Axis MF launches AXIS CRISIL IBX AAA NBFC INDEX JUN 2027 FUND

Mutual Fund

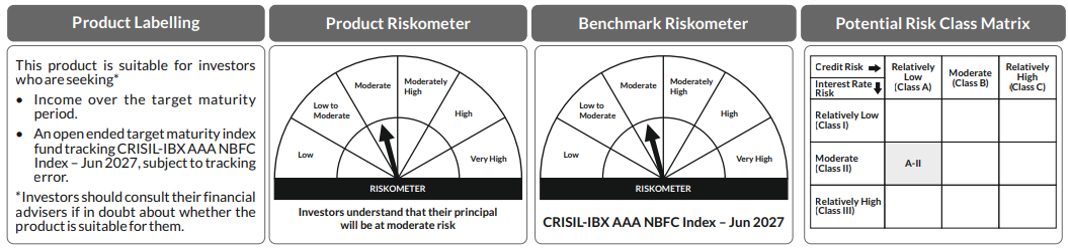

(An open-ended Target Maturity Index Fund investing in constituents of CRISIL-IBX AAA NBFC Index – Jun 2027. A moderate interest rate risk and relatively low credit risk.)

Fund Snapshot: -

- An open-ended Target Maturity Index Fund investing in constituents of CRISIL-IBX AAA NBFC Index – Jun 2027. A moderate interest rate risk and relatively low credit risk.

- Benchmark: CRISIL-IBX AAA NBFC Index – Jun 2027

- Expected Scheme Maturity Date: 30th June, 2027

- NFO Date: September 13 to September 23, 2024

- Minimum Investment: Rs. 5,000 and in multiples of Rs. 1/- thereafter

- Fund Manager: Aditya Pagaria

- Exit Load: Nil

Mumbai | September 13, 2024: Axis Mutual Fund, one among the fastest growing fund houses in India, announced the launch of their New Fund Offer – AXIS CRISIL-IBX AAA NBFC INDEX – JUN 2027 Fund. It is an open-ended Target Maturity Index Fund investing in constituents of CRISIL-IBX AAA NBFC Index – Jun 2027, a moderate interest rate risk and relatively low credit risk. The new fund will track the CRISIL-IBX AAA NBFC Index – Jun 2027. The fund will be managed by Aditya Pagaria. The minimum investment amount is Rs. 5,000/- and in multiples of Rs. 1/- thereafter. The exit load is Nil.

AXIS CRISIL-IBX AAA NBFC INDEX – JUNE 2027 Fund

The investment objective of the scheme is to provide investment returns before fees and expenses that closely correspond to the total returns of the securities as represented by the CRISIL-IBX AAA NBFC Index – Jun 2027, subject to tracking errors. There is no assurance that the investment objective of the Scheme will be achieved. The scheme would be allocating 95% to 100% of its underlying assets in Fixed Income Instruments replicating CRISIL-IBX AAA NBFC Index – Jun 2027 and the remaining in Debt and Money Market instruments for liquidity purpose. (Please refer to SID for detailed Asset Allocation & Investment Strategy)

The open-ended nature of such a fund means that investors can use systematic investment and withdrawal facilities to tailor entry and exit in the fund to meet investor objectives. The fund is a passively managed scheme by providing exposure to constituents of CRISIL-IBX AAA NBFC Index – Jun 2027 and tracking its performance, before expenses. Furthermore, the Scheme will follow Buy and Hold investment strategy in which debt instruments by NBFCs will be held till maturity unless sold for meeting redemptions/rebalancing.

Top features of the fund include:

- Index YTM: 8.12% (as on 9th Sep 2024)

- Low-Cost Passive Investment: A hassle-free solution for investors looking for a low cost fixed income product

- High quality portfolio: 100% AAA rated assets

- Reduced Bias in Security Selection: As the fund is passively managed and replicates CRISIL-IBX AAA NBFC Index – Jun 2027, there is reduced bias in security selection

- Simple and Easy: Target maturity NBFC portfolio

The above features are based on Index details as on September 9, 2024.

Commenting on the launch of the NFO, Mr. B. Gopkumar, MD & CEO, Axis AMC said, “AXIS CRISIL-IBX AAA NBFC INDEX – JUN 2027 FUND is first NBFC Sector based target maturity mutual fund scheme in India. It gives an opportunity to investors to invest in a high-quality portfolio. Target Maturity Funds can be a viable option for investors seeking some degree of predictability. The newly launched scheme will be an important add on to Axis Mutual Fund’s portfolio of passive debt offerings”

The new fund offers (NFO) open for subscription between September 13 to September 23, 2024.

For more information, please visit www.axismf.com.

Source: Axis MF Research as on September 09, 2024

Product Labelling: AXIS CRISIL-IBX AAA NBFC INDEX – JUN 2027 FUND

(The above product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made)

AXIS CRISIL-IBX AAA NBFC INDEX – JUN 2027 FUND is not a capital protection or guarantees returns scheme. Please refer to SID for detailed Investment Strategy and other scheme related features available at axismf.com

About Axis AMC: Axis AMC is one of India`s fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds (https://www.axismf.com/), portfolio management services and alternative investments (https://www.axisamc.com/homepage).

CRISIL Indices Disclaimer: Each CRISIL Index (including, for the avoidance of doubt, its values and constituents) is the sole property of CRISIL Limited (CRISIL). No CRISIL Index may be copied, retransmitted or redistributed in any manner. While CRISIL uses reasonable care in computing the CRISIL Indices and bases its calculation on data that it considers reliable, CRISIL does not warrant that any CRISIL Index is error-free, complete, adequate or without faults. Anyone accessing and/or using any part of the CRISIL Indices does so subject to the condition that: (a) CRISIL is not responsible for any errors, omissions or faults with respect to any CRISIL Index or for the results obtained from the use of any CRISIL Index; (b) CRISIL does not accept any liability (and expressly excludes all liability) arising from or relating to their use of any part of CRISIL Indices.

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein.

Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Top stocks mentioned above are for illustration purpose and should not be construed as recommendation.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025

-

Axis AMC Partners with NISM to Launch Industry-First Talent Development Program "Unnati"

Mar 4, 2025

-

Axis MF launches Axis NIFTY AAA Bond Financial Services: Mar 2028 Index Fund

Feb 27, 2025

-

RBI Monetary Policy: Feb 2025 New Governor ushers in a softer rate regime

Feb 7, 2025