Top 6 long term income funds in 2015

In the previous article of our debt fund series this month, we had reviewed the top 5 short term debt mutual funds. As the name suggests short term debt or income funds are good low risk investment options for one or two years. In this blog, we will discuss another variety of debt funds, long term income funds. As the name suggests, investors should have a long term investment horizon, at least 3 years, when investing in long term income funds. But over a sufficiently long investment these funds can give excellent returns to investors with conservative risk profile, provided they have some appetite for volatility in the interim period.

Before we discuss, the top long term income funds in 2015, it will be useful to re-cap two useful concepts related to fixed income investments. Debt funds invest in fixed income securities, they employ two different kinds of investment strategy:-

Hold till Maturity:

This is also known as accrual strategy, by which the fund invests in certain types of fixed income securities (or bonds) and hold them till maturity of the bond, earning the interest offered by the bond over the maturity period. Interest rate risk in accrual strategy is quite low.Duration Calls:

Using this strategy the fund manager, takes a view on the trajectory of interest rates. Bond prices go up when interest rate falls and declines when interest rate goes up. When interest increases duration call strategy will give a lower return, and when they decrease the same strategy will give higher returns. This strategy involves interest rate risk.

While short term debt funds employ an accrual strategy, long term income funds employ a combination of both accrual strategy and also duration calls. Long term income funds invest in a variety of fixed income securities such as bonds, debentures and government securities, across different maturity profiles. For example they can invest in 2 to 3 year corporate non convertible debentures and at the same time invest in a 20 year Government bond. Their investment strategy is a mix of both hold to maturity (accrual income) and duration calls. This enables them to earn good returns in different interest rate scenarios. However, the average maturities of securities in the portfolio of income funds are in the range of 7 to 20 years. Therefore, these funds are also highly sensitive to interest rate movements. However, the interest rate sensitivity of income funds is less than gilt funds. If interest rate falls by 1%, income funds can give 12 – 14% returns. On the other hand, if interest rate goes up the returns will be much lower.

Top 6 Long Term Income Funds

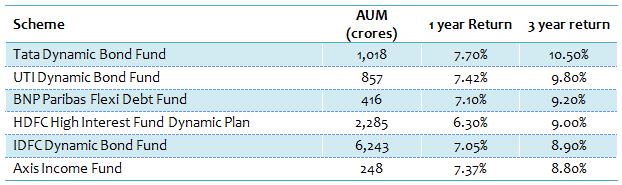

Our selection of long term income funds is based on the most recent CRISIL ranking. CRISIL ranks long term debt funds based on several parameters like annualized returns, volatility, asset quality (exposure to credit risk), company concentration, modified duration, liquidity and exposure to sensitive sector. Each of the short term income funds in our selection has been assigned either Rank 1 or 2 by CRISIL. Further, in addition to CRISIL ranking, we have applied MORNINGSTAR rating as a secondary filter for our fund selection. The funds in our selection all have Morningstar rating of 4 stars, which was the cut-off in our selection methodology. Here are the top 6 long-term income funds selected using the discussed criteria, sorted on the basis of the last 3 year returns.

Source: Advisorkhoj Research

Tata Dynamic Bond Fund:

The scheme has र 1,018 crores of Assets under Management with an expense ratio of 1.73%. CRISIL has assigned Rank 1 for Tata Dynamic Bond Fund, while Morningstar has given the scheme a 4 star rating. Over a three years investment period the fund gave double digit annualized returns. The average maturity of the fund’s portfolio is 10 years and the yield to maturity (YTM) is 7.8%. Interest rate risk is high. The modified duration, which is the effective maturity after factoring in coupon payments from the bonds in the fund’s portfolio, is 6.46. This implies that in absence of any changes to the portfolio, if bond yields go down by 1 to 2% in the next three years, the fund will give a return of 6.46% over and above the YTM of the fund portfolio. On an annualized basis, this can generate double digit returns for the investor. Investors should note that, these are not the indicative returns of the scheme, but just a what-if analysis, assuming a certain trajectory of interest rates in the future. The asset quality of the scheme is excellent with 100% of the scheme portfolio securities rated AAA. The scheme has an exit load of 0.5% for redemptions within 180 days.

UTI Dynamic Bond Fund:

The scheme has र 857 crores of Assets under Management with an expense ratio of 1.09%. CRISIL has assigned Rank 2 for UTI Dynamic Bond Fund, while Morningstar has given the scheme a 5 star rating. Three year trailing annualized return of the fund is 9.8%. The average maturity of the fund’s portfolio is 14.2 years and the yield to maturity (YTM) is 8.14%. Interest rate risk is high. The asset quality of the scheme is excellent with 95% of the scheme portfolio securities rated AAA. The scheme has an exit load of 1% for redemptions within 365 days.

BNP Paribas Flexi Debt Fund:

The scheme has र 416 crores of Assets under Management. The expense ratio of the fund is one the higher side at 1.89%. CRISIL has assigned Rank 2 for BNP Paribas Flexi Debt Fund, while Morningstar has given the scheme a 5 star rating. Three year trailing annualized return of the scheme is 9.2%. The average maturity of the fund’s portfolio is 13.3 years and the yield to maturity (YTM) is 7.85%. Interest rate risk is high. The asset quality of the scheme is excellent with 100% of the scheme portfolio securities rated AAA. The scheme has an exit load of 0.75% for redemptions within 180 days.

HDFC High Interest Fund Dynamic Plan:

The scheme has र 2,285 crores of Assets under Management with an expense ratio of 0.7% only. CRISIL has assigned Rank 1 for HDFC High Interest Fund Dynamic Plan, while Morningstar has given the scheme a 4 star rating. The three year trailing annualized return is 9%. The average maturity of the fund’s portfolio is 16.8 years and the yield to maturity (YTM) is 8.03. Interest rate risk is high. The asset quality of the scheme is excellent with 98% of the scheme portfolio securities rated AAA. The scheme has an exit load of 0.5% for redemptions with 180 days.

IDFC Dynamic Bond Fund:

The scheme has र 6,243 crores of Assets under Management with an expense ratio of 1.65%. CRISIL has assigned Rank 1 for IDFC Dynamic Bond Fund, while Morningstar has given the scheme a 5 star rating. Three year trailing annualized return of the fund is 8.9%. The average maturity of the fund’s portfolio is 16 years and the yield to maturity (YTM) is 7.98%. Interest rate risk is high. The asset quality of the scheme is excellent with 100% of the scheme portfolio securities rated AAA. The scheme has an exit load of 0.5% for redemptions with 90 days.

Axis Income Fund:

The scheme has र 248 crores of Assets under Management with an expense ratio of 1.65%. CRISIL has assigned Rank 2 for Axis Income Fund, while Morningstar has given the scheme a 4 star rating. Three year trailing annualized return of the fund is 8.8%. The average maturity of the fund’s portfolio is 11.8 years and the yield to maturity (YTM) is 8.15%. Interest rate risk is high. The asset quality of the scheme is excellent with 95% of the scheme portfolio securities rated AAA. The scheme has no exit load.

Taxation of Debt Funds

If units of debt mutual funds are redeemed within 36 months of purchase, then short term capital gains is calculated by subtracting the purchase cost from sales consideration. Short term capital gains is added to the income of the investor and taxed as per the income tax rate of the investor. If the units are redeemed after 36 months from the date of purchase then long term capital gains apply. Long term capital gains for debt mutual funds are calculated by subtracting the indexed cost of purchase from the sales consideration. The indexed cost of purchase is calculated by multiplying the actual cost of purchase with the ratio of cost of inflation index in the year of redemption and the year of purchase. Cost of inflation index table is published by the Reserve Bank of India and is available in the public domain. Long term capital gains for debt mutual funds are taxed at 20.6% (including education cess) after indexation.

Conclusion

Investors should have a long investment horizon of at least 3 years for investment in income funds. Investors should also be prepared for volatility in the interim period. When selecting long term income funds of Mutual Funds, investors should select schemes from fund houses with strong long term track record and also pay attention to the expense ratios, in addition to other considerations like average maturity and YTM. Because of the dynamic characteristics of these funds and the tax advantage these funds enjoy for an investment period exceeding three years, these funds can be excellent investment choices for long term fixed income investors, provided they understand the characteristics of these funds. Investors should consult with their financial advisors, if long term income funds are suitable for their investment needs.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team