Axis Mutual Fund: RBI Monetary Policy

Mutual Fund

The Reserve Bank of India surprised the market with a pause in its rate hike campaign leaving the policy repo rate unchanged at 6.50%. The RBI Governor emphasized that this pause was only for this meeting and the Monetary Policy Committee wouldn't hesitate to act as needed in future meetings to bring inflation down. The MPC retained its stance of withdrawal of accommodative.

The Governor likened the RBI's stance as a "war on inflation" observing that this war was far from being won. Inflation remains above the RBI's upper threshold of 6% (last print: 6.4% in Feb). At the most recent inflation reading, the policy rate is barely in real positive territory and interest rates are still seen to be acommodative. Then why have they paused?

The short answer: financial stability. The recent failures / bailouts of banks such as Silicon Valley Bank in the US and Credit Suisse in Europe has raised the risk of financial instability. This could pose growth risks for the global economy. At such a juncture they deemed it prudent to wait and watch rather than hike.

Growth has returned to its central place in RBI's framework. With inflation projected to fall below 6%, and no mention of the 4% official target of inflation, it appears that RBI is comfortable with its projection of inflation in the coming year. Average inflation is projected at 5.2%. GDP growth was marginally marked up to 6.5% for FY24. The impact of the 290 bps of tightening over the last year is now expected to affect the real economy. The clear emphasis seems to be support for growth unless inflation again surprises above 6% consistently.

The other key factor appears to be the relative stability of the Indian Rupee. In the past several months, the RBI has been able to rebuild its forex reserves back above US$600 billion thanks to this stability.

Lastly the RBI is mindful of the large government borrowing programmer this year. With this in mind, the RBI also indicated that it would be agile in liquidity management. We are now close to a neutral liquidity position - and at the current pace of outflows (currency and reserve demand), the liquidity demand from the RBI is likely to be close to र 4 lakh crores. A part of this can be filled by forex flows if the currency is stable and financial conditions globally are easy. However, it is likely that the RBI will need to respond to liquidity needs through open market operations later this year.

The market is reading this policy as a "pivot" by the RBI. While inflation risks continue, the focus clearly appears to be on growth. With a US recession / global economic slowdown being a distinct possibility, it is possible that growth may undershoot the forecast.

The unexpected pause and the promise on agility on liquidity was cheered and yields across the curve dropped by around 10 basis points immediately after the policy announcement. In the near term, the policy is expected to remove some fears from the market and bonds are expected to be relatively well bid.

In the medium term the borrowing programme and supply will be key to watch. Longer duration may be the most under pressure as the supply risk is highest there. As the curve is still very flat, our preference is to maintain longer duration – but through the short to mid parts of the curve.

Allocation and strategy is based on the current market conditions and is subject to changes depending on the fund manager's view of the markets. Data as on 31st March 2023

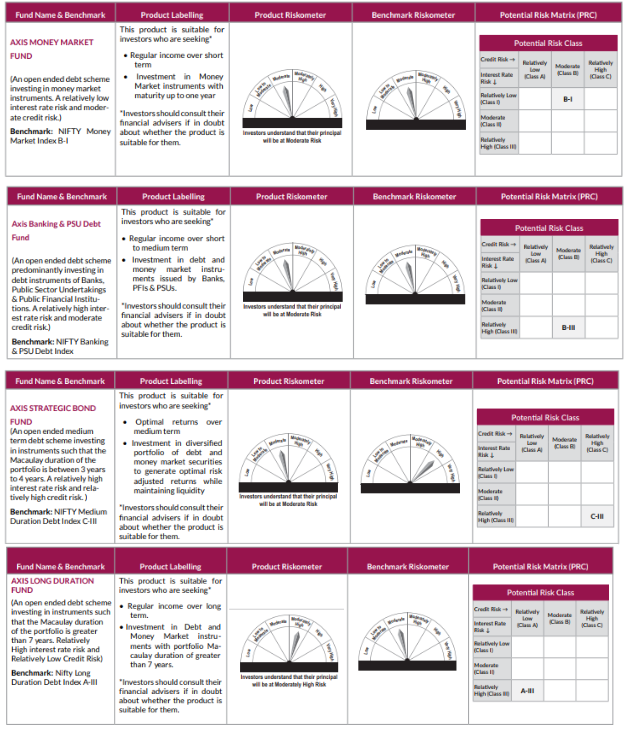

Product Labelling

Disclaimer

* Investors should consult their investment advisers if in doubt about whether the product is suitable for them.

Source of Data: RBI Governor' Statement, RBI Monetary Policy Statement & RBI post policy press conference dated 6th April 2023, Axis MF Research

This document represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. The material is prepared for general communication and should not be treated as research report. The data used in this material is obtained by Axis AMC from the sources which it considers reliable.

While utmost care has been exercised while preparing this document, Axis AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The AMC reserves the right to make modifications and alterations to this statement as may be required from time to time.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC) Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025