Edelweiss Government Securities Fund - Regular Plan Weekly - IDCW Option

Fund House: Edelweiss Mutual Fund| Category: Debt: Gilt |

| Launch Date: 13-02-2014 |

| Asset Class: Fixed Income |

| Benchmark: CRISIL Dynamic Gilt Index |

| TER: 1.15% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 100.0 |

| Minimum Topup: 100.0 |

| Total Assets: 171.29 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: - | Exit Load: :Nil |

10.3459

0.03 (0.3199%)

6.85%

Benchmark: 7.37%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY COMPOSITE G-SEC INDEX

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

There is no value for 2x

There is no value for 4x

There is no value for 5x

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The investment objective is to generate income by investing primarily in money market and short term debt instruments.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 2.44 |

| Sharpe Ratio | - |

| Alpha | -0.33 |

| Beta | 0.63 |

| Yield to Maturity | 6.94 |

| Average Maturity | 18.26 |

PEER COMPARISON

Scheme Characteristics

Minimum investment in Gsecs- 80% of total assets (across maturity).

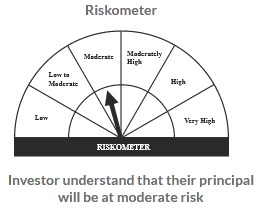

Riskometer

PORTFOLIO

Market Cap Distribution

Others

100.0%