Back to school: Plan for children's education with mutual funds

In a few weeks, schools will reopen after summer vacation. The focus will be back on academics and school activities. Child’s education is one of the most important life-stage goals of parents, since good higher education is an important factor in career success of your child. Many parents will be willing to sacrifice some luxuries in life to give the best possible education to their children. Lack of proper planning can leave you short of achieving your / your children’s education goals. In this article, we will discuss how you should save and invest for your child’s higher education.

Why do you need to start education planning when your child is young?

- In recent years, more and more students are aspiring for post graduate education, professional education (e.g. engineering, medical, MBA etc), and specialized courses / programs which provide better career prospects to our children. Cost of higher education in India has sky-rocketed over the years. For example, current cost of MBBS education currently in private universities / deemed universities is Rs 40 – 50 lakhs as per conservative estimates.

- Cost of higher education e.g. MBBS, B-Tech/Engineering, and MBA etc is expected to rise by 10% every year over the next 10 years or so (source: ET Online Survey, August 2022). If the current cost of the higher education, you aspire for your child is Rs 20 lakhs, in 10 years the cost will be more than Rs 50 lakhs (assuming 10% inflation).

- With rising prosperity in our country, many parents want to send their children to foreign university for graduate or post graduate level education. If you are planning high quality foreign education for your child, then the cost will be several times higher than that of in India.

- Many financial planners recommend that you start saving and investing for your child’s higher education from the time your child starts going to kindergarten or primary school, so that you have 12 – 15 years for your investments to generate sufficient returns for your child’s higher education goals.

How to plan for your child’s education?

- Define your goal: You need to estimate how much your child’s higher education will cost, factoring in inflation. The cost will depend on the career aspirations of your child e.g. engineering, medical, MBA, foreign education etc. You should consult with a certified financial planner or financial advisor if you need help in quantifying your financial goal.

- Have an investment plan: Your investment plan will tell you, how much you need to save and invest every month in order to achieve your child’s higher education. You should take the help of a certified financial planner or financial advisor if required.

- Start early, when your child is young: By starting early, you give yourself sufficient time to accumulate the corpus through the power of compounding over long investment tenure.

- Saving is not enough, you need to invest: To accumulate a sufficiently large corpus for your child’s education, you need to invest your savings in the right asset class in order to get the returns needed to achieve your child’s education plan goals. You should consider investing in mutual fund schemes of suitable risk / return profiles.

- Mutual fund SIP for your child’s education: Through mutual fund Systematic Investment Plan (SIP), you can start investing from your monthly savings when your child is young and leverage the power of compounding over long investment horizons.

- Have a separate fund for child’s education: Do not invest your savings for your child’s education in a general purpose fund, where you are saving / investing for other financial goals also. Have a separate fund (e.g. separate SIP account) for your child’s education, so that you do not compromise their aspirations for other priorities. You should consult with your financial advisor, if you need help in planning for your children’s education.

Where to invest for your child’s higher education?

Mutual funds provide investment solutions for different life-stage goals. Since education planning is a long term goal, equity or equity oriented mutual funds should be suitable investment options. Different equity or equity oriented funds have different risk profiles. You should invest according to your risk appetite and investment needs.

Your child is 10 years or younger

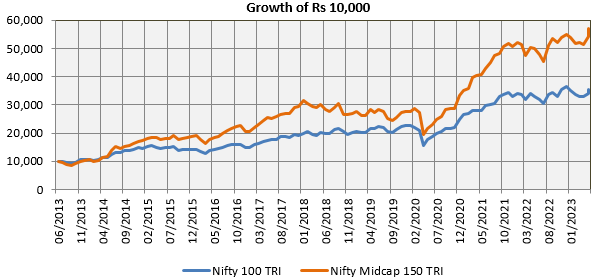

You have 8+ years to save and invest for your child’s higher education. You can invest in fund categories which have the potential of giving higher returns, even though they may be more volatile in the short term. Midcaps and small caps have higher growth potential than large caps even though they may be more volatile (see the chart below). If you are investing through SIPs, you can take advantage of asset volatility through Rupee Cost Averaging. Along with small / midcap funds, you must also have allocations to Large / Multicaps, to ensure diversification and stability. Your asset allocation will depend on your risk appetite. As you get nearer to your child’s higher education goal, you should rebalance your asset allocation to reduce risk.

Source: National Stock Exchange, Advisorkhoj Research. Period: 01.06.2013 to 31.05.2023. Disclaimer: Past performance may or may not be sustained in the future.

Your child is 11 – 13 years

You have 5 to 7 years to save and invest for your child’s higher education. This is also fairly long investment tenure and equity will be the suitable asset class. However, since your child’s financial goal is nearer, you can invest in relatively less volatile funds. Large cap and flexicap funds can be suitable investment options for higher education planning of your child at this age. Along with Large and Flexicaps, you can have allocation to midcaps to boost returns (depending on your risk appetite). As mentioned before, you should keep rebalancing your asset allocation as you get closer to your child’s financial goal.

Your child is 13 years plus

Now you have about 5 years or less for your child’s higher education goal. As investment tenure gets shorter, downside risk protection and income becomes more important. At the same time, you also need capital appreciation. Hybrid funds, especially Dynamic Asset Allocation Funds or Balanced Advantage Funds, may be suitable investment options for the higher education children of this age. Balanced advantage funds manage the asset allocation dynamically depending on market conditions. They reduce portfolio downside risks and provide stability.

After your child starts higher education

Once your child starts college / university education, you can use Systematic Withdrawal Plan (SWP) to pay for your children’s tuition fees and other associated expenses like boarding (hostel), food, library, books, broadband, mobile, online courses etc. With SWP, you draw a fixed amount every month or any other interval, while the rest of your investment continues to earn returns. SWP in equity oriented funds is also much more tax efficient compared to traditional fixed income investments.

If your child is pursuing professional degrees e.g. medical, engineering etc which will continue for at least 4 years or longer or your child wants to go for post graduate education e.g. MBA, M-Tech, MD etc, then you can continue to invest in equity or equity oriented mutual funds even after your child starts going to college / university. Over 5 years plus investment horizons, equity or equity oriented mutual funds have the potential of generating higher returns compared to traditional fixed income investments.

You should invest according to your risk appetite and consult with your financial advisor if you need any help in investment planning.

Issued as an investor education initiative by HSBC Mutual Fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY