Mirae Asset Balanced Advantage Fund Regular Plan- Growth

Fund House: Mirae Asset Mutual Fund| Category: Hybrid: Dynamic Asset Allocation |

| Launch Date: 18-08-2022 |

| Asset Class: |

| Benchmark: NIFTY 50 Hybrid Composite debt 50:50 Index |

| TER: 2.08% As on (31-03-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 1,765.79 Cr As on 31-03-2025(Source:AMFI) |

| Turn over: 273% | Exit Load: I. For investors who have opted for SWP under the plan: a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil. b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO): If redeemed within 1 year (365 days) from the date of allotment: 1%. If redeemed after 1 year (365 days) from the date of allotment: NIL. II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out): If redeemed within 1 year (365 days) from the date of allotment: 1%. If redeemed after 1 year (365 days) from the date of allotment: NIL. |

13.523

0.12 (0.8504%)

11.83%

Benchmark: 11.41%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

AK Hybrid Balanced TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

There is no value for 2x

There is no value for 4x

There is no value for 5x

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme seeks to capitalize on the potential upside of equities while attempting to limit the downside by dynamically managing the portfolio through investment in equity & equity related instruments and active use of debt, money market instruments and derivatives.

Current Asset Allocation (%)

Indicators

| Standard Deviation | |

| Sharpe Ratio | |

| Alpha | |

| Beta | |

| Yield to Maturity | 6.9 |

| Average Maturity | 4.64 |

PEER COMPARISON

Scheme Characteristics

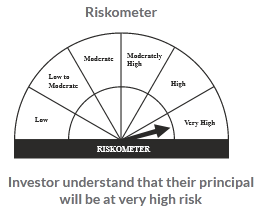

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

9.09%

Others

16.98%

Large Cap

51.65%

Mid Cap

7.85%