UTI Childrens Equity Fund - Regular Plan - IDCW

(Erstwhile UTI CCP Advantage Fund - Income)

Fund House: UTI Mutual Fund| Category: Childrens Fund |

| Launch Date: 17-02-2004 |

| Asset Class: Mixed Asset |

| Benchmark: NIFTY 500 TRI |

| TER: 2.27% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 1000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 994.15 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: 27% | Exit Load: Nil |

78.488

-0.17 (-0.2114%)

10.25%

Benchmark: 12.34%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY 500 TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

10 Years 2 Months

14 Years 6 Months

16 Years 12 Months

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

Investment can be made in the name of the children upto the age of 15 years so as to provide them, after They attain the age of 18 years, a means to receive scholarship to meet the cost of higher education and /or to help them in setting up a profession, practice or business or enabling them to set up a home or finance the cost of other social obligation.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 12.35 |

| Sharpe Ratio | 0.68 |

| Alpha | -2.59 |

| Beta | 0.9 |

| Yield to Maturity | 6.62 |

| Average Maturity | 0.01 |

PEER COMPARISON

Scheme Characteristics

Scheme having a lock-in for at least 5 years or till the child attains age of majority whichever is earlier.

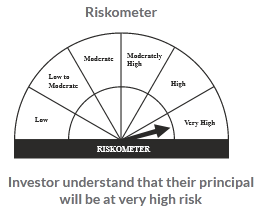

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

6.59%

Others

2.94%

Large Cap

70.64%

Mid Cap

19.8%