Franklin India Focused Equity Fund - Growth Plan

(Erstwhile Franklin India High Growth Companies Fund - Growth Plan)

Fund House: Franklin Templeton Mutual Fund| Category: Equity: Focused |

| Launch Date: 05-07-2007 |

| Asset Class: Equity |

| Benchmark: NIFTY 500 TRI |

| TER: 1.8% As on (31-03-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 11,396.38 Cr As on 31-03-2025(Source:AMFI) |

| Turn over: 26.36% | Exit Load: Exit load of 1% if redeemed within 1 year |

103.3764

0.59 (0.5711%)

14.06%

Benchmark: 12.44%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The fund seeks to achieve capital appreciation through investments in Indian companies/sectors with high growth rates or potential. It will focus on companies offering the best trade-off between growth, risk and valuation. The fund managers will follow an active investment strategy and will be focusing on rapid growth companies which will be selected based on growth, measures such as Enterprise value, growth rate, price/earnings/growth, forwardprice/sales, and discounted EPS.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 13.42 |

| Sharpe Ratio | 0.58 |

| Alpha | 1.68 |

| Beta | 0.87 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Franklin India Focused Equity Fund - Growth Plan | 05-07-2007 | 8.12 | 23.32 | 17.05 | 26.28 | 13.39 |

| HDFC Focused 30 Fund - GROWTH PLAN | 05-09-2004 | 18.27 | 29.32 | 23.33 | 30.83 | 14.32 |

| DSP Focus Fund - Regular Plan - Growth | 10-06-2010 | 18.04 | 28.72 | 18.07 | 22.71 | 12.01 |

| ICICI Prudential Focused Equity Fund - Growth | 05-05-2009 | 16.86 | 30.76 | 21.98 | 28.36 | 14.3 |

| BANDHAN Focused Equity Fund - Regular Plan - Growth | 16-03-2006 | 14.01 | 26.45 | 16.3 | 22.05 | 11.68 |

| SBI Focused Equity Fund - Regular Plan -Growth | 01-10-2004 | 13.56 | 21.92 | 13.58 | 21.59 | 13.96 |

| Invesco India Focused Fund - Growth | 08-09-2020 | 13.46 | 38.38 | 21.63 | - | - |

| Edelweiss Focused Fund - Regular Plan - Growth | 26-07-2022 | 12.67 | 24.79 | - | - | - |

| Canara Robeco Focused Equity Fund - Regular Plan - Growth Option | 05-05-2021 | 12.54 | 23.8 | 16.91 | - | - |

| Old Bridge Focused Equity Fund - Regular Growth | 24-01-2024 | 12.37 | - | - | - | - |

Scheme Characteristics

A scheme focused on the number of stocks (maximum 30). Minimum investment in equity & equity related instruments - 65% of total assets.

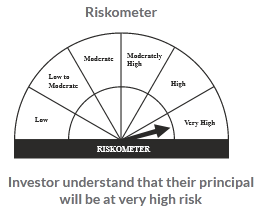

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

4.4%

Others

5.19%

Large Cap

79.7%

Mid Cap

10.73%