HDFC Banking and PSU Debt Fund - IDCW Option

Fund House: HDFC Mutual Fund| Category: Debt: Banking and PSU |

| Launch Date: 26-03-2014 |

| Asset Class: Fixed Income |

| Benchmark: Nifty Banking & PSU Debt Index A-II |

| TER: 0.74% As on (31-03-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 100.0 |

| Minimum Topup: 100.0 |

| Total Assets: 5,996 Cr As on 31-03-2025(Source:AMFI) |

| Turn over: - | Exit Load: Nil |

10.2447

0 (0.0%)

6.49%

Benchmark: 7.37%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY COMPOSITE G-SEC INDEX

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

There is no value for 2x

There is no value for 4x

There is no value for 5x

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme seeks to generate regular income through investments in debt and money market instruments consisting predominantly of securities issued by entities such as Scheduled Commercial Banks and Public Sector undertakings.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 0.98 |

| Sharpe Ratio | -0.23 |

| Alpha | 3.54 |

| Beta | 1.88 |

| Yield to Maturity | 7.44 |

| Average Maturity | 5.42 |

PEER COMPARISON

Scheme Characteristics

Minimum investment in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions - 80% of total assets.

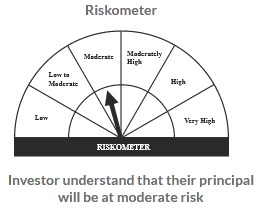

Riskometer

PORTFOLIO

Market Cap Distribution

Others

100.0%