Sundaram Equity Multiplier: Long term wealth creation potential

Over the last 15 years, the frontline benchmark equity index Nifty has grown about 5.8 times. Over the same period, stocks like HDFC bank and Asian Paints grew by 50 to 60 times. The two companies mentioned are just examples. If you had invested र 1 lac in Nifty fifteen years back you could have comfortably beaten inflation and earned higher than risk free fixed income returns. However, if you had invested the same money in stocks like HDFC Bank or Asian Paints, you could have created wealth for yourself. There is a misconception among many retail investors that only small and midcap stocks give spectacular returns in the long term. It is true that small and midcap stocks have the potential to give extraordinary long term returns, but HDFC Bank and Asian Paints were very large companies even back in 2000. Yet the returns given by these companies were nothing short of spectacular. How can a retail investor spot such investment opportunities? This is where a good fund manager comes into the picture. Through their stock picking competencies, a fund manager can create substantial wealth for their investors while at the same time provide enough risk diversification to limit downside risks for the investors.

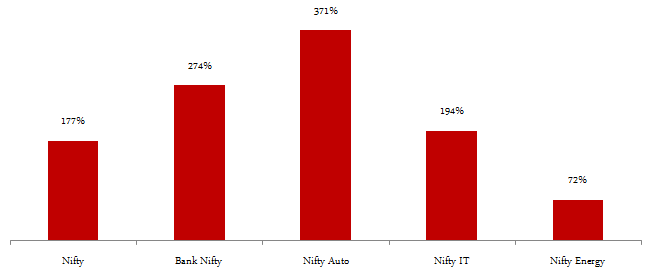

Let us now look at relative sector performances. While over the last one year the banking sector has corrected sharply relative to other sectors, if we look at the returns over the last 10 years, Bank Nifty outperformed Nifty by a huge margin. Automobiles outperformed by an even bigger margin. On the other hand the Oil and Gas sector (Nifty Energy) underperformed significantly in the last 10 years. The chart below shows the absolute returns of Nifty, Bank Nifty, Nifty – Auto, Nifty – IT and Nifty – Energy over the last 10 years.

Source: NSE data

As a retail investor, you will be able to partake in wealth creation through careful identification of value and growth opportunities, both at the stock level and sector level, by investing in mutual funds. Sundaram Equity Multiplier Fund aims to create wealth for its investors through aggressive sector positioning versus the benchmark index and selecting high quality stocks which have strong growth potential. The fund was launched in February 2007 and has र 140 crores of assets under management. The expense ratio of the fund is 2.99%. The fund portfolio has undergone substantial restructuring since Shiv Chanani took over as the fund manager in 2013. Prior to 2013, the Sundaram Equity Multiplier Fund was almost purely a small and midcap equity fund. After Mr Chanani took over the fund management, he increased the allocation to large cap stocks to more than 60%. For the large cap segment of the fund’s portfolio, the fund manager employs a combination of top down and bottom up approach with the objective of generating alphas through:-

- Aggressive sector positioning versus the benchmark index

- Selective stock specific contra bets

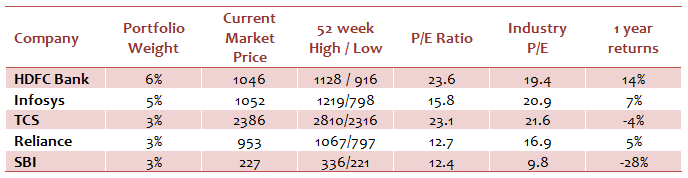

Infosys, the top stock holding of Sundaram Equity Multiplier Fund in terms of company concentration (6% weight in fund portfolio), is a great example of Mr Chanani’s stock picking strategy. While many diversified equity funds were overweight on TCS during the past 2 years or so, Infosys has been a part of the portfolio from September 2013. Back then, Infosys was trading at a fairly deep discount to its peer TCS in terms of valuation. In 2014 Vishal Sikka took over as the CEO of Infosys, which brought confidence amongst investors. Consequently Infosys got rerated and the valuation gap to TCS has reduced significantly. Over the last 12 months, even in difficult market conditions, Infosys has given a return of over 7%, not only outperforming Nifty, but also its large cap IT peers like TCS by a significant margin.

For the small and midcap segment of the fund portfolio, the fund manager allocates funds across domestic and multinational companies with strong balance sheets, corporate governance and good management teams. For example, one of the top midcap holdings of the Sundaram Equity Multiplier Fund, Elantas Beck Limited, has given a return of more than 25% in the last one year. Over the last one year the BSE Midcap index grew by only 4%. Other examples of smart stock picking by the fund manager include among others Gillette India Limited, which gave more than 50% returns in the last one year even in very difficult market conditions. In fact, over the last one year the fund has not only beaten the benchmark Nifty 500 index, but also beaten most of its peers in the diversified flexicap equity funds category.

The table below shows different statistics of the top 5 stocks in the portfolio of Sundaram Equity Multiplier Fund.

In terms of sector allocation while the Sundaram Equity Multiplier Fund has a bias towards cyclical sectors. Banking and Finance account for 22% of the fund’s portfolio holdings. The banking and finance sector has the highest weight in Nifty. While the sector has underperformed this year, due to some sector specific factors and general weakness in the market, we have seen earlier that, this sector has the potential to give very strong returns in the long term. The future outlook, over the medium to long term, of the banking and finance sector is very good due to a number of factors. Firstly, the Reserve Bank of India has repeatedly reiterated its accommodative stance as far as interest rates are concerned. Secondly, the Government has announced significant reforms in the Public Sector Bank space. Thirdly, the Government is planning to hike the FDI limit in private sector banks, which will potentially attract more foreign investments in the sector. Fourthly, the Government is planning action steps to alleviate the stressed assets or NPAs of the banks, especially assets related to the core sectors. Finally, the revival of capex growth in the economy will result in higher demand for loans and consequently result in growth of the banking sector. The Sundaram Equity Multiplier Fund also has a significant exposure to the Automobile and Auto Ancillaries sector, accounting for around 7% of the portfolio value. This has been one of the best performing sectors in the last 10 years, as we have seen earlier in the article. It has also performed quite well in the recent past. This sector is expected to do even better in the future with the revival of economic growth and a benign interest rate environment in the country. Technology is another major sector in Sundaram Equity Multiplier Fund’s portfolio. With definite signs of improvement in the US economy, the business prospects of IT companies in India will be brighter in the near to medium term. The depreciation of the Indian Rupee versus the US Dollar is also likely to improve the competitiveness of the Indian IT companies. The fund also has significant exposure to the infrastructure sector. While this sector has been underperforming for the past year or so, this sector has terrific growth potential with increase in Government spending and announcement of reforms related to this sector. In summary, investors should not look at recent performance of a fund or sector, but the growth potential of their investment. Large cap cyclical sector stocks have given average returns of 15 to 17% compounded annual returns over the last 10 years. Long term growth prospects of the fund portfolio sectors coupled with the fund manager’s bottoms up stock picking methodology to unlock value / growth potential can translate into excellent long term risk adjusted returns for Sundaram Equity Multiplier Fund. The results are starting to show, if we compare the returns of the fund versus the diversified equity funds category and the benchmark index over the last one year.

If we look at the 1 year rolling returns of Sundaram Equity Multiplier Fund, we can see a definite improvement in performance since the middle of 2013.

While the uptick in performance coincided with a bull market phase, it reinforces the fact that once we are past the volatile market conditions the fund is positioned to do well in the future. In fact, investors can take advantage of the prevailing volatility to invest in the fund through the systematic investment plan (SIP) route also. By investing in the fund through SIPs, investors can average out the rupee cost of units and earn superior future returns.

While the Sundaram Equity Multiplier Fund takes aggressive sector bets versus the benchmark, it is fairly well diversified in terms of company concentration. The top 5 companies in the fund portfolio, Infosys, HDFC Bank, Reliance Industries, TCS and SBI account for only 21% of the portfolio value. Even the top 10 holdings of the fund account for about 33% of the portfolio value. In terms of risk measures, the annualized standard deviation of monthly returns of the fund is lower than the standard deviation of diversified flexi-cap funds category. In other words, the fund has done better than its peers on an average, in volatile market conditions. In terms of risk adjusted returns, as measured by Sharpe Ratio, the fund has outperformed its benchmark.

Fund Manager Mr. Shiv Chanani is very optimistic about the future potential of the fund and he has following to say “We believe that our Equity Multiplier Fund is a close proxy for the entire market. Hence, this fund is aptly suited for investors who are looking to take a market-wide exposure. The fund is designed to generate alpha through sector allocation in large caps and specific stock selection in the mid & small cap category”.

Conclusion

For long term investors, Sundaram Equity Multiplier Fund is well positioned to give good returns in the future. For equity mutual fund investors, there are many advantages of investing through the Systematic Investment Plan (SIP) mode. Not only does SIPs enable you to stay disciplined in investing, you can also take advantage of volatility through rupee cost averaging of units. However, investors can also tactically take advantage of sharp market corrections, such as the one we are seeing now, to increase their allocation to equities by investing in lump sum. Investors should consult with their financial advisors if Sundaram Equity Multiplier Fund is suitable for their long term investment portfolios.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team