Tata Housing Opportunities Fund - Regular Plan - IDCW Payout

Fund House: Tata Mutual Fund| Category: Equity: Thematic-Others |

| Launch Date: 02-09-2022 |

| Asset Class: |

| Benchmark: Nifty Housing TRI |

| TER: 2.41% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 475.79 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: 9.74% | Exit Load: Exit load of 1%, if redeemed within 30 days. |

13.7484

-0.04 (-0.3215%)

13.03%

Benchmark: 14.18%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

Nifty Housing TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

There is no value for 2x

There is no value for 4x

There is no value for 5x

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme seeks to generate long-term capital appreciation by investing predominantly in equity and equity related instruments of entities engaged in and/or expected to benefit from the growth in housing theme.

Current Asset Allocation (%)

Indicators

| Standard Deviation | |

| Sharpe Ratio | |

| Alpha | |

| Beta | |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Tata Housing Opportunities Fund - Regular Plan - IDCW Payout | 02-09-2022 | 0.69 | 19.22 | - | - | - |

| HDFC Defence Fund - Growth Option | 02-06-2023 | 20.26 | - | - | - | - |

| Franklin India Opportunities Fund - Growth | 05-02-2000 | 15.08 | 39.0 | 27.61 | 34.05 | 14.85 |

| HSBC Business Cycles Fund - Regular Growth | 20-08-2014 | 13.48 | 29.44 | 20.63 | 28.95 | 12.39 |

| ICICI Prudential Exports & Services Fund - Growth | 01-11-2005 | 13.37 | 27.74 | 19.1 | 29.58 | 13.36 |

| Samco Active Momentum Fund - Regular Plan - Growth Option | 05-07-2023 | 12.71 | - | - | - | - |

| Union Innovation & Opportunities Fund - Regular Plan - Growth Option | 06-09-2023 | 12.04 | - | - | - | - |

| Sundaram Services Fund Regular Plan - Growth | 21-09-2018 | 12.04 | 23.99 | 15.23 | 27.74 | - |

| ICICI Prudential India Opportunities Fund - Cumulative Option | 05-01-2019 | 11.87 | 31.45 | 23.45 | 36.31 | - |

| Kotak Business Cycle Fund-Regular Plan-Growth | 05-09-2022 | 11.84 | 23.26 | - | - | - |

Scheme Characteristics

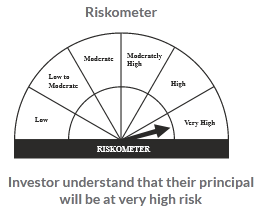

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

28.89%

Others

5.46%

Large Cap

45.23%

Mid Cap

20.42%