SIPs for children's education

Careers of children are one of the most important priorities of most parents. In this competitive age high quality higher education is a very necessary. Parents want their children to go to the best college or university, but given our demographic structure and availability of seats, competition is intense. You must start planning for your child’s higher education when your child is young. With proper guidance, financial planning is essential if you want to provide the best education for your child.

Why is financial planning important for higher education?

- Cost of higher education in India has sky-rocketed. The fees in schools and the higher education courses have fees which practically go through the roof. As parents you should definitely aspire the best for your children’s education and wouldn’t want this goal to be compromised in any way.

- With rising affluence more parents want their children to study in foreign universities. Undergraduate and / or graduate courses in top foreign universities are several times more expensive than in India. Hence as parents you will have to save much more if you want to send your child to a foreign university.

- While you are saving for your child’s higher education, you will also have to spend on his / her school education and extra-curricular activities. It is recommended that you start saving and investing for your child’s higher education from the time your child starts going to school, so that you have 12+ years for your investments to bear fruits.

You may also like to read financial planning in the new financial year

Why is early start so important?

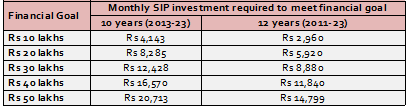

The biggest advantage of early start is the benefit of compounding over longer investment tenures. Compounding is interest on interest. The longer your investment tenure more is the power of compounding. Let us assume you needed Rs 50 lakhs for your child’s higher education in 2023. The chart below shows how much monthly savings you would have had to make for different investment tenures. You can see that an early start is greatly advantageous in achieving your financial goal.

Source: Advisorkhoj, AMFI, Mean CAGR returns considered for illustration is 12.64% by taking mean of 10-year rolling returns between 1 June 2013 and 30 May 2023 of Sensex. SIP investments on first day of every month for the stated periods have been considered for this illustration. SIP Return are calculated on CAGR basis. The above illustration is provided as per AMFI Best Practice Guidelines Circular No. 109 dated November 1, 2023 and as amended from time to time to define the concept of power of compounding. Past performance may or may not be sustained in future and is not a guarantee of any future returns. The investors should not consider the same as investment advice. Please note the illustration above is purely for investor education purposes and should not be taken as financial or investment planning recommendations. Consult with your financial advisor before investing.

Invest in the right assets

While an early start is important, you need to invest in the right assets to generate long term returns. Different asset classes have different risk / return profiles. You can see that you can achieve your financial goals with relatively less savings if you get higher returns on your investment. For long term financial goals, equity may be a suitable asset class i.e. equity funds can potentially generate returns over long run e.g. fixed income over long investment tenures. However, you should know that equity as an asset class is volatile. If you do not have long investment tenures, you should opt for relatively less volatile assets like debt funds depending on your investment horizon.

Suggested read why you should have multi asset allocation funds in your portfolio

How to save for your child’s higher education?

Systematic Investment Plans (SIPs) is one of the most suitable ways of saving for your child’s higher education by investing regularly from your regular monthly savings. Through SIPs you can start investing for your child’s higher education with relatively small amounts every month. If you start early, you will give yourself a long runway and benefit from the power of compounding. As your income increases over time, you can also increase your SIP amounts to generate a bigger corpus for your child’s higher education goal.

Have a separate SIP account for your child’s education

Do not invest your savings for your child’s education in a general-purpose fund. Investors tend to draw from general purpose funds for short term requirements e.g. making a big-ticket purchase like down payment for a vehicle, home improvements etc.

Have a separate fund (e.g. separate SIP account) for your child’s education# so that you do not compromise their aspirations for other priorities. You can even do a SIP in your minor child’s name. If you want to make mutual funds in your child’s name, your child will be sole owner of the portfolio, but you can operate it on his / her behalf till your child is a minor. The SIP debits can originate from your (guardian’s) bank account or the child’s bank account.

Related read: Importance of discipline in savings and investments

After your child goes to college / university

Your child’s higher education can continue for 5 years or longer, if he / she is pursuing post graduate degrees, professional qualifications etc. Do not liquidate / redeem all your investments in your child’s higher education fund when your child starts going to college / university. You can use Systematic Withdrawal Plan (SWP) to pay for your children’s tuition fees and other associated expenses like board, food, library, books, broadband, mobile, online courses etc. With SWP, you draw a fixed amount every month or any other interval, while the rest of your investment can continue to earn returns.

You may also like to read back to school: Plan for Children’s education with mutual funds

Conclusion

Children’s future is the most important priority of any parent. By starting a SIP in your child’s name or having a SIP account specifically for the purpose of your child’s higher education goal, you can strengthen your commitment towards the bright future of your child. You should always invest according to your risk appetite and investment horizon. Consult with your financial advisor if you need help in planning for your child’s higher education.

Note - #In case of Minor investor, the bank account details for investment shall be accepted from the bank account of the minor, parent or legal guardian of the minor, or from a joint account of the minor with parent or legal guardian. Please note that the Redemption proceeds shall be credited only to the bank account held in the name of minor investor.

Disclaimer:

This document has been prepared by HSBC Asset Management (India) Private Limited for information purposes only and should not be construed as i) an offer or recommendation to buy or sell securities referred to herein or any of the funds of HSBC Mutual Fund; or ii) an investment research or investment advice. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment or investment strategies that may have been discussed or referred herein and should understand that the views regarding future prospects may or may not be realized. This document is intended only for those who access it from within India and approved for distribution in Indian jurisdiction only. Distribution of this document to anyone (including investors, prospective investors or distributors) who are located outside India or foreign nationals residing in India, is strictly prohibited.

An Investor Education & Awareness Initiative by HSBC Mutual Fund.

Visithttps://www.assetmanagement.hsbc.co.in/en/mutual-funds/investor-resources/information-library/know-your-customer w.r.t. one-time Know Your Customer (KYC) process, complaints redressal process including SEBI SCORES (https://www.scores.gov.in). Investors should only deal with Registered Mutual Funds, to be verified on SEBI website under Intermediaries/Market Infrastructure Institutions (https://www.sebi.gov.in/intermediaries.html). Investors may refer to the section on Investor Education on the website of HSBC Mutual Fund for the details on all Investor Education and Awareness Initiatives undertaken by HSBC Mutual Fund.

Document intended for distribution in Indian jurisdiction only and not for outside India or to NRIs. HSBC MF will not be liable for any breach if accessed by anyone outside India. For more details, Click here / refer website.

Issued as an investor education initiative by HSBC Mutual Fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

CL 1240

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY