What makes Arbitrage Funds safe and tax efficient

Arbitrage Funds are one of the least understood types of funds and people who understand it, are the ones who make the most of it. If you are looking for Debt Investments with Equity Taxation Benefit, or 6-9% returns without any equity exposure and yet reap the benefits of Equity Investment, then Arbitrage Funds is the answer to your needs! Didn’t understand, well, let me explain.

What is arbitrage advantage

If you take the advantage of the price difference in 2 markets at the same time, it is called Arbitraging and Arbitrage Funds does exactly the same thing.

Gold jewellery is available in Dubai at 42.13 USD for 24 Karat and the same is priced in India at 47.81 USD. If someone buys at a cheaper rate in Dubai and sells in India, then the price difference can create arbitrage advantage for him.

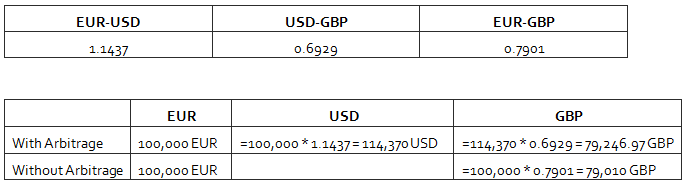

Another example, in the forex market.

Let us take an example of EUR-USD is being sold at 1.1437 and EUR-GBP is priced 0.7901 and that of USD-GBP is marked at 0.6929. A forex trader sells 100,000 Euros to purchase 114,370 USD and 114,370 USD to get 79,246.97 GBP. However, if he had converted EUR-GBP at the going rate of 0.7901, then he would have got only 79,010 GBP.

Thus he stands to gain 236.97 GBP in this arbitrage transaction.

How arbitrage funds work

Arbitrage Mutual Funds simply take the advantage of the price difference of Equity buying and selling in the derivative space. Thus, they buy 65% of Equity to get the Equity Taxation Benefit and in order to reduce risk of the fund, sell that 65% of Equity in the derivative market and thereby almost nullifying the equity exposure. The fund makes gain in the price difference of the two markets at the same time but the fund managers need to be extremely prompt to reap the benefits because prices get adjusted almost immediately in this highly competitive market.

For example, they buy a stock for Rs 100 from NSE cash market and then sell the futures of the same stock the NSE F&O market for Rs 103.25. At the time of expiry of futures contract (which takes place on the last Thursday of a month), the cash price and the futures price will converge. Therefore, the difference in price Rs 3.25 at the time of initiating this trade can be locked in as risk free profit by the fund manager. At expiry of the futures contract, the fund manager will sell the stock and buy the futures contract. Therefore, irrespective of whether the price of the stock moves up or down after initiating the trade, the difference in price of Rs 3.25 at the time of initiating this trade, can be locked in as risk free profit by the fund manager. Readers should note that, we have given a simplistic example, to explain the concept of Arbitrage. In a practical situation the fund house has to incur transaction costs for each leg of the transactions. For example, when the fund manager buys the stock, he or she has to pay brokerage, securities transaction tax and service tax. Same costs apply to the futures contract. The fund manager has to incur these costs again in the other legs of the transactions (i.e. at the time of expiry). The actual arbitrage profit is net off the transaction costs.

However, before I can explain what Arbitrage Funds are and how they work, I need to talk about Equity and Debt and how the Tax Advantage affects the two.

Equity Taxation advantage of arbitrage funds

Any mutual fund with more than 65% exposure in equity at all points of time enjoys the benefit of Equity Taxation.

What is Equity Taxation?

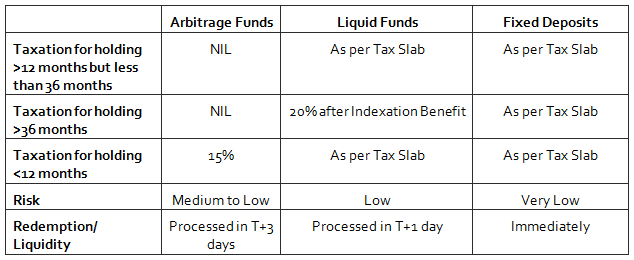

The difference in Selling Price and Buying Price of a unit of Mutual Fund is called Capital Gains. Now, if you hold any equity mutual fund for a period of more than 12 months, i.e. 365 days, the profit that you would make will be considered as Long Term Capital Gains and there is no taxation applicable on the gains. Thus Long Term Capital Gains Taxation for Equity Oriented Mutual Funds is NIL

If you sell the units of an Equity Mutual Fund within a period of 12 months, it becomes Short Term Capital Gains and that is taxed at 15%.

Equity mutual funds are more beneficial than debt mutual funds both in terms of short term and long term capital gains tax, especially for investors in the higher tax brackets.

Let us talk about short term capital gains first (mutual fund investments held for a period of less than 12 months). Profit made by selling units of debt mutual funds, including liquid funds, held for a period of less than 12 months, are taxed per the income tax rate of the investor. Whereas, as discussed earlier, profits made by selling units of equity mutual funds, including arbitrage funds, held for a period of less than 12 months, are taxed at 15%. Therefore, arbitrage fund returns held for a period of less than 12 months, are more tax efficient than liquid or other debt fund returns, for investors in the 20% and 30% tax brackets. Investors who want to invest in arbitrage funds can reduce their tax obligation even further by investing in dividend or dividend re-investment options because equity fund dividends are tax free (we will discuss dividend taxation in mutual funds in more details).

Profit made by selling units of debt mutual funds, including liquid funds, held for a period of more than 12 months but less than 36 months continue to be taxed as per the income tax rate of the investor, whereas arbitrage fund profits, for investments held for a period of more than 12 months, are completely tax free. So for an investment period of more than 12 months, arbitrage funds are more tax efficient for all investors.

Equity fund dividends are totally tax free. Debt fund dividends are tax free in the hands of the investor, but the fund house has to pay dividend distribution tax, roughly around 28%, before paying dividends to investors. Therefore, for investors who want dividends, arbitrage funds are much more tax efficient than liquid and other debt funds.

Features of arbitrage funds

Arbitrage funds have:

- Equity Taxation Benefit, i.e. the returns are tax free after a year

- Return can be compared to that of Liquid or Debt Funds

- Risk is almost zero like Liquid Funds, but very short term (1 to 3 months) volatility might be higher in Arbitrage Funds

- Dividends are tax free because it is considered an Equity Fund. There is no Dividend Distribution Tax applicable in Arbitrage Funds like in Liquid or Debt Funds.

So the risk as well as return can be very well be compared to that of Liquid Funds but the Return is tax free after a years’ time and the dividends are tax free in the interim period for regular cash flow in the account. This is the most important benefit of Arbitrage Funds and have gained quite popularity since Debt Taxation has been increased to 3 years from Financial year 2014-2015 with retrospective effect.

Returns of arbitrage funds

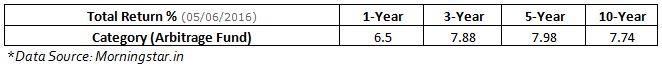

Most fund manager’s expertise in each fund category is to generate an alpha over the fund category return. For Arbitrage Fund, the Fund Category Returns historically is:

Thus, Arbitrage Funds have historically given 7-8% return over 5 to 10 years and top performing Arbitrage Funds have done better by about 1%. Thus returns of top performing arbitrage funds have mostly varied from 8-9%.

However, mutual fund investors should note that, past performance does not assure future performance.

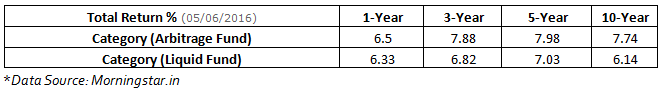

Arbitrage funds versus liquid funds

Since arbitrage funds are being compared to liquid funds in terms of both risk as well as return, let us compare the difference in returns in the category of these two types of funds, of course Arbitrage category of funds outperform the same.

Risk factors of arbitrage funds

Arbitrage Risk:

There is an amount of risk factor in Arbitrage Funds as well. It is the risk of spotting the rightful arbitrage opportunity in the market and acting upon it before the thought is over, i.e. super quickly. This is because the price difference will no longer exist when people realize the difference in the prices! So the arbitrage opportunity will then cease to exist. Thus, the opportunity needs to be identified and actioned upon even before the opportunity actually arrives!

Liquidity Risk:

An arbitrage fund, unlike a Liquid Fund takes 3 days to be redeemed and your account to be funded whereas a Liquid Fund gets credited into your account in1 day time. An arbitrage fund, being classified as Equity due to taxation advantage, has a redemption TAT of T+3 days, thereby losing float for 2 interim days. However, a Liquid Fund gets credited into the account on redemption in T+1 day.

Exit Load Risk:

Some, almost all, arbitrage funds have an exit load of 60-90 days unlike that of liquid funds. Thus, any money, which is definitely there for a period of 3 months to a year’s time can be invested in this fund over liquid funds.

Arbitrage funds versus fixed deposits

Fixed deposits are often compared with that of Arbitrage Funds in terms of Risk and Return only. However, they get beaten hands down as far as taxation advantage is considered.

Conclusion

Arbitrage Funds are not very difficult to comprehend but the calculations of how it works may be complex. However, conceptually it isn’t very difficult. If you have surplus funds which you might not require for a period of more than 3 months to a year, you may consider parking them in Arbitrage Funds. Arbitrage fund returns, like liquid fund returns are likely to be much higher than your savings bank interest rate. The additional benefits of arbitrage funds over liquid funds are in terms of tax advantages, as discussed earlier in the article.

Liquid funds definitely score over arbitrage funds, as far as short term liquidity and volatility is concerned. However, Arbitrage funds are more tax efficient than liquid funds. Investors should note that, arbitrage fund returns are correlated with the volatility in the equity market. On the other hand, liquid funds returns depend on the money market yields, which are more stable than equity market volatility. When the equity market volatility is high and money market yields are lower, arbitrage funds can give better returns than liquid funds.

On the other hand, if the equity market volatility is low and money market yields are higher, liquid funds can give better returns than arbitrage funds. Historically, we have seen that, both these categories of fund have given similar average returns, but there were periods of time, depending on equity and money market conditions, where one category of funds outperformed the other. However, the tax advantage of Arbitrage funds is a big benefit, which is difficult to ignore, especially for investors in the higher tax brackets. So, either ways both funds have their pros and cons; hence choosing the same depends on your financial situation and needs!

RECOMMENDED READS

- SWP from Debt Mutual Funds give the most tax efficient income over fixed deposits

- Combination of Home Loan EMI and Mutual Fund SIP can save you lot of money

- Systematic Withdrawal Plans from Debt Mutual Funds give the most tax efficient income

- How to select the right debt mutual funds for your portfolio: Part 1

- How to select the right debt mutual funds for your portfolio: Part 3

LATEST ARTICLES

- Different types of diversified equity mutual funds: Schemes from Principal MF stable

- Principal Equity Savings Fund: For investors who look for regular income and capital appreciation

- Regular Withdrawal Plan: A smart and convenient way of getting regular income

- Mutual Fund ELSS schemes: best way to save tax and create wealth

- What are Balanced Mutual Funds

We understand what you're working for

We are committed towards helping individuals, businesses & institutional clients achieve financial security & success.

Quick Links

Product Brochures

More About Principal MF

POST A QUERY