Nippon India Multi Cap Fund - IDCW Option

(Erstwhile Reliance Multi Cap Fund-Dividend Plan)

Fund House: Nippon India Mutual Fund| Category: Equity: Multi Cap |

| Launch Date: 28-03-2005 |

| Asset Class: Equity |

| Benchmark: NIFTY500 MULTICAP 50:25:25 TRI |

| TER: 1.58% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 100 |

| Minimum Topup: 100 |

| Total Assets: 35,353.47 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: 26% | Exit Load: For units more than 10% of the investments, an exit load of 1% if redeemed within 12 months. |

57.1286

-0.2 (-0.3508%)

17.03%

Benchmark: 15.87%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY500 MULTICAP 50:25:25 TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

1 Years 1 Months

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme aims to invest in stocks across those sectors and industries where Indias strong inherent potential is increasingly becoming visible to the world, which are driving our economy and whose fundamental future growth is influenced by ongoing economic reforms, FDI inflows and infrastructural changes.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 13.06 |

| Sharpe Ratio | 1.72 |

| Alpha | 11.38 |

| Beta | 0.91 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Nippon India Multi Cap Fund - IDCW Option | 28-03-2005 | 9.47 | 29.55 | 21.18 | 32.28 | 12.86 |

| SBI Multicap Fund- Regular Plan- Growth Option | 05-03-2022 | 15.48 | 26.59 | 15.48 | - | - |

| LIC MF Multi Cap Fund-Regular Plan-Growth | 31-10-2022 | 14.91 | 27.83 | - | - | - |

| Axis Multicap Fund - Regular Plan - Growth | 05-12-2021 | 13.55 | 33.02 | 18.87 | - | - |

| WhiteOak Capital Multi Cap Fund Regular Plan Growth | 22-09-2023 | 12.58 | - | - | - | - |

Scheme Characteristics

Minimum investment in equity & equity related instruments - 65% of total assets.

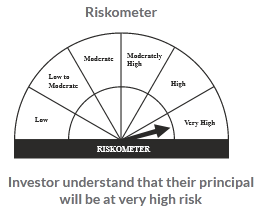

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

26.18%

Others

2.41%

Large Cap

44.87%

Mid Cap

26.54%