BANK OF INDIA Large & Mid Cap Equity Fund Regular Plan- Quarterly IDCW

(Erstwhile BOI AXA Equity Fund Regular Plan- Quarterly Dividend)

Fund House: Bank of India Mutual Fund| Category: Equity: Large and Mid Cap |

| Launch Date: 21-10-2008 |

| Asset Class: Equity |

| Benchmark: BSE 250 Large MidCap TRI |

| TER: 2.48% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 327.89 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: 142% | Exit Load: For redemption/switch out upto 10% of the initial units allotted -within 1 year from the date of allotment: “NIL” Any redemption/switch out - in excess of the above mentioned limit would be subject to an exit load of 1%, if the units are redeemed/switched out within 1 year from the date of allotment of units. If the units are redeemed/switched out after 1 year from the date of allotment of units : “Nil” You may also call at our Customer Engagement Centre on 1800 103 2263 / 1800 266 2676 (Toll free) to know the load structure prevailing from time to time. |

29.32

-0.1 (-0.3411%)

12.22%

Benchmark: 15.89%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY LARGE MIDCAP 250 TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

12 Years 10 Months

There is no value for 4x

There is no value for 5x

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme aims at income and long-term capital appreciation through a diversified portfolio of predominantly equity and equity-related securities including equity derivatives, across all market capitalizations. The Scheme is in the nature of diversified mutli-cap fund.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 13.02 |

| Sharpe Ratio | 1.04 |

| Alpha | 2.48 |

| Beta | 0.95 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| BANK OF INDIA Large & Mid Cap Equity Fund Regular Plan- Quarterly IDCW | 21-10-2008 | 2.95 | 22.84 | 14.9 | 24.2 | 11.09 |

| DSP Equity Opportunities Fund-Regular Plan - Growth | 16-05-2000 | 15.98 | 30.11 | 19.99 | 28.06 | 14.82 |

| LIC MF Large & Mid Cap Fund-Regular Plan-Growth | 05-02-2015 | 15.28 | 27.47 | 14.87 | 24.13 | 13.97 |

| Invesco India Large & Mid Cap Fund - Growth | 09-08-2007 | 14.71 | 33.05 | 20.26 | 26.25 | 14.06 |

| Motilal Oswal Large and Midcap Fund - Regular Plan Growth | 01-10-2019 | 13.83 | 33.21 | 24.31 | 29.69 | - |

| UTI Large & Mid Cap Fund - Regular Plan - Growth Option | 01-08-2005 | 12.29 | 30.15 | 19.93 | 31.18 | 12.77 |

| SBI Large & MIDCap Fund- Regular Plan -Growth | 28-02-1993 | 12.12 | 23.31 | 16.71 | 28.15 | 14.18 |

| Nippon India Vision Fund-Growth Plan-Growth Option | 05-10-1995 | 11.88 | 29.79 | 18.81 | 28.46 | 11.73 |

| BANDHAN Core Equity Fund - Regular Plan - Growth | 09-08-2005 | 11.79 | 32.23 | 21.88 | 30.76 | 14.35 |

| ICICI Prudential Large & Mid Cap Fund - Growth | 09-07-1998 | 11.61 | 29.04 | 20.95 | 31.83 | 14.58 |

Scheme Characteristics

Minimum investment in equity & equity related instruments of large cap companies - 35% of total assets. Minimum investment in equity & equity related instruments of mid cap stocks - 35% of total assets.

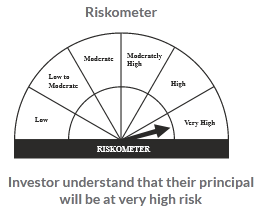

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

14.8%

Others

2.14%

Large Cap

47.2%

Mid Cap

35.86%