Wealth Protection: Investing for Retirees

The retirement years are supposed to be the golden period of one’s life. These are years to enjoy the fruits of all the hard work you put throughout your student and working life. Relieved from the stress of your career and your children well settled, now is the time to relax, spend time with your loved ones and pursue your non work related interests. Unfortunately, many retirees are increasingly getting nervous about their income and financial health.

With a shift from joint family construct to nuclear families, retirees now have to depend on their savings to meet their expenses. With advancements in healthcare, retired lives are getting longer and retirees fear that they may outlive their savings. Superior lifestyle compared to previous generations of retirees and inflation is also putting pressure on savings. Finally, sky-rocketing cost of private sector healthcare is also a serious financial risk.

In this blog post, we will discuss about Wealth Protection, one of the most important concerns for retirees. Though the term, Wealth Protection, is self-explanatory, there are several aspects for which you need plan. The most fundamental aspect of Wealth Protection, as the name suggests, is trying to ensure that you do not outlive your assets (savings) in retirement. For your assets to last beyond your lifetime, they should be able to generate sufficient income.

You also need to ensure that, there are sufficient assets left behind for your spouse, if she outlives you, to maintain her financial independence. You should also have enough highly liquid assets to meet any financial exigency, without having to draw down on your longer term assets. Finally, you may want to leave behind some inheritance for your children and grand-children. So estate planning is also an aspect of wealth protection. To ensure that all the aspects are addressed, there should be four important considerations for senior citizens or those who are planning for retirements in the next few years. These four considerations are asset diversification, tax efficiency, liquidity and risk protection.

Asset diversification

Asset or investment risk is obviously a serious concern for senior citizens because after retirement, senior citizens depend on income from their assets. If your asset depreciates in value, your income will be lower. Capital market can be volatile – after retirement, your assets should not expose to too much risk. If before retirement, you had a substantial part of your assets in equities, you should re-think your asset allocation post retirement. A stock market crash, which can never be predicted, will be more challenging to deal with, compared to when you were working. After retirement, your asset allocation profile should be conservative – skewed towards low risk assets like fixed income investments.

We suggest that you read – Importance of equity in asset allocation

While financial conservatism is a virtue in retirees, total risk aversion can cause problems. Total risk aversion was not such a problem for retirees in India a few decades back. My grandfather, a retired ex-serviceman, was able to enjoy financial independence throughout his retired life by putting his modest retirement savings in bank and post office deposits. However, most senior citizens, who I have come across over the last 10 years or so, think that bank deposit and post office savings interest is not enough to sustain their lifestyles. Interest from risk free assets on a post-tax basis, cannot keep up with inflation and retirees are forced to liquidate their assets to meet expenses, faster than they would have liked.

In the last 3 years, Bank FD interest rates, even for senior citizens, have come down almost 200 basis points from what it was just a few years back. Post Office small savings schemes rates have also come down by almost the same amount. Interest rates may go down further in the future. This is causing a lot of concern to senior citizens.

For Wealth Protection, senior citizens should balance risk and return, so that they can get sufficient income from assets and at the same time, also get capital appreciation which can help them beat inflation in the longer term. This can be achieved through asset diversification. As discussed earlier, senior citizens should have a conservative asset allocation strategy. The majority of the asset allocation, 60 to 70% or even more, should be in fixed income to get regular income from the investment. But they should not ignore equity since it is the only asset class which has consistently beaten inflation over longer tenures. There is no formula for asset allocation – senior citizens should ensure that their fixed income investment should be adequate to take care of their essential monthly expenses.

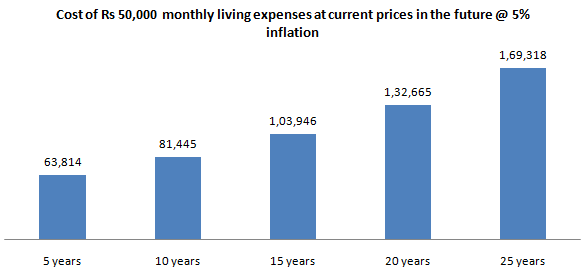

Let us look at the chart below to understand how your monthly expenses are going to increase due to inflation –

Retirees should not depend on equity returns to meet their essential expenses because equity returns can be volatile depending on market conditions. Equity returns should be a booster to overall portfolio returns. Over a sufficiently long period, equity is likely to appreciate more in value than fixed income assets. Retirees should therefore, from time to time, rebalance their asset allocation (from equity to debt) to optimize risk and also boost income to beat inflation. Retirees can meet these investment objectives by investing in a diversified portfolio of debt and equity mutual funds. Hybrid mutual fund schemes, which invest in debt and equity, can also be useful arsenals in senior citizen’s portfolios.

Did you know how hybrid mutual funds can be effective risk diversification solutions

Tax Efficiency of Investments

Tax affects cash-flows because income generated from assets are subject to tax rates varying from zero to 30% plus cess and surcharge, depending on the nature of investment, tenure of investment and the overall income of the investor. I have read in some Western retirement planning blogs which suggest that, retirees should plan their lifestyle and monthly budgets in such a way, which ensures that their incomes fall in a lower tax bracket.

Some of these blogs suggest that, retirees should postpone big ticket expenses like travel, home improvements etc. till the time they get favorable tax treatment on returns from investments required to fund these expenses. It is a sensible suggestion. Just to explain this further, assume you have your retirement assets in a debt mutual fund. If you redeem these assets partially or fully before three years from investment date to meet your one-time expenses, your returns will be taxed at your income tax slab rate. If you are able to postpone these expenses for three years, then your returns will be taxed at 20% after allowing for indexation benefits, which will further reduce your tax rate and tax obligation.

If you can adjust your lifestyle such that your income falls in a lower tax bracket, you can save a considerable amount in taxes. Try imagining the amount of taxes you will save if your current income falls from your current tax bracket to the next lower one. At the same, we also recognize that, the tax structure in India does not offer much leeway because there are only three slab rates. Further, depending on your lifestyle needs, it may not be comfortable for you to bring your lifestyle down to a lower income tax bracket. Therefore, you should look for the most tax efficient investment options.

Bank FDs and post office savings schemes for senior citizens are taxed as per the income tax rate of the investors. While they assure you risk free returns, they are not the most tax efficient investment options, especially for investors in the higher tax brackets. Mutual funds offer one of the most tax efficient investment options for retirees.

Debt fund returns are taxed as per the income tax rate of the investor in the first three years, but they are taxed at 20% after allowing for indexation benefits for redemptions made three years after the investment date. For investors in the highest tax brackets, mutual fund dividends are taxed at a lower rate (28.8%) than their income tax rates. Equity fund returns in the first 12 months are taxed at 15% and after 12 months are tax free up to profits of Rs 1 Lakh; profits in excess of Rs 1 Lakh are taxed at 10%. Equity oriented hybrid funds, despite lowering the investment risk profile due to their fixed income components, are subject to equity taxation and these funds can be used by retirees for a variety of investment needs.

As you plan your post retirement investments, make tax efficiency an important consideration because it will affect your income and Wealth Protection.

You may like to read: How is systematic withdrawal plan better than dividend option

Liquidity

Life can throw uncertainties from time to time and we may need sufficient money to deal with these exigencies. A portion of your assets should be in highly liquid and very low risk assets, which you can redeem partially or fully at a short notice to meet these exigencies without any penalty. Why do you need to have a separate liquidity arrangement? You can also redeem your long term assets, but if the exigency strikes at a time when market conditions are unfavorable, then you may have to sacrifice your long term returns in order to meet the exigency.

If you have some money set aside in an emergency fund, which also earns return for you like a money market mutual fund e.g. liquid fund, ultra-short term debt fund, then you will have access to liquidity, while earning higher returns than a savings bank account. There is no thumb rule for how much emergency fund you will need – at the end of the day, it is for an emergency situation and emergencies cannot be predicted. Senior citizens have the years of experience and the wisdom to roughly estimate how much might be required by their families in an emergency situation – they may also consult financial advisors who have the experience of such situations with their clients.

When setting up an emergency fund in highly liquid assets like liquid funds and ultra-short term debt funds it is good to be conservative, but retirees should not be ultra-conservative because highly liquid and very low risk assets tend to give lower returns than other asset types. While peace of mind is important, retirees should not compromise their long term financial future for securing peace of mind in the short term.

Risk Protection

One of the most concerning exigencies in the financial lives of senior citizens is medical emergencies. Your healthcare is critical for the happiness of your family. Medical emergency is one of the most unpredictable uncertainties in our lives. A serious illness requiring hospitalization for a few days can easily set you back by a few lakhs – a critical illness can cause a severe dent in your retirement savings. Therefore, it is essentially from a wealth protection perspective that, senior citizens should have a comprehensive health insurance or Mediclaim cover. When buying health insurance, pay attention to exclusions and waiting period for pre-existing medical conditions – if required, consult with a health insurance advisor.

Many senior citizens do not buy adequate health insurance or Mediclaim because they think that the premiums are too high. You should try to understand that, if you are struck with a serious illness, your family will not compromise on expenses and may have to pay the expenses out of their own pocket if you do not have sufficient cover. Make sure that you have sufficient health insurance cover so that a serious illness does not dent your family’s savings and consequently, your financial independence in retirement or your children’s financial plans. Apart from medical insurance, home insurance which provides fire insurance or a more comprehensive cover which includes fire and other allied perils like riots, floods and other natural disasters, is something that senior citizens may also want to consider depending on their personal situations.

Conclusion

In this blog post, we discussed about Wealth Protection in terms of how retirees should invest. Asset diversification is the most important consideration because capital safety and sufficient income generation to beat inflation are both important objectives. A cautious balancing act is therefore of utmost importance. Tax is another important consideration for retirees because it directly affects cash-flows. The importance of liquidity cannot be over-emphasized, especially when retirees do not income from their profession to bank on. Last but not the least, adequate insurance, primarily health insurance, is a critical need for retirees. Retirees should consult with a financial advisor if they need help in planning their investments and other financial requirements.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY