Best Small and Midcap Mutual Funds: Consistent performers for investment in 2015

In the previous two articles in this series on Best Mutual Fund consistent performers, we discussed the most consistent Best mutual fund performers in the large cap and diversified equity categories. Consistent performance should be an important criterion for selecting a mutual fund for long term investment objectives. In this blog, we will discuss the top most consistent small and midcap equity mutual funds, based on CRISIL’s ranking of consistent performers. CRISIL ranks consistent performers based mean return and volatility over 5 years, in addition to the CRISIL cluster rank for the 3 year performance of the fund. CRISIL calculates mean return and volatility for five years, with each one-year period being weighted progressively with the most recent period having the highest weight.

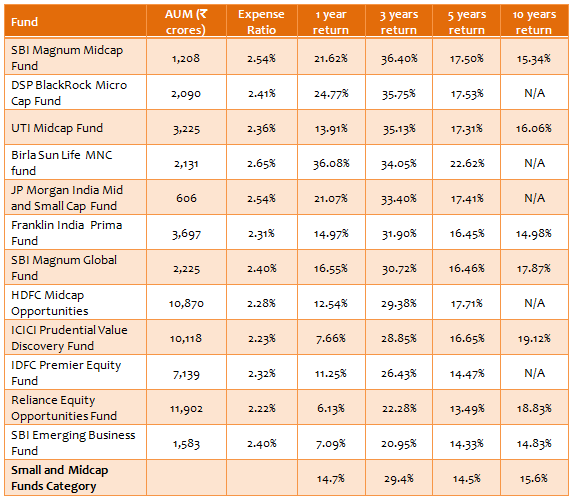

Top small and midcap equity mutual fund consistent performers

The table below lists the top 8 consistent small and midcap fund performers based on CRISIL ranking. The funds are listed in descending order of 3 years trailing annualized returns. Returns in the table are for growth options in regular plans. Trailing returns are based on NAVs on September 09, 2015. While the table shows trailing returns from the funds across different timescales, investors should not give too much importance to short term returns. Equity mutual fund investments should always be made with a long term investment horizon.

Rolling Returns of most consistent performers

Rolling returns is the best measure of a fund’s performance in terms of consistency. Trailing returns have a recency bias and point to point returns are specific to the period in consideration. Rolling returns, on the other hand, measures the fund’s absolute and relative performance the timescale in question, without bias. We will see that the Top small and midcap consistent performers have delivered outstanding rolling returns over the long term.

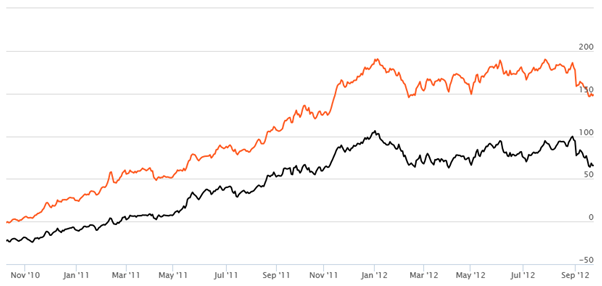

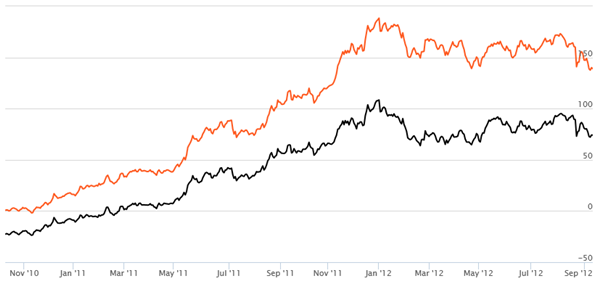

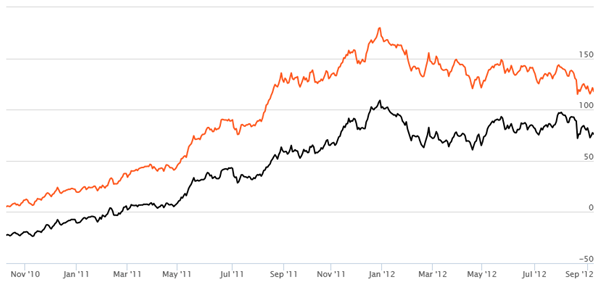

SBI Magnum Midcap Fund

The chart below shows the 3 year rolling returns of the SBI Magnum Midcap fund over the last 5 years. Rolling returns are the absolute returns of the scheme taken for a specified period on every day/week/month and taken till the last day of the duration. We have chosen 3 years as the rolling returns time period because it is always recommended that long term investors should hold equity funds for at least 3 years. In this chart we are showing returns on every day during the specified period and comparing it with the benchmark. The orange line shows the 3 year rolling returns of the SBI Magnum Midcap (Growth Option) and the black line shows the 3 year rolling returns of the benchmark CNX Midcap index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) since March of 2011. From September 2011 onwards, the fund has given more than 100% absolute 3 year returns (more than 26% on an annualized basis).

Source: Advisorkhoj Rolling Return Calculator

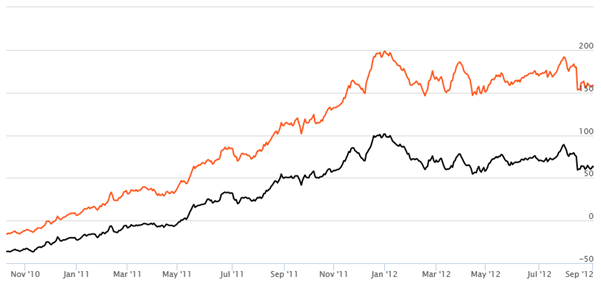

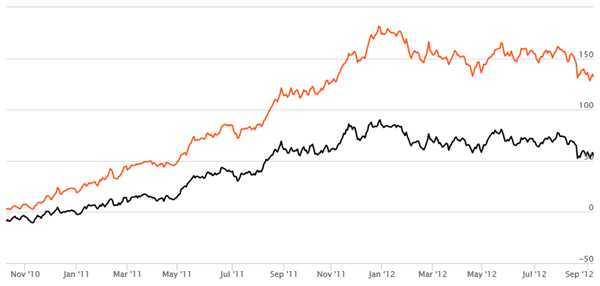

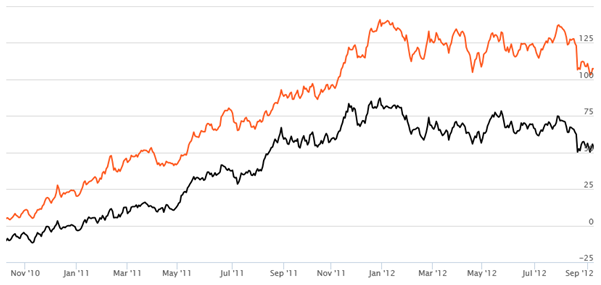

DSP BlackRock Micro Cap

The chart below shows the 3 year rolling returns of the DSP BlackRock Micro Cap Fund over the last 5 years. The orange line shows the 3 year rolling returns of the DSP BlackRock Micro Cap Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark S&P BSE Small Cap. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from September of 2011.

Source: Advisorkhoj Rolling Return Calculator

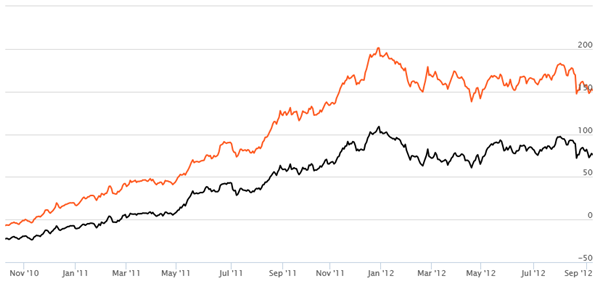

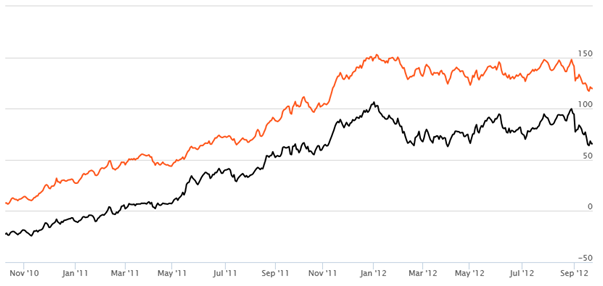

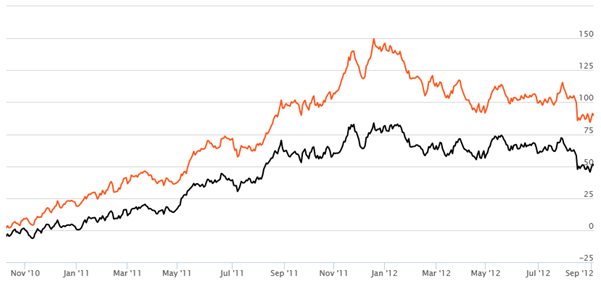

UTI Midcap Fund

The chart below shows the 3 year rolling returns of the UTI Midcap Fund over the last 5 years. The orange line shows the 3 year rolling returns of the UTI Midcap Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark CNX Midcap Index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from September 2011 onwards.

Source: Advisorkhoj Rolling Return Calculator

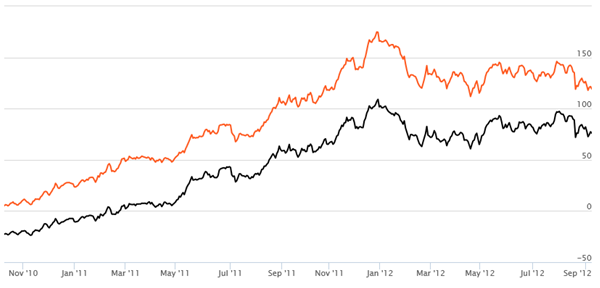

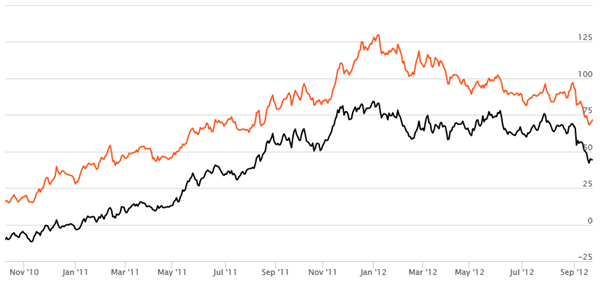

Birla Sun Life MNC fund

The chart below shows the 3 year rolling returns of the Birla Sun Life MNC Fund over the last 5 years. The orange line shows the 3 year rolling returns of the Birla Sun Life MNC Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark CNX Midcap Index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from September 2011 onwards.

Source: Advisorkhoj Rolling Return Calculator

JP Morgan India Mid and Small Cap Fund

The chart below shows the 3 year rolling returns of the JP Morgan India Mid and Small Cap Fund over the last 5 years. The orange line shows the 3 year rolling returns of the JP Morgan India Mid and Small Cap Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark CNX Midcap index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from September 2011 onwards.

Source: Advisorkhoj Rolling Return Calculator

Franklin India Prima Fund

The chart below shows the 3 year rolling returns of the Franklin India Prima Fund over the last 5 years. The orange line shows the 3 year rolling returns of the Franklin India Prima Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark CNX 500 index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from September 2011 onwards.

Source: Advisorkhoj Rolling Return Calculator

SBI Magnum Global Fund

The chart below shows the 3 year rolling returns of the SBI Magnum Global Fund over the last 5 years. The orange line shows the 3 year rolling returns of the SBI Magnum Global Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark CNX 500 index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from September 2011 onwards.

Source: Advisorkhoj Rolling Return Calculator

HDFC Midcap Opportunities Fund

The chart below shows the 3 year rolling returns of the HDFC Midcap Opportunities Fund over the last 5 years. The orange line shows the 3 year rolling returns of the HDFC Midcap Opportunities (Growth Option) and the black line shows the 3 year rolling returns of the benchmark CNX Midcap index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from September 2011 onwards.

Source: Advisorkhoj Rolling Return Calculator

ICICI Prudential Value Discovery Fund

The chart below shows the 3 year rolling returns of the ICICI Prudential Value Discovery Fund over the last 5 years. The orange line shows the 3 year rolling returns of the ICICI Prudential Value Discovery (Growth Option) and the black line shows the 3 year rolling returns of the benchmark CNX Midcap index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from September 2011 onwards.

Source: Advisorkhoj Rolling Return Calculator

IDFC Premier Equity Fund

The chart below shows the 3 year rolling returns of the IDFC Premier Equity Fund over the last 5 years. The orange line shows the 3 year rolling returns of the IDFC Premier Equity Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark S&P BSE 500 index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from November 2011 onwards.

Source: Advisorkhoj Rolling Return Calculator

Reliance Equity Opportunities Fund

The chart below shows the 3 year rolling returns of the Reliance Equity Opportunities Fund over the last 5 years. The orange line shows the 3 year rolling returns of the Reliance Equity Opportunities Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from September 2011 onwards.

Source: Advisorkhoj Rolling Return Calculator

SBI Emerging Business Fund

The chart below shows the 3 year rolling returns of the SBI Emerging Business Fund over the last 5 years. The orange line shows the 3 year rolling returns of the SBI Emerging Business Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark S&P BSE 500 index. We can see that the fund has consistently given more than 50% absolute 3 year returns (more than 14% on an annualized basis) from the middle of 2011 and more than 100% absolute 3 year returns (more than 26% annualized) from September 2011 onwards. However, it has been declining this year due to the ongoing volatility.

Source: Advisorkhoj Rolling Return Calculator

Conclusion

As discussed earlier, since mutual fund investments should always be made with a long investment horizon, consistent performance should be an important criterion when selecting Best mutual funds. Certain Mutual Fund schemes do exceptionally well under certain market conditions, but consistent performers do well in all market conditions and therefore are able to give excellent long term returns.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team