What should you do when market is at all time high?

Market is at all time high

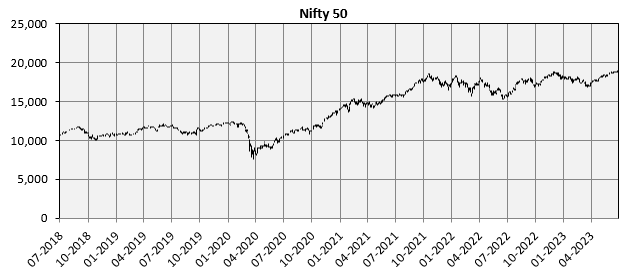

After a long period of volatility starting from October 2021, the Nifty 50 index has been in a strong bull market and is now at its all time high (as on 30th June 2023, see chart below). Some investors may be tempted to book profits at these levels by redeeming their investments, but market level based profit booking is not the right approach for long term investors.

Source: National Stock Exchange, as on 30th June 2023.

Disclaimer: Past performance may or may not sustained in the future

Why you should not redeem when market is high?

Equity as an asset class is volatile; it will have ups and downs. We have seen in the past that the market has fallen from the highs, but it is very difficult to determine beforehand whether the fall is a retracement i.e. minor pullback from high level or a deep correction (bear market). Furthermore, historical data shows that whether the pullback is short term or bear market, the market always recovers and makes new highs. Therefore, in the interest of long term investors it is advisable to remain invested.

Suggested reading should you book short term profits on yoru SIPs

Records are meant to be broken

For cricket lovers, one record of test cricket was considered sacred for several decades – the record of Don Bradman’s 29 test centuries. The record stood for more than 30 years and for many years cricket lovers thought that this record will never be broken. In 1983, Sunil Gavaskar broke Bradman’s record and became the new record holder. Gavaskar’s record of 34 test centuries stood for nearly 20 years till Sachin Tendulkar broke it in 2005. Can Tendulkar’s record of 51 test centuries be broken? It is an enormous task but as history shows, records are meant to be broken.

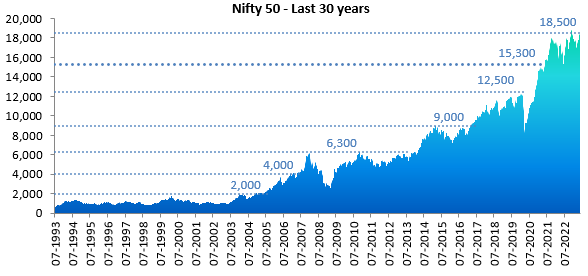

Market has always made new highs previous levels

Like the test match records, the stock market has kept beating previous records despite ups and downs. The chart below shows the growth of Nifty 50 Index over the last 30 years (ending 30th June 2023). The dotted lines shows the major levels (highs) of the market over the last 20 years from which we saw trend reversals. The market may have corrected from the highs (as shown in the chart below), but it has always gone on to make new highs. This chart shows why you need to remain invested over long investment horizons to create wealth.

Source: National Stock Exchange, as on 30th June 2023.

Disclaimer: Past performance may or may not sustained in the future.

What should investors do when market is at all time high?

- Invest according to your financial goals and plan. You should remain disciplined in your investment.

- You should focus on asset allocation. In high market, the asset allocation gets skewed towards equity. You should rebalance your asset allocation by investing in fixed income.

- You should continue your Systematic Investment Plan (SIP). Investing through SIP makes market timing irrelevant because you will invest at all levels and benefit from Rupee Cost Averaging. You may also like to read what is financial independence and how SIPs can help?

- You can take advantage of market corrections / pullback by tactically investing in lump sum. You should always have long investment horizon (minimum 5 years) for equity funds.

- You should always invest according to your risk appetite. You should consult with your mutual fund distributor or financial advisor if you need help in understanding your risk appetite and risk profile of your mutual fund scheme.

An Investor Education & Awareness Initiative

Investors should deal only with Registered Mutual Funds, to be verified on SEBI website under Intermediaries/Market Infrastructure Institutions. Refer to www.assetmanagement.hsbc.co.in for details on completing a one-time KYC (Know Your Customer) process, change of details like address, phone number and change of bank details etc. For complaints redressal, either visit www.assetmanagement.hsbc.co.in or SEBI’s website www.scores.gov.in. Investors may refer to the section on ‘Investor Education’ on the website of Mutual Fund for the details on all ‘Investor Education’ on the website of Mutual Fund for the details on all ‘Investor Education and Awareness Initiatives’ undertaken by the AMC.

Issued as an investor education initiative by HSBC Mutual Fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

CL 424

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY