Axis Mutual Fund launches Axis Nifty IT Index Fund

Mutual Fund

(An Open-Ended Index Fund Tracking the NIFTY IT TRI)

Highlights:

- Category: An Open-Ended Index Fund Tracking the NIFTY IT TRI

- Benchmark: NIFTY IT TRI

- Fund Manager: Mr. Hitesh Das

- NFO open date: 27th June 2023

- NFO close date: 11th July 2023

- Minimum Investment: Rs. 5,000 and in multiples of Re. 1/- thereof

- Exit Load: If redeemed or switched out within 7 days from the date of allotment: 0.25% If redeemed / switched out after 7 days from the date of allotment: Nil

Mumbai, June 26, 2023: Axis Mutual Fund, one among the fastest growing fund houses in India, announced the launch of their New Fund Offer – Axis Nifty IT Index Fund, an open-ended index fund tracking the NIFTY IT TRI. Mr. Hitesh Das (Fund Manager) would be managing the fund. Axis Nifty IT Index Fund will track the NIFTY IT TRI and aim to provide returns before expenses that correspond to the total returns of the NIFTY IT TRI, subject to tracking errors. The minimum investment amount is Rs. 5,000 and in multiples of Re.1/- thereof.

The main objective of an Index Fund is to replicate a stock market index in terms of the portfolio. All the stocks in these indices will find some representation in their investment portfolio. Essentially, this ensures a performance fairly identical to that of the index being tracked. Within Index Funds, investors have the option to invest in certain Sector Based Index Funds as well, with the aim to capitalize on the growth opportunity provided in that particular sector.

Leveraging the opportunity in India’s growing IT landscape

Technology is a focal point for all businesses, across sectors. All organisations, big or small, are reshaping and accelerating their businesses through new age technology like cloud computing, machine learning, augmented reality, artificial intelligence etc. Consequently, this sector usually sees better than expected demand. Indian technology companies have been consistently increasing their market share vis a vis global peer. India’s IT and BPM exports have outperformed global IT services growth. With exports of over US$ 194 billion annually, the IT space is the largest single service exporter industry in India.

As per NASSCOM, the industry is estimated to grow to $245 billion, reflecting an incremental net revenue addition of $19 billion for the year. The growth has been seen in IT services, BPM, software products, ER&D, and the domestic market.

The external headwinds faced in 2022 resulted in valuations of IT companies becoming far more reasonable. Companies are now trading at discount to last 3/5 years’ average multiples. These attractive valuations and a better-than-expected earnings season in Q1FY24 could lead to recovery in revenue momentum from second half of FY24.

Axis NIFTY IT Index Fund

Axis Mutual Fund’s current bouquet of passive offerings almost 20 different schemes, tailored to leverage various benchmarks to achieve its intended objective. While Axis Mutual Fund had introduced the Axis Nifty IT ETF in 2021, the launch of the Axis NIFTY IT Index Fund will enable an investment opportunity for an even wider audience.

The investment objective of the Axis Nifty IT Index Fund is to provide returns before expenses that correspond to the total returns of the NIFTY IT TRI, subject to tracking errors. However, there is no assurance that the investment objective of the scheme will be achieved. The Scheme endeavours to invest in stocks forming part of the underlying index in the same ratio as per the index to the extent possible. Essentially, 95% to 100% of the investments will be made in securities covered by Nifty IT TRI and the remaining in Debt and Money Market investments. To that extent follows a passive investment strategy, except to the extent of meeting liquidity and expense requirements. (Please refer to SID for detailed Asset Allocation & Investment Strategy and other scheme related features available at www.axismf.com).

Some Key Attributes of the Fund include:

- Low cost passive investment solution - A hassle free solution for investors looking for a low cost equity product that will allow them exposure to a particular sector

- Elimination of bias - As the fund invests in the underlying index, it eliminates fund manager bias while purchasing/selling securities

- Equity taxation - As maximum investments will be made in Equity instruments covered by Nifty IT TRI, the scheme is subject to Equity taxation

- Endeavour for minimal tracking error - The passively managed fund endeavours for minimal tracking error as it aims to replicate the benchmark

B. Gopkumar, MD & CEO, Axis AMC said, “India has been a leader in driving change through technology across sectors. This has been more visible in the last three years, post Covid where we showed our resilience and resurgence. We are in the cusp of rewriting our growth story led by technological innovations. Increasingly all companies will be operating in this digital arena. With the launch of the Axis Nifty IT Index Fund, we are expanding our bouquet of products, more importantly, offering our investors an opportunity to be part of India’s tech enabled story.”

Given the mutual fund structure, investors can look to invest through various systematic options like SIPs, STP’s & lumpsum investments. The NFO opens for subscription from 27th June 2023 to 11th July 2023.

For more information, please visit www.axismf.com.

Source: AMFI, Axis AMC Research data as on 20th June, 2023

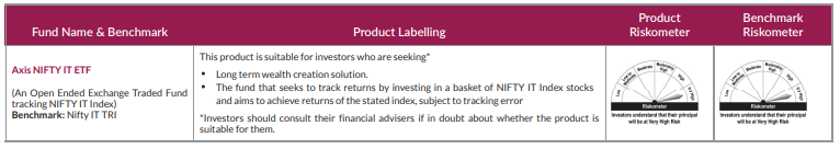

Product Labelling and Riskometer:

Axis Nifty IT Index Fund (An open ended Index fund tracking the NIFTY IT TRI)

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

(The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may vary post NFO when actual investments are made)

Axis Nifty IT ETF (An open-ended Exchange Traded Fund tracking the NIFTY IT Index)

About Axis AMC: Axis AMC is one of India`s fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds (https://www.axismf.com/), portfolio management services and alternative investments (https://www.axisamc.com/homepage).

NIFTY Indices Disclaimer: The Axis NIFTY IT Index Fund (Products) are not sponsored, endorsed, sold or promoted by NSE INDICES LIMITED (formerly known as India Index Services & Products Limited ("IISL"). NSE INDICES LIMITED does not make any representation or warranty, express or implied, to the owners of the Axis NIFTY IT Index Fund or any member of the public regarding the advisability of investing in securities generally or in the Product(s) particularly or the ability of the Nifty IT TRI to track general stock market performance in India. The relationship of NSE INDICES LIMITED to the Issuer is only in respect of the licensing of the Indices and certain trademarks and trade names associated with such Indices which is determined, composed and calculated by NSE INDICES LIMITED without regard to the Issuer or the Product(s). NSE INDICES LIMITED does not have any obligation to take the needs of the Issuer or the owners of the Product(s) into consideration in determining, composing or calculating the Nifty IT Index. NSE INDICES LIMITED is not responsible for or has participated in the determination of the timing of, prices at, or quantities of the Product(s) to be issued or in the determination or calculation of the equation by which the Product(s) is to be converted into cash. NSE INDICES LIMITED has no obligation or liability in connection with the administration, marketing or trading of the Product(s). NSE INDICES LIMITED do not guarantee the accuracy and/or the completeness of the Nifty IT TRI or any data included therein and NSE INDICES LIMITED shall not have any responsibility or liability for any errors, omissions, or interruptions therein. NSE INDICES LIMITED does not make any warranty, express or implied, as to results to be obtained by the Issuer, owners of the product(s), or any other person or entity from the use of the Nifty IT TRI or any data included therein. NSE INDICES LIMITED makes no express or implied warranties, and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the index or any data included therein. Without limiting any of the foregoing, NSE INDICES LIMITED expressly disclaim any and all liability for any claims, damages or losses arising out of or related to the Products, including any and all direct, special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages. An investor, by subscribing or purchasing an interest in the Product(s), will be regarded as having acknowledged, understood and accepted the disclaimer referred to in Clauses above and will be bound by it.

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Stock(s) / Issuer(s)/ Top stocks, if any, mentioned above are for illustration purpose and should not be construed as recommendation.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025

-

Axis AMC Partners with NISM to Launch Industry-First Talent Development Program "Unnati"

Mar 4, 2025

-

Axis MF launches Axis NIFTY AAA Bond Financial Services: Mar 2028 Index Fund

Feb 27, 2025

-

RBI Monetary Policy: Feb 2025 New Governor ushers in a softer rate regime

Feb 7, 2025