ICICI Prudential Exports and Other Services Fund: An outstanding performer

ICICI Prudential Exports and Other Services Fund is relatively less well known compared to the more popular funds from ICICI Prudential and other fund houses, but the long term performance of this fund has been nothing short of outstanding. As the name suggests, the fund invests in export oriented companies and companies in the services sector. So it is less diversified than the typical diversified equity funds in the market. However, unlike typical thematic funds the performance of this mutual fund scheme has been amazingly consistent. If you started a monthly SIP of र 5,000 in this fund, five years back, by today (Jan 20 2016) you would be sitting on a corpus of र 589,000 with an investment of just र 305,000, an annualized return of 27%.

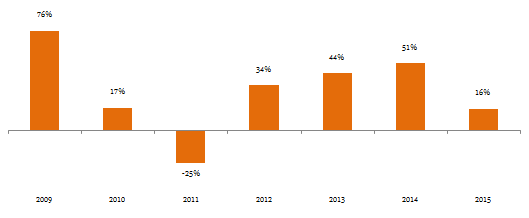

Normally, thematic funds are considered to be less consistent than diversified equity funds over a long time horizon because of the concentrated sector exposures of thematic funds. But look at the performance consistency of ICICI Prudential Exports and Other Services Fund from 2009 onwards, as shown in the rolling returns chart below (Rolling returns are the total returns of the scheme taken for a specified period on every day/week/month and taken till the last day of the duration. Rolling return is best measure of a fund’s performance consistency because there is no bias related to the selected timeframe over which returns are measured).

Source: Advisorkhoj Research

We can see that over the last 6 years, except for the 2011 bear market period, the rolling returns of ICICI Prudential Exports and Other Services Fund have always been positive. Further, we can see that the fund 1 year rolling returns have been over 25% for nearly 60% of the times since 2009.

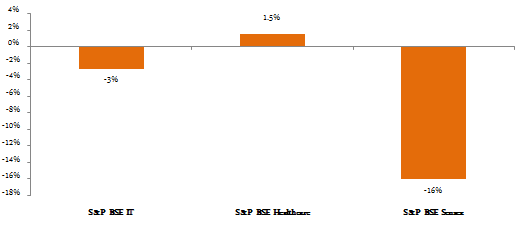

The drivers responsible for the exceptional performance of this thematic mutual fund scheme are embedded in the theme of the fund itself. Services sector has powered India’s GDP growth over the last many years. Also, historically it has been seen across the globe that, while services sectors are not immune to economic cycles, they tend to do better than manufacturing in bear markets. While export oriented companies are impacted by global economic weakness, rupee devaluation increases the competitiveness of our export oriented companies and as such they tend to do outperform domestic consumption oriented companies in bear markets. The chart below shows the last 1 year returns of S&P BSE Technology Index and S&P BSE Healthcare Index (technology and pharmaceutical stocks comprise more than 70% of the ICICI Prudential Exports and Other Services Fund portfolio) compared to the S&P BSE Sensex, in what was quite difficult market conditions.

Source: Bombay Stock Exchange

In fact, while frontline indices like the Sensex and Nifty, as well as many large cap oriented equity mutual funds gave negative returns in the last one year, ICICI Prudential Exports and Other Services Fund clocked 16% returns in 2015. The outperformance of this fund in the last one year notwithstanding, the fund also did extremely well in bull market conditions.

Source: Advisorkhoj Research

ICICI Prudential Exports and Other Services completed 10 years a few months back. It has र 820 crores of assets under management and an expense ratio of 2.63%. Yogesh Bhatt and Manish Gunwani are the fund managers of this scheme. CRISIL has a number 1 ranking for this scheme.

Portfolio Construction

The fund has a large cap bias with a growth investment approach. Large cap companies comprise nearly 60% of the fund’s portfolio. From a sector perspective, as discussed earlier Pharmaceuticals and Technology companies comprise nearly 73% of the portfolio holdings in value terms. From a company concentration perspective, the fund is fairly well diversified with the top 5 holdings, Cipla, Infosys, HCL Tech, Wipro and Sun Pharma account for 30% of the portfolio value. The top 10 holdings account for 58% of the portfolio value. While this may seem a little high, it is natural for thematic funds to have fairly concentrated portfolios.

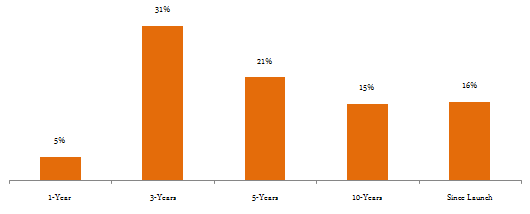

Risk and Return

The volatility of the fund, as measured by the annualized standard deviation of monthly returns, is relatively low at 12.8% compared to the average volatilities of large cap oriented diversified equity funds. The annualized trailing returns of the fund over different time-scales are quite strong.

Source: Advisorkhoj Research

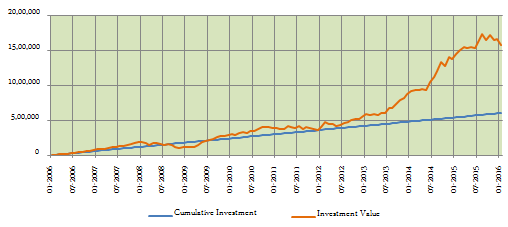

The chart below shows the returns of र 5,000 monthly SIP over the last 10 years in ICICI Prudential Exports and Other Services Fund.

Source: Advisorkhoj Research

We can see that, if you started a monthly Systematic Investment Plan of र 5,000 in the ICICI Prudential Exports and Other Services Fund, you would have accumulated a corpus of over र 15.6 lacs, with an investment of just a little over र 6 lacs. The annualized SIP return over the last 10 years has been over 18%. You can also see in the chart above that, if started your SIP in the fund 10 years back, your investment returns over the last 10 year period would have been negative only during the financial crisis of 2008.

Conclusion

We have seen that the ICICI Prudential Exports and Other Services Fund delivered more than 10 years of outstanding performance. Though this a thematic fund, the investment theme is extremely powerful in the context of India, especially over the past few years and hopefully continue to be very relevant in the India Growth Story going forward. As such, a fund like ICICI Prudential Exports and Other Services in combination with good diversified equity funds can add a lot of richness to an investor’s mutual fund portfolio. This fund is suitable for investors with long term investment objectives like retirement planning, children’s education etc. You should consult with your financial advisor if the ICICI Prudential Exports and Other Services Fund is suitable for your investment needs.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team