Is Value investing the right investment style for you: Part 2

In our previous post on this topic, Is Value investing the right investment style for you: Part 1, we discussed how different investment styles relate to our investment needs and risk attitudes. We also discussed in the previous post that, investment style is not just relevant for investors who directly invest in stocks through their brokers, but also for mutual fund investors because mutual fund manager’s usually have preference for one investment style relative to others. Knowing the fund manager’s investment style will help the investors understand the investment strategy of the fund.

From an investor’s perspective there can be different investment styles, but there are broadly three themes – active versus passive investing, large cap versus midcap investing and growth versus value investing. In this two part series, our focus is primarily on the growth versus value stock picking style. In our post, Is Value investing the right investment style for you: Part 1, we discussed the basic differences between these two investment styles.

To recap, in the growth style, investors or fund managers, invest in stocks which showed high earnings growth in the past and more importantly, can deliver high earnings growth in the near term (over the next few quarters or years). In the value style, investors or fund managers, invest in underpriced stocks, in other words, stocks trading a lower valuation compared to its fair price. In our earlier post, we discussed that over the last 10 to 15 years, the overall performances of growth and value stocks were not very different. However, growth and value stocks outperformed each other in different market conditions. In this post, we will discuss the different characteristics of value investing.

What is Value Investing?

In Value Investing style, investors or fund managers try to identify stocks which are trading at prices which are significantly below their fair price. Why would shares trade at price above or below its fair value? Share prices on a day to day basis are determined by demand and supply of shares in the market (stock exchange). As per Eugene Fama’s Efficient Market Hypothesis, the market discounts all information about companies in the share prices. If Fama’s Efficient Market Hypothesis was true then, it will not be possible for fund managers to beat the market. Yet, as many of our readers probably know, Warren Buffett, the foremost practitioner of value investing, has consistently beaten index funds for a long period of time.

In reality, the market is often not able to discount all information correctly in share prices. This may be because not all market participants have access to all the information and even when they have, they may not be able to factor them correctly in share prices. Even in a highly matured market like the US stock market, Warren Buffet believes that, “there is much inefficiency in the market”. A discussion on various factors leading to mispricing in the market is outside the scope of this post, but for our purpose, it suffices to say that some stocks can be over-valued in the market while others can be under-valued. Over a period of time, the market price of the shares will converge with the fair value in the process of price discovery by the market. Value investors and fund managers have successfully exploited gaps between price and value to get good returns. Investors may need to be patient with value because the fair (intrinsic) value price discovery process in the market may sometimes take a fairly long time depending to industry specific or company specific factors. However, historical data has shown that quality value stocks, which were bought at deep discounts to fair value, gave fantastic returns to investors.

How do fund manager identify value stocks?

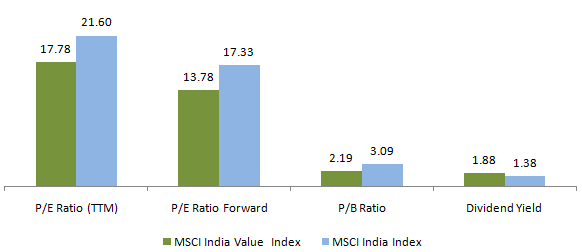

While EPS growth is the primary focus for growth investors, valuation metrics is of a lot of importance in value investing. Price Earnings Ratio (P/E) and Price to Book (P/B) Ratio are two important valuation metrics used in the value investing. Dividend Yield is another important ratio which value investors look at. Many of our regular readers know about these metrics, but we will briefly recap these ratios for the sake of all our readers.

- Price Earnings (P/E) Ratio is the ratio of the current market share price of a company to its earnings per share (EPS). Earnings per share is the Profit after Tax (PAT) less dividends paid for preferred stock divided by the total number of shares of the company outstanding. P/E Ratio can be based either on the EPS of the last 4 quarters (this P/E ratio is known as Trailing Twelve Months or TTM P/E Ratio) or on the forecasted EPS of the next 4 quarters (this P/E ratio is known as Forward P/E Ratio). In our view Forward P/E ratio is a better valuation measure. If P/E ratio is high, then a stock is perceived to be expensive, whereas if the P/E ratio is low, then the stock is perceived to be cheap. Value investors seek stocks with lower than average Price to Earnings (P/E ratio)

- Price to Book (P/B) Ratio is the ratio of the share price of a company to its book value per share. Book value of a company is the difference of the total asset of a company and its total liabilities. Please note that, in accounting terms, the book value is also known as the shareholder’s equity. Book value of the company is divided by the number of shares outstanding is the denominator in Price to Book calculation, the numerator being the share price. Stocks with low P/B ratios are perceived to be undervalued, whereas stocks with high P/B ratios are perceived to be overvalued. Value investors seek stocks with lower than average Price to Book (P/B ratio)

- Dividend Yield is the ratio of how much dividends a company paid in a financial year to its share price. Dividend yield is a measure of the cash-flows you are getting for each rupee of investment in a stock. If you ignore capital gains, dividend yield is essentially your return on investment. Is high dividend yield good? Opinions differ on this matter. Dividends have obvious advantages. Dividends are income for investors. If the share price falls and yet the company pays good dividends, then the investor has something to cheer about.

However, growth investors are not all gung ho about high dividend yields because they believe that higher dividend payout comes at the cost of growth. In other words, they think that the company does not have enough opportunities to grow the business and hence, they pay dividends instead of re-investing the profits in business growth opportunities.

Value investors, on the other hand, like high dividend yields because it shows that, the share price of the company is low relative to its earnings. High dividend yield also reduces downside risks in volatile markets. However, good value fund managers do not give too much importance to dividend yields, because dividend yield is basically an outcome of the company’s dividend policy and may not be true reflection of the fundamentals of the company; hence, value fund managers look at a host of other fundamental factors of the company.

The chart below shows that the Price to Earnings ratios (both trailing twelve months and forward) and Price to Book ratio of MSCI India Value Index (index of value stocks) is lower those of MSCI India Index (index of both growth and value stocks), while the dividend yield of MSCI India Value Index is higher than that of MSCI India Index.

Margin of Safety

Margin of safety is one of the most important concepts in value investing. Margin of Safety is the strategy to buy stocks which are trading at a significant discount to their intrinsic value or fair price. One of the biggest challenges of value investing is estimating the fair price (intrinsic value) of a stock. Fair price is usually determined by estimating future free cash-flows and discounting them. In value investing, you may not simply want to buy stocks which are trading below their fair price – you may want to buy stocks which are trading at least 10 – 30% below their fair price. This discount to the fair price is the margin of safety.

One of the most important tenets of value investing espouses the importance of preservation of capital. Margin of safety ensures that, you are buying stocks at deep discounts and this limits your downside risks even in market crashes. Margin of safety also protects the investor from mistakes. Estimating the intrinsic value of a stock is highly subjective; different analysts, brokerage houses and fund houses use different valuation models, which can produce different results. Further forecasting future earnings or cash flows is quite difficult, because a lot of assumptions go into the forecast of future cash flows or earnings. By using a margin of safety, you have a cushion if you overestimated the intrinsic value of the stock.

Using a margin of safety, you can not only limit your downside risks, but you can get extraordinary returns in the future, provided you bought fundamentally good quality stocks. Legendary investor, Warren Buffett, is known to have applied 50% discount on fair price or even more to set his target price for some shares. The financial crisis of 2008 gave him an opportunity to buy shares at such deep discounts and make extraordinary returns over the next 5 – 6 years. Buffet’s investment in Goldman Sachs shares in the wake of Lehman Brothers collapse is part of investment folklore on Wall Street. He bought Goldman shares at very deep discount and made several billion dollars of profit within a few years of his investment.

It takes a lot of skill and opportunism to identify high quality stocks trading at very deep discounts, which give investors high margin of safety. Retail investors may not be equipped with these skills and we think that, retail investors are best served by mutual funds for long term equity investments. We have discussed the concept of margin of safety in much greater details in our post, Margin of Safety: Importance in Equity Investing; we urge investors, who are interested in value investing to read that post.

How to be a successful value investor

Warren Buffett once said that, success in investing does not correlate to high IQ (intelligence). Buffett says, “What you need is the temperament to control the urges that get other people into trouble in investing.” Value investing requires a patience if you want to get the best results. Patience does not come naturally to many Indian equity investors, but it is essential in value investing - value funds may underperform for a period of time, even a few years, but if you are patient, you are likely to get rewarded handsomely.

Value investors need to have an absolute return mindset. What you ultimately want from your investment is the absolute return, which meets your investment goals. However, investors often compare how their funds are doing versus the market and relative to their peers. Relative return versus benchmark or peers is useful for comparison, but it may lead to you make reactive and often wrong investment decisions because there inevitably be periods when growth funds will outperform value funds. However, this should not lead you to switch from a value to growth fund, because you may find the growth fund under performing in the subsequent period. As a value investor, you should primarily care about, how much return your value fund has given over sufficiently long investment tenure (at least 3 to 5 years). If it meets your expectation, you should remain invested.

Conclusion

In this two part blog post series, we discussed about different investment styles, with emphasis on value investing. Depending on investment needs and attitude, you should determine if value investing is the suitable investment strategy for. Then you can work with your financial advisor to select good value funds.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY