 Trillion GDP provides ample headroom for companies to grow. Further with domestic economy companies in favour for much of the government’s capex outlay, economic multiplier effects should have a significant bearing on sectors like steel, cement, telecom and also trickle down effects into consumption.

The focus in favour of productive growth of the economy should be seen as a positive step for the prospects of the Indian economy and ergo the outlook for equity markets in India. Budget 2023 in that sense is more pragmatic and we will wait to see how the government executes its bold capex play for the year. Our portfolios currently are positioned to play the growth story.

We have attached a sector wise snapshot for key sectors in the annexure below

Debt Markets

The budget was cheered by the markets. The short end of the yield curve moved favourably as a lower borrowing target implies opportunities for other market participants to borrow to cater to the surging credit growth in the economy. We also anticipate a materially calmer RBI in light of the prevailing economic situation and stable inflation. The yield curve continues to remain flat offering competitive rates across much of the short and medium term segments.

We retain our stance of adding duration to portfolios in a staggered manner given that a large uncertainty driving rates and duration calls in now out of the way. For investors with a medium term investment horizon, we believe the time has come to incrementally add duration to bond portfolios.

Debt Markets (contd.)

The current yield curve presents material opportunities for investors in the 4-year segment. This category also offers significant margin of safety given the steepness of the curve. For investors with medium term investment horizon (3 Years+), incremental allocations to duration may offer significant risk reward opportunities. Spreads between G-Sec/AAA & SDL/AAA have seen some widening over the last month which could make a case for allocations into high quality corporate credit strategies. Lower rated credits with up to 18-month maturity profiles can also be considered as ideal ‘carry’ solutions in the current environment.

Focus Funds

Annexure

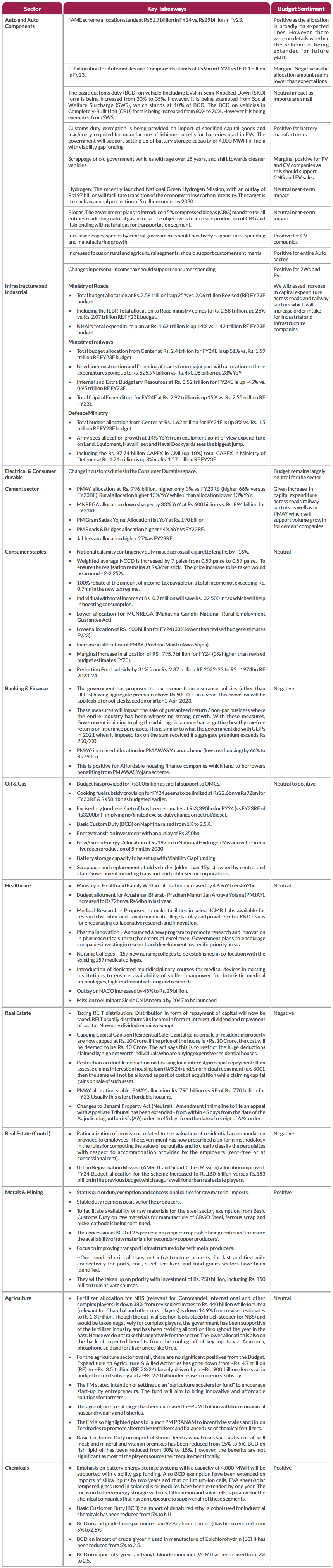

Sector Wise Analysis

The above sector commentary is not a recommendation to trade in either stocks or sectors. The AMC/mutual fund may hold positions in many of the companies/sectors mentioned and may have taken trade actions post the publication of this note. The note should not be treated as a research note.

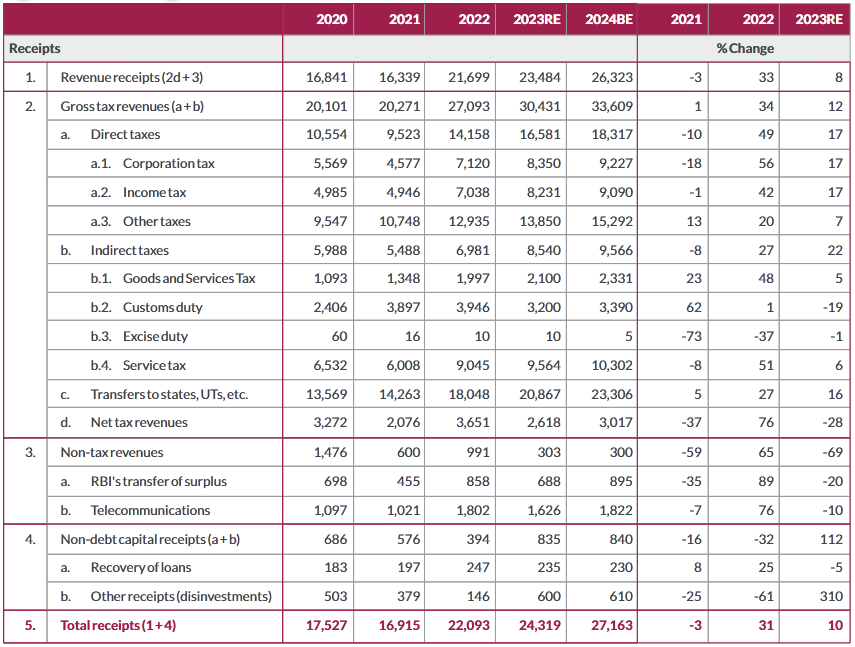

Revenue Snapshot

Source: Budget Documents FY 22-23, Kotak Institutional Equities. RE – Revised estimates

Key summary numbers

Source: Bloomberg, Axis MF Research. All Numbers as of respective Financial Year ends. * Data as of 1st Feb 2023.

BE – Budgeted Estimates

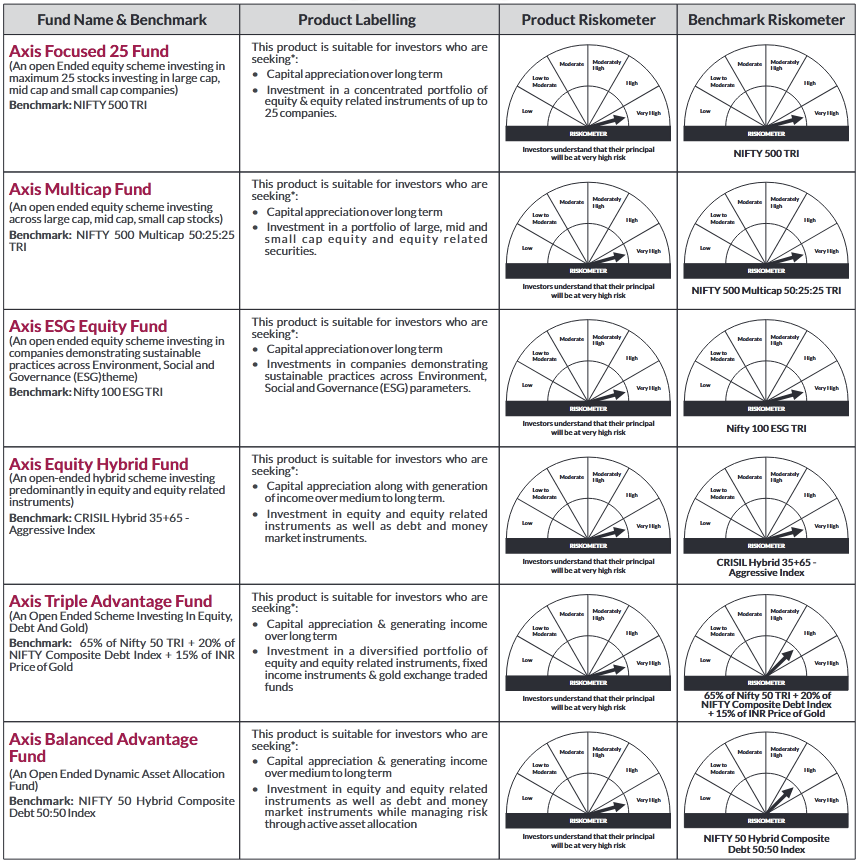

Product labelling

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

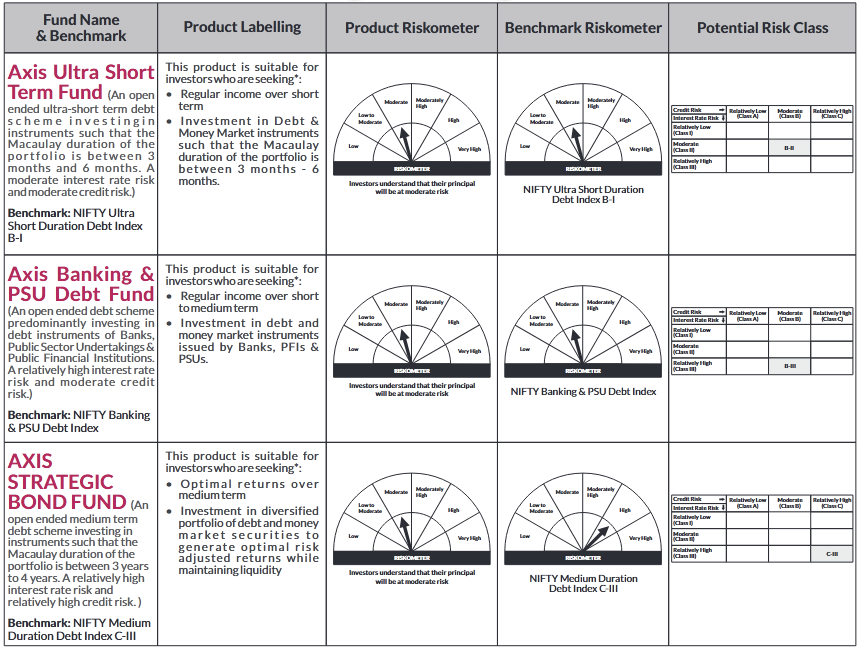

Product labelling (Contd.)

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimers

Source: Axis MF Internal Analysis, Budget Documents 2023.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC)

The above changes to taxation is subject to presidential assent to the finance bill 2023. Stocks/sectors mentioned may or may not form part of mutual fund portfolios. The note should not be treated as a research report. The document has been prepared on the basis on the budget documents published by the ministry of finance and should not be used for tax planning given the individual nature of income tax. This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable. While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025

-

The Wealth Company Mutual Fund Receives SEBI Approval to Launch Specialized Investment Fund SIF

Nov 26, 2025

-

Axis Mutual Fund Launches Axis Multi Asset Active FoF Fund of Fund: A One Stop Solution for Dynamic Asset Allocation

Nov 21, 2025

-

The Wealth Company Mutual Fund makes record debut with four active NFOs, garners close to Rs 2000CR

Oct 29, 2025

-

Axis MF Launches Axis Income Plus Arbitrage Passive FOF

Oct 28, 2025