UTI Aggressive Hybrid Fund - Regular Plan - Growth

(Erstwhile UTI - Balanced Fund-Growth)

Fund House: UTI Mutual Fund| Category: Hybrid: Aggressive |

| Launch Date: 20-03-1995 |

| Asset Class: Mixed Asset |

| Benchmark: CRISIL Hybrid 35+65 Aggressive Index |

| TER: 1.88% As on (31-03-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 1000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 5,910.13 Cr As on 31-03-2025(Source:AMFI) |

| Turn over: 33% | Exit Load: Redemption /Switch out within 12 months from the date of allotment– (i) NIL for upto 10% of the allotted Units (ii) 1.00 % for beyond 10% of the allotted Units. , if any, will be levied on units redeemed/ switched-out , basis the rate prevailing at the time of allotment of the corresponding units. |

386.5108

3.34 (0.8641%)

12.9%

Benchmark: 12.22%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

AK Hybrid Aggressive TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

4 Years 11 Months

10 Years 4 Months

10 Years 12 Months

19 Years 1 Months

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

An open-ended balanced fund investing between 40% to 75% in equity/equity related securities and the balance in debt (fixed income securities) with a view to generate regular income together with capital appreciation.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 10.32 |

| Sharpe Ratio | 0.76 |

| Alpha | 4.53 |

| Beta | 1.05 |

| Yield to Maturity | 7.09 |

| Average Maturity | 10.46 |

PEER COMPARISON

Scheme Characteristics

Equity & Equity related instruments - between 65% and 80% of total assets; Debt instruments - between 20% and 35% of total assets.

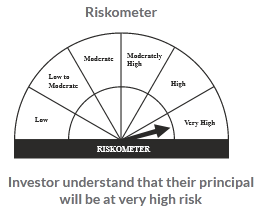

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

10.35%

Others

30.52%

Large Cap

45.41%

Mid Cap

13.58%