Why you should have Multi Asset Allocation Funds in your portfolio

Why is asset allocation important?

In investing, risk and returns are correlated. You need to balance risk and returns, so that you are able to achieve your investment objectives without taking unnecessary risks. Asset allocation balances risk and returns of diversifying your investments over different asset classes e.g. equity, fixed income, gold, real estate etc. Each asset class has an important and unique role to play in your investment portfolio.

Role of different asset classes in your portfolio

- Equity: The primary investment objective for equity as an asset class is capital appreciation and wealth creation. Historical data shows that equity as an asset class has the potential to create wealth over long investment horizons. However, equity can be volatile in the short term.

- Fixed income: Fixed income or debt may generate relatively stable returns. Since fixed income as an asset class is relatively less volatile compared to equity, they are suited for a variety of investment tenures, from a few days to several years.

- Gold: From time immemorial, gold is considered to be a store of value because it is able to retain its purchasing power over time. In other words, gold is seen as a hedge against inflation.

- Other asset classes: Apart from the 3 common asset classes mentioned above, other asset classes like silver, real estate, international equities etc. can also play unique roles in diversifying your portfolio.

Investor behaviour in market cycles

Equity and gold exhibit cyclicality in their returns. Behavioural biases (e.g. greed and fear) get exposed in market cycles. For example, in bull markets, investors keep investing at higher and higher prices in the hope that prices will rise further. In bear markets, investors sell even at very low prices because they fear that price may fall further. These behavioural biases harm the financial interest of the investors. Timing the market cycles is very difficult because price behaviours of different assets are driven by a variety of factors including macro-economic data, liquidity in financial markets, risk sentiments etc. So, how do we solve this jigsaw of volatility in asset classes? A multi-asset allocation strategy can bring stability to your portfolio across investment cycles.

Multi Asset Allocation Funds

Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI regulations multi asset allocation funds must invest minimum 10% each in at least 3 asset classes. Apart from the two most popular asset classes, fixed income and equity, these schemes can invest in asset classes like gold, silver, real estate investment trusts (REIT), infrastructure investment trusts (InvIT), international equities etc. The fund manager decides the proportional allocation to each asset class based on the market conditions with the objective of balancing risks and returns.

Low correlation of asset class returns

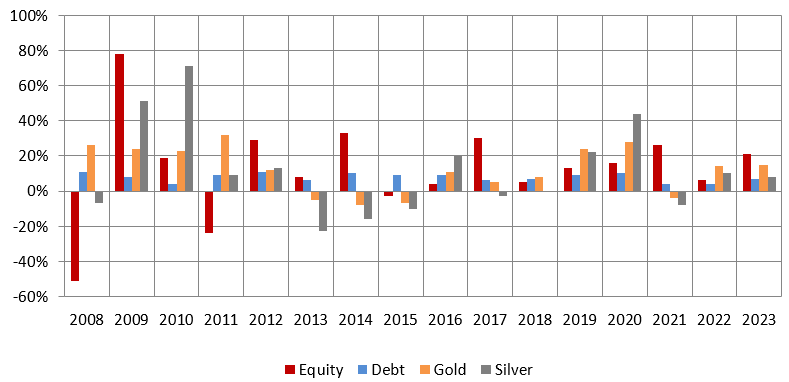

There is low correlation between returns of different asset classes in different market conditions; equity and gold are usually counter-cyclical to each other i.e. gold outperforms when equity underperforms and vice versa (see the chart below). Equity and gold have low correlation with debt. Gold and silver returns are usually correlated but silver tends to outperform gold in early stages of recovery. Multi Asset Allocation will keep you disciplined in your investments and provide you a more stable investment experience viz. if one asset class underperforms, the outperformance of another asset class will balance the risks.

Source: HSBC MF, as on 31st December 2023. Equity as an asset class is represented by Nifty 50 TRI, Debt as an asset class has been represented by Nifty Short Duration Debt Index, domestic price of gold and silver. Absolute Returns for the period of 1 Jan to 31 Dec for respective Calendar Years. Disclaimer: Past performance may or may not be sustained in the future.

Why invest in multi asset allocation?

- Diversification across asset classes will reduce portfolio volatility due to low correlation of asset class returns across investment cycles.

- You do not have to guess which asset class will do well in the near term since your investments will be spread across multiple asset classes.

- As an investor, you will be less susceptible to behavioural biases and stay disciplined in your investments.

- Multi asset allocation funds have the potential to optimize returns at a given level of risk to ensure that investment experience is better.

- You may get the benefit of rebalancing in multi asset allocation funds

Is this a good time to invest in multi asset allocation funds?

- Equities have rallied in anticipation of lower interest rates in coming quarters. Equities may rally further when interest rates actually come down.

- The rally in equities may have made valuations expensive in certain pockets of the markets.

- Gold may continue to gain strength when interest rates come down. Traditionally, there has been an inverse relationship between gold prices and interest rates.

- Bond yields have eased and bond prices will go up when central banks will start cutting interest rates.

- In these market conditions a multi asset strategy can be suitable for long term investors.

Who should invest in multi asset allocation funds?

- Investors looking for capital appreciation over long investment horizons.

- Investors who want to reduce portfolio volatility by diversifying across multiple asset classes.

- Investors with minimum 3 – 5 years investment tenure.

- Investors with very high risk appetite

- Investors can invest either in lumpsum or SIP based on their investment needs

Investors should consult their financial advisors or mutual fund distributors if multi asset allocation funds are suitable for their investment needs.

Note: Views provided above based on information available in public domain at this moment and subject to change. Investors should not consider the same as investment advice. Past performance may or may not be sustained in future and is not a guarantee of any future returns.

An Investor Education & Awareness Initiative by HSBC Mutual Fund.

Visit https://www.assetmanagement.hsbc.co.in/en/mutual-funds/investor-resources/information-library/know-your-customer w.r.t. one-time Know Your Customer (KYC) process, complaints redressal process including SEBI SCORES (https://www.scores.gov.in). Investors should only deal with Registered Mutual Funds, to be verified on SEBI website under Intermediaries/Market Infrastructure Institutions (https://www.sebi.gov.in/intermediaries.html). Investors may refer to the section on Investor Education on the website of HSBC Mutual Fund for the details on all Investor Education and Awareness Initiatives undertaken by HSBC Mutual Fund.

Issued as an investor education initiative by HSBC Mutual Fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

CL 1124

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY