Canara Robeco Infrastructure Fund - Regular Plan - IDCW (Payout/Reinvestment)

Fund House: Canara Robeco Mutual Fund| Category: Equity: Sectoral-Infrastructure |

| Launch Date: 02-12-2005 |

| Asset Class: Equity |

| Benchmark: BSE India Infrastructure TRI |

| TER: 2.37% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 726.15 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: 31% | Exit Load: for switch between Equity/Balanced and Balanced/Equity Schemes. Load We.f. : 17/07/2010. Lump Sum/SIP/STP : 1% - if redeemed / switched out within 1 year from the date of allotment, NIL - if redeemed / switched out after 1 year from the date of allotment. |

58.44

-0.29 (-0.4962%)

14.36%

Benchmark: 11.95%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

Nifty Infrastructure TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

1 Years 10 Months

17 Years 6 Months

18 Years 1 Months

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme aims to invest in equities and equity related instruments of companies in the infrastructure sector. The scheme is designed to invest in shares of those companies, which hold high potential to benefit from such infrastructure spending.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 14.61 |

| Sharpe Ratio | 1.81 |

| Alpha | 10.11 |

| Beta | 0.49 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Canara Robeco Infrastructure Fund - Regular Plan - IDCW (Payout/Reinvestment) | 02-12-2005 | 13.34 | 33.79 | 25.86 | 34.53 | 13.93 |

| LIC MF Infrastructure Fund-Regular Plan-Growth | 29-02-2008 | 15.85 | 38.38 | 25.39 | 33.49 | 13.62 |

| Canara Robeco Infrastructure Fund - Regular Plan - Growth Option | 02-12-2005 | 13.6 | 34.05 | 26.03 | 34.84 | 14.43 |

| HSBC Infrastructure Fund - Regular Growth | 01-01-2013 | 8.13 | 31.16 | 23.25 | 32.95 | 14.96 |

| ICICI Prudential Infrastructure Fund - Growth | 31-08-2005 | 8.07 | 34.21 | 29.51 | 40.84 | 15.83 |

| DSP India T.I.G.E.R. Fund - Regular Plan - Growth | 11-06-2004 | 7.52 | 35.03 | 26.93 | 36.46 | 15.14 |

| Franklin Build India Fund Growth Plan | 04-09-2009 | 6.83 | 36.84 | 27.99 | 36.47 | 16.21 |

| BANDHAN Infrastructure Fund - Regular Plan - Growth | 08-03-2011 | 6.32 | 37.25 | 27.22 | 37.98 | 14.86 |

| Sundaram Infrastructure Advantage Fund Regular Plan - Growth | 29-09-2005 | 4.89 | 29.55 | 20.6 | 32.01 | 13.17 |

| HDFC Infrastructure Fund - Growth Plan | 10-03-2008 | 4.86 | 39.38 | 29.94 | 36.76 | 10.3 |

Scheme Characteristics

Minimum investment in equity & equity related instruments of a particular sector/ particular theme - 80% of total assets.

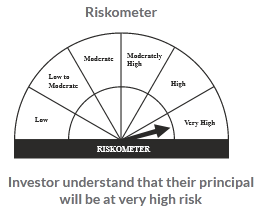

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

14.86%

Others

3.55%

Large Cap

56.84%

Mid Cap

25.16%