What are the Best Tax Saving Investments: Fixed Income Part 1

We often come across blogs comparing Public Provident Fund (PPF) with ELSS. When comparing these two asset types, one should remember that their risk return characteristics are fundamentally different and therefore, it is unfair to compare the returns of PPF (risk free) and ELSS (subject to market risks). However, many a time investors have the same goal in mind when investing in these two asset types. Therefore, it is important for investors to understand the differences between the two, so that they can form expectations and plan accordingly.

PPF is the best tax saving investment option for the risk-averse investor

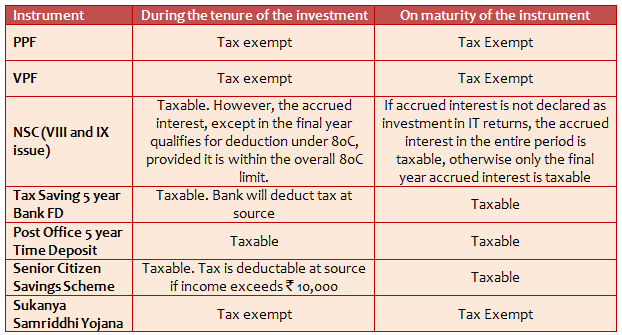

PPF is one of the best tax saving investments under Section 80C of Income Tax Act 1961 for risk-averse investors. PPF offers the triple benefits of tax saving, risk free returns and tax free returns. As per the tax changes announced by the Finance Minister in his 2014 Budget, investors can deposit up to र 1.5 Lakhs per annum in their PPF account. In the 2016 Budget, the PPF interest rate for FY 2017 was revised to 8.1%. From October 1, 2016 PPF interest rate has been revised to 8.0%. PPF is one of the most tax friendly investments under Section 80C (please see table below).

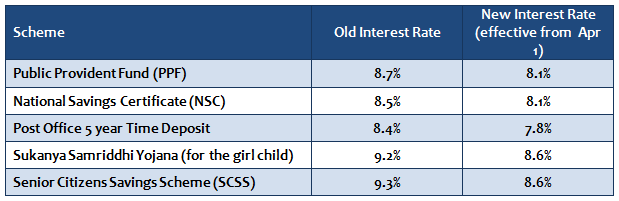

Change in interest rates of Government Small Savings Schemes in 2016

In the month of February, the Government announced new small savings scheme rules, which has come into effect from April 1, 2016. Under the new rules, investors in small savings schemes like Public Provident Fund, National Savings Certificates, Senior Citizens Savings Scheme, Post Office Monthly Income Scheme, etc will earn considerably lower income than before.

While the lower interest rates have certainly hurt the income of investors in these schemes, this is not the only change in small savings schemes. Earlier, the interest rates were set for one year.

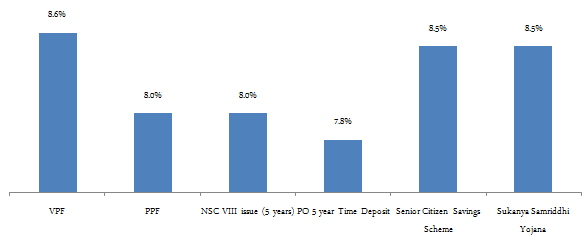

Under the new rules, the interest rates will be revised every quarter, based on the previous 3 month yields of the benchmark Government Bonds with a small mark up. Under the new rules, even the quantum of mark up has been reduced. So if Government Bond yields fall by 20 basis points in the first quarter of this year, the interest rates of small savings schemes can go down further by 0.2% in the next quarter. This is an important point that you should remember for your financial planning. The chart below shows the current interest rates of small savings schemes.

Source: India Post

Specific demographic profiles are eligible to invest in Senior Citizen Savings Scheme and Sukanya Samriddhi Yojana. If you are a senior citizen or if you have a girl child below the age of 10, then these two schemes offer more attractive interest rates compared to other small savings schemes eligible under Section 80C. For other investors, VPF (assuming you have a EPF account with your employer) offers the highest interest rate (please see chart above). However, you have to wait till retirement to get money from your EPF account (under certain exceptional circumstances, you can apply for loans from your EPF account). For lesser investment tenures, PPF (15 years term) offers the best post tax returns.

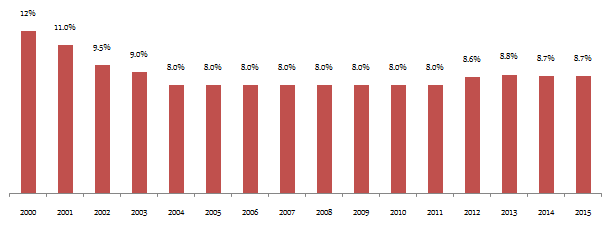

PPF interest rate is not fixed

Though we have touched upon this point before, we should reiterate that, PPF interest rate is not fixed throughout the investment tenure. The PPF interest rates are set to the benchmark Government Bond yield with a small mark-up. This is not something that, this Finance Minister has introduced; it has always been benchmarked to Government Bond yield. The chart below shows the PPF interest rates since FY 2000.

What this Government has done is that, it has revised the interest rate reset period; earlier the rates were set for one year, but now the rates will be reset every quarter. The Government has said that, this has been done to bring some parity between Government small saving schemes and fixed income products offered by banks and other institutions.

Investors should understand that, the collections in the small savings schemes are invested in Government bonds of different maturities. While the yields of the Government bonds are market driven, the interest rates of small savings schemes were set for a year and sometimes remained unchanged for years together. The quarterly reset of interest rates of these small savings is a measure to bring about a greater alignment between market yields and small savings interest rates.

PPF Interest Rate outlook

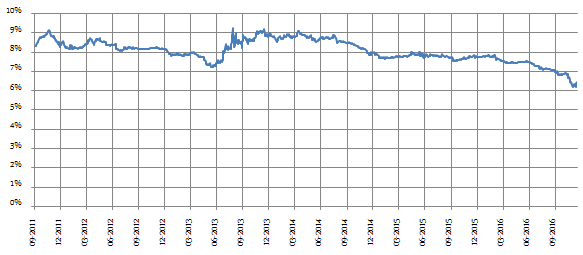

In our blog, we do not make forward looking statements like predicting future market levels or interest rates. Our endeavour is to educate the investors about market and economics so that, they can make their own decisions. As discussed earlier, the PPF interest rate has been benchmarked to the reference bond yield. The future interest rates of your PPF deposits will depend on the trajectory of Government bond yields. The future bond yields will depend on rate actions by the Reserve Bank of India and the macro-economic variables. The chart below shows the trajectory of 10 year bond yield over the last 5 years or so.

Source: Investing.com

You can see that, the 10 year bond yield is on a declining trajectory from 2014 onwards. It is now at a 5 year low. This chart can help you understand why, the PPF interest rate was reduced (from 8.7%) to 8.1% in April and further reduced to 8% in October. Purely by applying macroeconomic logic, interest rates can be expected to decline even further due to two reasons; lowering of core inflation and improving fiscal deficit. These two factors were, in fact, responsible for reduction in yields over the past year or so, and should continue in the future.

Further, the Government has said that, the demonetization scheme, announced last month, will improve the liquidity in the banking system and therefore, will have a benign effect on interest rates. We will have to see how the effects of demonetization play out in our monetary system. But the RBI will be watching two developments very closely; US interest rates and crude prices. Rise in US treasury yields will make Indian bonds less attractive to global investors and increase in crude prices will have an impact on our inflation; these two factors will have a negative impact on interest rates. Economic variables change over time and investors who understand / anticipate these changes can make good investment decisions.

Equity Linked Savings Scheme (ELSS)

While falling interest rates negatively impact investors in small savings schemes, it usually has a positive impact on capital markets. In a scenario of falling interest rates, market linked investments become more attractive investment option for investors. As an asset class, historical data shows that, equity, though more volatile, outperforms other asset classes over a long investment horizon. Equity Linked Savings Scheme, a market linked investment, also qualifies for tax savings under Section 80C of Income Tax Act (up to a limit of र 1.5 Lakhs per annum).

An ELSS is a diversified equity scheme with a lock in period of three years from the date of investment. If you investment in an ELSS through a systematic investment plan (SIP), each investment will be locked in for 3 years from their respective investment dates. Like PPF, ELSS is also one of the most tax friendly investment options; in tax parlance, it falls in the exempt – exempt – exempt category. In other words, ELSS investment qualifies for tax savings under Section 80C, there is no tax on the income from ELSS during the investment tenure and there is no capital gains tax on ELSS at the time of redemption. Over the past 10 years, average annualized ELSS funds category returns have been around 10% (please see Mutual Fund Category Monitor in our MF Research Section). Compared to 10% annualized returns from ELSS (top performing funds have given higher returns), PPF interest rate has been between 8 to 8.7% in the last 10 years. ELSS funds are market linked investments and therefore, they are subject to market risks. As such, ELSS investors need to have appetite to stomach short term volatility.

Conclusion

We have discussed a number of times in our blog that, short term volatility is inconsequential for long term investors. Over a long investment horizon, wealth creation is usually the investment goal. Finance theory teaches us that, risk and return are correlated. Therefore, for long term wealth creation, investors need to take some risks. In the next part of this post, we will compare and contrast wealth creation by PPF versus ELSS over a long investment horizon. Stay tuned for more.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY