Canara Robeco Focused Equity Fund - Regular Plan - Growth Option

Fund House: Canara Robeco Mutual Fund| Category: Equity: Focused |

| Launch Date: 05-05-2021 |

| Asset Class: |

| Benchmark: BSE 500 TRI |

| TER: 1.97% As on (31-03-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 2,459.22 Cr As on 31-03-2025(Source:AMFI) |

| Turn over: - | Exit Load: 1% if redeemed / switched out within 1 year from the date of allotment. Nil - if redeemed/switched out after 1 Year from the date of allotment. |

18.46

0.28 (1.5168%)

16.52%

Benchmark: 12.37%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY 500 TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

3 Years 4 Months

There is no value for 4x

There is no value for 5x

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme seeks to generate long term capital appreciation/income by investing in equity and equity related instruments across market capitalization of up to 30 companies.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 13.77 |

| Sharpe Ratio | 0.59 |

| Alpha | 1.87 |

| Beta | 0.9 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Canara Robeco Focused Equity Fund - Regular Plan - Growth Option | 05-05-2021 | 11.24 | 22.21 | 15.45 | - | - |

| HDFC Focused 30 Fund - GROWTH PLAN | 05-09-2004 | 17.33 | 28.05 | 21.97 | 30.19 | 13.84 |

| DSP Focus Fund - Regular Plan - Growth | 10-06-2010 | 15.87 | 27.07 | 16.2 | 21.85 | 11.41 |

| ICICI Prudential Focused Equity Fund - Growth | 05-05-2009 | 15.34 | 28.84 | 20.11 | 27.59 | 13.77 |

| Invesco India Focused Fund - Growth | 08-09-2020 | 13.73 | 36.23 | 19.95 | - | - |

| BANDHAN Focused Equity Fund - Regular Plan - Growth | 16-03-2006 | 13.66 | 24.75 | 14.59 | 21.72 | 11.13 |

| SBI Focused Equity Fund - Regular Plan -Growth | 01-10-2004 | 13.35 | 21.09 | 12.16 | 21.01 | 13.54 |

| Nippon India Focused Equity Fund -Growth Plan -Growth Option | 26-12-2006 | 10.49 | 20.45 | 12.77 | 25.78 | 12.76 |

| ITI Focused Equity Fund - Regular Plan - Growth | 19-06-2023 | 10.32 | - | - | - | - |

| Edelweiss Focused Fund - Regular Plan - Growth | 26-07-2022 | 10.19 | 23.19 | - | - | - |

Scheme Characteristics

A scheme focused on the number of stocks (maximum 30). Minimum investment in equity & equity related instruments - 65% of total assets.

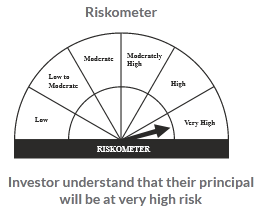

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

4.47%

Others

5.63%

Large Cap

72.96%

Mid Cap

16.94%