Axis MF Launches Axis Momentum Fund

Mutual Fund

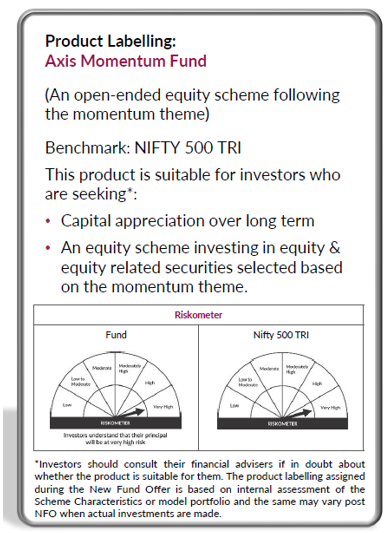

(An Open-Ended Equity Scheme following Momentum Theme)

Highlights:

- Benchmark: NIFTY 500 TRI

- Fund Managers: Mr. Karthik Kumar and Mr. Mayank Hyanki

- NFO open date: 22nd November 2024

- NFO close date: 06th December 2024

- Minimum Application Amount: Rs. 100 and in multiples of Rs. 1/- thereafter

- Exit Load:

- If redeemed / switched out within 12 months from the date of allotment - For 10% of the investment: Nil, For remaining investments: 1%

- If redeemed/switched out after 12 months from the date of allotment: Nil

Mumbai, November 22, 2024: In recent years, momentum as an investment strategy has gained significant traction in India, as investors increasingly seek to capitalize on market trends and growth opportunities within the country’s dynamic economy. To leverage this behaviour, Axis Mutual Fund, one of India’s fastest-growing fund houses, has introduced the Axis Momentum Fund— an open-ended equity scheme following the Momentum Theme. With a structured and model-based approach for a strong framework, the investment objective of the scheme is to generate long-term capital appreciation for investors from a portfolio of equity and equity related securities based on the momentum theme. There is no assurance that the investment objective of the scheme will be achieved.

Speaking about the launch, Mr. B Gopkumar, MD & CEO, of Axis Mutual Fund said, "India’s evolving economy presents distinct opportunities for those who can effectively leverage market trends. Momentum investing, a strategy widely embraced globally, is especially relevant in the Indian context, where rapid sectoral shifts and evolving market dynamics create pockets of sustained outperformance. Our launch of the Axis Momentum Fund aligns with our commitment to continuously innovate and offer investors access to cutting-edge investment strategies that align with evolving market dynamics. By harnessing the power of momentum investing, we aim to unlock new avenues for growth, offering our investors a differentiated approach to achieving their financial goals.”

Understanding Momentum Investing

Momentum investing, as a strategy focuses on identifying and capitalizing on underlying securities with strong upward trends. Unlike the usual approach of seeking undervalued stocks or high-growth companies, momentum investing embraces the principle of "buying high to sell higher". While often simplified, momentum investing is rooted in rigorous quantitative analysis. By applying robust filters, the strategy screens for stocks with strong performance indicators, making it adaptable to varying market conditions and reducing the influence of emotional biases on decision-making. In India, momentum investing benefits from historical performance data, with momentum indices like the Nifty200 Momentum 30 frequently outperforming broader benchmarks on a risk-adjusted basis.

Axis Momentum Fund

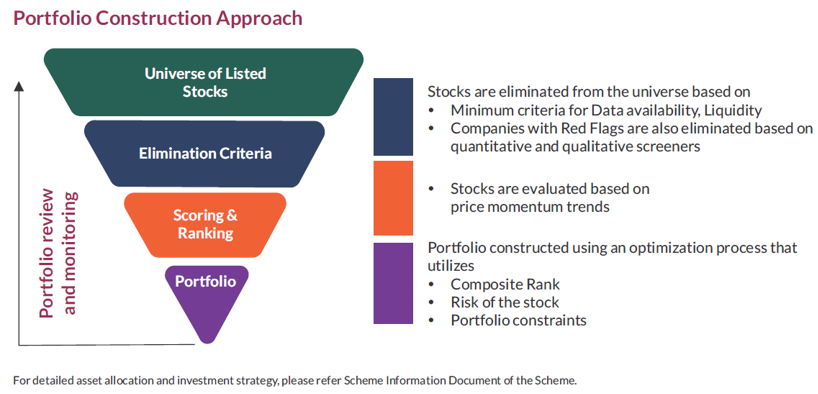

The Axis Momentum Fund offers a unique model-driven approach, systematically identifying and investing in high-momentum securities across sectors. The fund employs a framework that filters securities by considering data availability and liquidity, and then evaluates them based on price momentum trends. Essentially, the portfolio construction uses an optimized process that utilizes Composite Rank, Risk of the Stock, and Portfolio Constraints.

The fund utilizes an optimization process that evaluates stocks for strong price momentum while integrating risk metrics to balance exposure. This model based approach combines momentum scoring with volatility measures, optimizing position sizes to achieve both performance and risk control. The fund's model has consistently proven its effectiveness across market cycles, outperforming the NIFTY 500 TRI benchmark in 12 out of 15 years with a cumulative outperformance of 6.62%. On a 3-year rolling return basis, the model has delivered positive returns 96% of the time and outperformed the benchmark in 76.8% of instances.

Mr. Ashish Gupta, CIO, Axis Mutual Fund said, “Momentum investing, while offering return potential, requires a disciplined and data-driven approach to manage risk effectively. The Momentum Fund employs a robust risk management framework that combines quantitative screens, advanced technical indicators, and rigorous fundamental analysis to identify high-conviction opportunities. Our portfolio construction process focuses on sector diversification to mitigate systemic risks, while maintaining a strict risk-to-reward ratio for each position. We have designed this fund to serve as both a standalone investment vehicle and a powerful portfolio diversification tool, particularly valuable in today's market where sector leadership and growth drivers are constantly evolving”.

Key Features of the Axis Momentum Fund

- Potential for Higher Returns: Leverages momentum investing to capture stocks with strong upward price trends, aiming for superior long-term returns.

- Agile Re-adjustments and Rebalancing: A dynamic, model-based approach ensures regular portfolio rebalancing, enabling the fund to seize emerging opportunities in the market.

- Controls Exposure to Sector/Stock Concentration, Market Cap Skewness, and Liquidity Risk: The fund’s risk management framework maintains a balanced portfolio, reducing over-concentration and addressing liquidity constraints.

- Complements Other Strategies, Enhancing Portfolio Potential: Designed to complement other strategies, enhancing portfolio performance by integrating a disciplined momentum strategy.

The New Fund Offer (NFO) period will be open from November 22 to December 6, 2024, with the fund benchmarked against the NIFTY 500 TRI. The fund will be managed by Mr. Karthik Kumar and Mr. Mayank Hyanki.

For detailed information on the investment strategy and to view the Scheme Information Document (SID)/Key Information Memorandum (KIM), please visit www.axismf.com.

Source: Axis MF Research, NSE Indices, MFI Data as of Oct 2024

Product Labelling and Riskometer:

About Axis AMC: Axis AMC is one of India's fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds (https://www.axismf.com/), portfolio management services and alternative investments (https://www.axisamc.com/homepage).

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

Past performance may or may not be sustained in the future.

Stock(s) / Issuer(s)/ Top stocks, if any, mentioned above are for illustration purpose and should not be construed as recommendation.

The data/statistics / information given are to explain various concepts and general market trends in the securities market. The information on sector(s)/stock(s)/issuer(s) mentioned in this presentation is provided on the basis of publicly available information illustration purpose only and should not be construed as any investment advice / research report / recommendation to buy / sell / hold securities by Axis AMC / Axis Mutual Fund. The Fund manager may or may not choose to have any present / future position in these sector(s)/stock(s)/issuer(s).

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to र1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025

-

Axis AMC Partners with NISM to Launch Industry-First Talent Development Program "Unnati"

Mar 4, 2025