UTI Dividend Yield Fund - Regular Plan - IDCW

Fund House: UTI Mutual Fund| Category: Equity: Dividend Yield |

| Launch Date: 03-05-2005 |

| Asset Class: Equity |

| Benchmark: NIFTY 500 TRI |

| TER: 2.01% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5,000 |

| Minimum Topup: 1,000 |

| Total Assets: 3,633.45 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: 30% | Exit Load: Exit load of 1% if redeemed less than 1 year |

31.8204

-0.11 (-0.3413%)

14.58%

Benchmark: 12.34%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY 500 TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

16 Years 1 Months

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

An Open ended equity scheme which aims to provide medium to long term capital gains and/or dividend distribution by investing predominantly in equity and equity related instruments which offer high dividend yield.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 13.05 |

| Sharpe Ratio | 1.02 |

| Alpha | 2.12 |

| Beta | 0.92 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| UTI Dividend Yield Fund - Regular Plan - IDCW | 03-05-2005 | 13.51 | 28.31 | 16.09 | 26.94 | 12.75 |

| UTI-Dividend Yield Fund.-Growth | 03-05-2005 | 13.56 | 28.36 | 16.15 | 27.04 | 13.14 |

| LIC MF Dividend Yield Fund-Regular Plan-Growth | 17-12-2018 | 12.19 | 30.55 | 18.64 | 27.06 | - |

| ICICI Prudential Dividend Yield Equity Fund Growth Option | 01-05-2014 | 9.32 | 31.09 | 21.73 | 34.63 | 15.19 |

| Templeton India Equity Income Fund-Growth Plan | 18-05-2006 | 7.74 | 24.06 | 17.73 | 32.01 | 15.17 |

Scheme Characteristics

Scheme should predominantly invest in dividend yielding stocks. Minimum investment in equity - 65% of total assets.

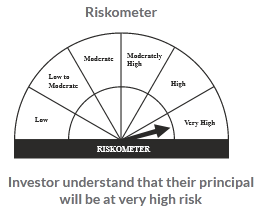

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

17.09%

Others

3.1%

Large Cap

67.24%

Mid Cap

12.56%