PGIM India Liquid Fund - Weekly Dividend

(Erstwhile DHFL Pramerica Insta Cash Plus Fund - Weekly Dividend)

Fund House: PGIM India Mutual Fund| Category: Debt: Liquid |

| Launch Date: 05-09-2007 |

| Asset Class: Fixed Income |

| Benchmark: CRISIL Liquid Debt A-I Index |

| TER: 0.22% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 390.62 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: - | Exit Load: W.e.f 20.10.2019, load is applicable as per the following load structure - 1st day - 0.007%, 2nd day - 0.0065%, 3rd day - 0.006%, 4th day - 0.0055%, 5th day - 0.005%, 6th day - 0.0045% Load Applicability: Please note that the exit load on the redemption would be as per the exit load applicability at the time of investment in the scheme |

100.7546

0.13 (0.1254%)

3.63%

Benchmark: 5.5%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

BSE Liquid Rate Index

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

0 Years 0 Months

0 Years 0 Months

0 Years 0 Months

0 Years 0 Months

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme aims to generate steady returns with high liquidity by investing in a portfolio of short-term , high quality money market and debt instruments. The fund would invest atleast 80% of the corpus in instruments with average maturity upto one year upto 20% of the corpus in instruments with average maturity greater than an year.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 0.48 |

| Sharpe Ratio | 0.27 |

| Alpha | 2.04 |

| Beta | 0.95 |

| Yield to Maturity | 7.28 |

| Average Maturity | 1.2 |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| PGIM India Liquid Fund - Weekly Dividend | 05-09-2007 | 7.27 | 7.26 | 6.68 | 5.4 | 5.3 |

| HSBC Liquid Fund - Growth | 04-12-2002 | 9.16 | 9.43 | 7.97 | 5.8 | 6.01 |

| BANK OF INDIA Liquid Fund- Regular Plan- Growth | 16-07-2008 | 7.39 | 7.35 | 6.79 | 5.45 | 6.29 |

| Union Liquid Fund - Growth Option | 15-06-2011 | 7.37 | 7.32 | 6.73 | 5.43 | 5.86 |

| Axis Liquid Fund - Regular Plan - Growth Option | 05-10-2009 | 7.35 | 7.35 | 6.76 | 5.45 | 6.33 |

| Groww Liquid Fund (formerly known as Indiabulls Liquid Fund) - Regular Plan - Growth Option | 25-10-2011 | 7.35 | 7.24 | 6.58 | 5.22 | 6.22 |

| Canara Robeco Liquid Fund - Regular Plan - Growth Option | 05-07-2008 | 7.34 | 7.33 | 6.74 | 5.34 | 6.17 |

| DSP Liquidity Fund - Regular Plan - Growth | 20-11-2005 | 7.34 | 7.3 | 6.7 | 5.39 | 6.25 |

| Edelweiss Liquid Fund - Regular Plan - Growth Option | 20-09-2007 | 7.33 | 7.25 | 6.62 | 5.32 | 6.13 |

| Edelweiss Liquid Fund - Retail Plan - Growth Option | 21-09-2007 | 7.33 | 7.25 | 6.62 | 5.32 | 6.12 |

Scheme Characteristics

Investment in Debt and money market securities with maturity of upto 91 days only.

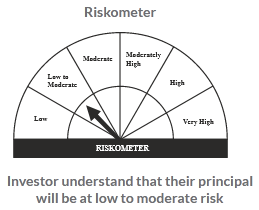

Riskometer

PORTFOLIO

Market Cap Distribution

Others

100.0%