ICICI Prudential Long Term Equity Fund (Tax Saving): Terrific track record of wealth creation over last 15 years

ICICI Prudential Long Term Equity Fund (Tax Saving) has been one of the top performing Equity Linked Savings Schemes (ELSS) over the last 15 years. If you had invested र 5,000 monthly in ICICI Prudential Long Term Equity Fund (Tax Saving) over the last 15 years, you would have saved up to र 270,000 in taxes over this period (assuming you are in 30% tax bracket) and on top of this accumulated a corpus of close to र 60 lacs. No other tax saving investment would have given this kind of returns in this period. The performance of this fund is a testimony of the wealth creation power of ELSS.

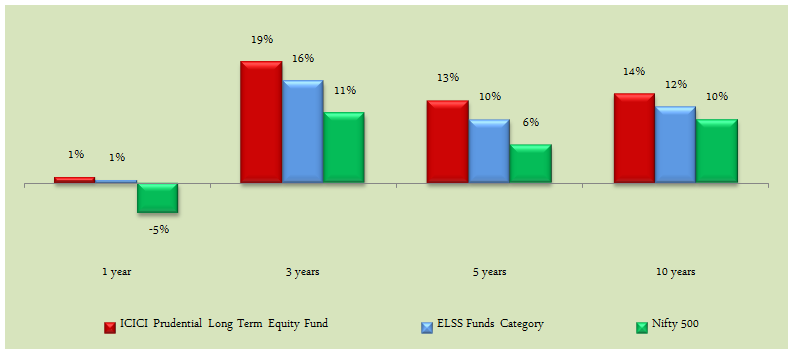

ICICI Prudential Long Term Equity Fund (Tax Saving) has been a top ELSS performer even over the last three to five years. This fund launched in August 1999, has a fantastic track record of generating alphas since its inception. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, of the fund, the ELSS Category and the benchmark Nifty 500 index (NAVs as on Dec 14 2015).

Source: Advisorkhoj Research

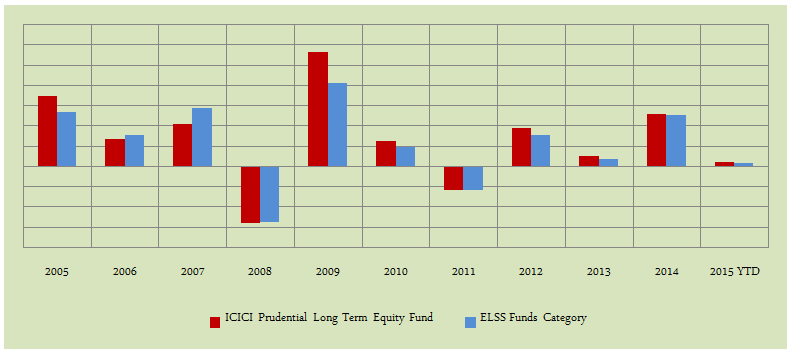

Even in terms of annual returns the fund’s performance has been outstanding, making this fund one of the most long term consistent performers in the ELSS category. The chart below shows the annual returns of the ICICI Prudential Long Term Equity Fund (Tax Saving) and the ELSS category over the last 10 years.

Source: Advisorkhoj Research

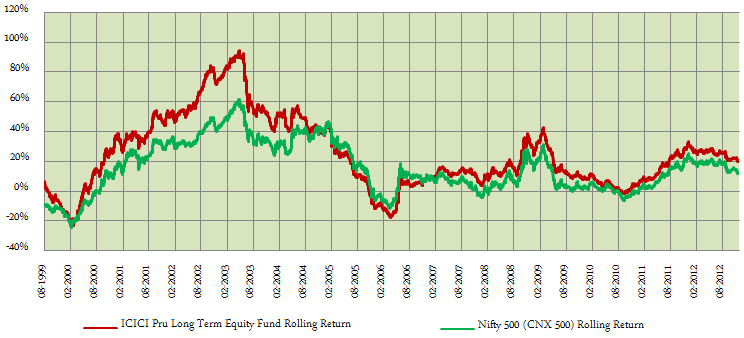

One of the best measures of the fund performance consistency is rolling returns relative to its benchmark. Rolling returns are annualized returns of the scheme for a specified cycle of period, meaning a three year rolling returns will show the returns generated over a three year period at each given point. We have chosen 3 years as the rolling returns time period because ELSS funds have a lock in period of 3 years. The chart below shows the 3 year rolling returns of the ICICI Prudential Long Term Equity Fund (Tax Saving) relative to the benchmark Nifty 500 index.

Source: Advisorkhoj Research

We can see the fund outperformed the benchmark index almost 100% of the times from 2007 onwards. Morningstar has a 4 star rating for this fund.

Fund Overview of ICICI Prudential Long Term Equity Fund

The ICICI Prudential Long Term Equity Fund is suitable for investors looking for tax planning investment options under Section 80C with the expectation of long term capital appreciation. However, since this is essentially a diversified equity fund, it is subject to market risk and volatility as compared to other tax saving instruments like PPF, NSC etc. However, equities as an asset class generate superior returns over the long term and serves as an effective hedge against inflation. As such, the fund is suitable for investors planning for long term financial objectives like retirement planning, children’s education, marriage etc. The fund has an AUM base of over र 2,840 crores, with an expense ratio of 2.41%. George Heber Joseph is the manager of this fund. Prior to George, Chintan Haria was the fund manager from 2011. Before Chintan, this fund was managed by ICICI Prudential CIO Shankaran Naren.

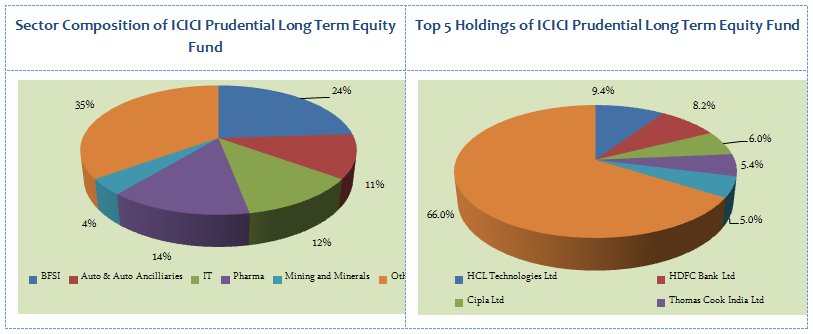

Portfolio Construction of ICICI Prudential Long Term Equity Fund

The fund has a large cap bias. The investment style is growth focused. 65% of the fund’s assets are invested in large cap companies. However, relative of the average portfolios of ELSS as a fund category, the fund has a higher allocation to small and midcap companies. From a sector perspective, the portfolio has a bias for cyclical sectors like Banking and Finance, Automobiles and Auto Ancillaries, Mining and Minerals, Capital Goods etc, but it also has substantial allocations to sectors like IT and Pharmaceuticals. This portfolio construction enables the fund manager to get good returns across different market conditions. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, HCL Technologies, HDFC Bank, Cipla, Thomas Cook, and Power Grid accounting for only 34% of the total portfolio value. The top 10 stocks account for around 55% of the portfolio holdings.

Source: Advisorkhoj Research

Other Performance Measures

From a risk perspective, the volatility of the ICICI Prudential Long Term Equity Fund, measured in annualized standard deviation over a three to five year period is in line with that of the ELSS category. However, on a risk adjusted return basis, as measured by Sharpe Ratio the fund has outperformed the ELSS category. Over the last three years the Sharpe Ratio of the fund is 0.87 versus 0.73 for the category. Over the last 5 year period the Sharpe Ratio of the fund is 0.4 versus 0.25 for the category.

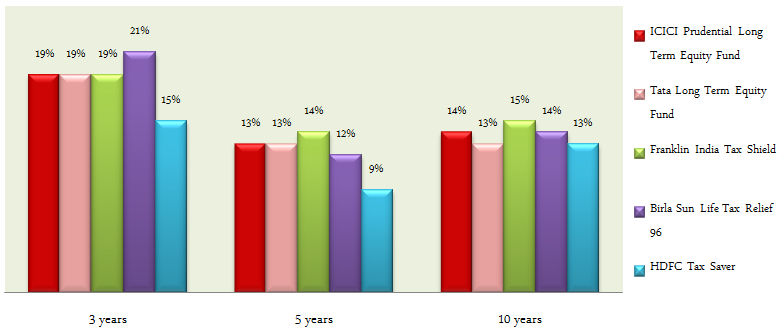

Comparison of ICICI Prudential Long Term Equity Fund with Peer Set

Comparison of annualized trailing returns of ICICI Prudential Long Term Equity Fund, with its ELSS peers across different time-scales shows why this fund is considered a top performer. While many of its peers have performed very strongly over the years, the performance of ICICI Prudential Long Term Equity Fund has either matched their performance or even beaten them.

Source: Advisorkhoj Research

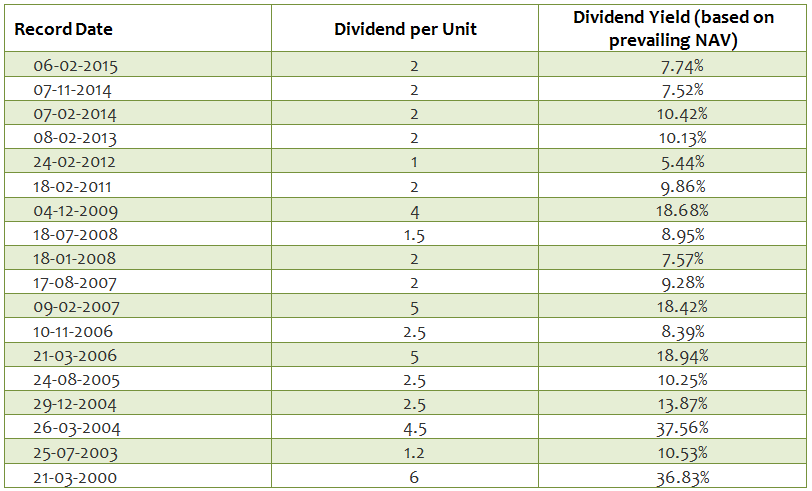

Dividend Payout Track Record of ICICI Prudential Long Term Equity Fund

ICICI Prudential Long Term Equity Fund has a terrific dividend payout track record since its inception. The scheme has paid out dividends almost year since its inception, except 2001, 2002 and 2010. The table below shows the dividend payout history of the scheme.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

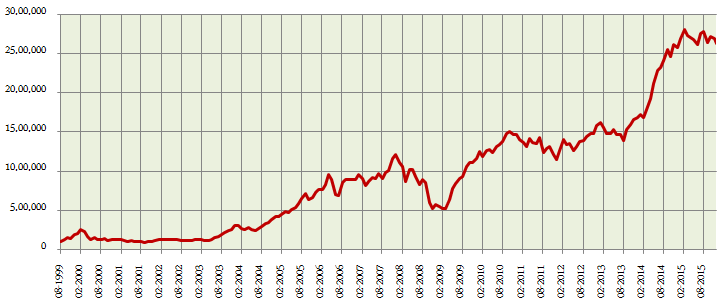

र 1 lac lump sum investment in the ICICI Prudential Long Term Equity Fund NFO (growth option) would have grown to value of nearly र 26 lacs as on December 1 2015. The chart below shows the growth of र 1 lac investment in the scheme since inception.

Source: Advisorkhoj Research

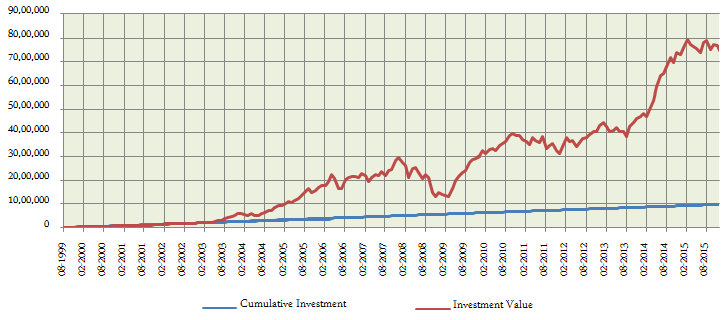

The chart below shows the returns since inception of र 5,000 invested monthly through SIP route in the ICICI Prudential Long Term Equity Fund (growth option) since inception of the scheme.

Source: Advisorkhoj Research

The chart above shows that a monthly SIP of र 5,000 started at inception of the ICICI Prudential Long Term Equity Fund would have grown to nearly र 75 lacs by December 15 2015, while the investor would have invested in total less than र 10 lacs. The Systematic Investment Plan return (as measured by XIRR) since inception of the fund is nearly 22%. If you compare these returns, with the returns of other 80C investment options, e.g. traditional life insurance plans, small savings schemes etc, you will realize that the wealth created by ELSS is of a different order of magnitude altogether.

Conclusion

By virtue of its outstanding long term track record of wealth creation, ICICI Prudential Long Term Equity Fund (Tax Saving) has established itself as one the top Equity Linked Saving Schemes (ELSS) funds. Investors planning for tax saving investments can consider buying the scheme through the systematic investment plan (SIP) or lump sum route with a long time horizon. Investors should also ensure that the investment objectives of the fund are aligned with their individual risk profiles and time horizons. They should consult with their financial advisors if ICICI Prudential Long Term Equity Fund (Tax Saving) is suitable for their investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team